Sunday, December 31, 2017

Monday, December 25, 2017

Sunday, December 24, 2017

come a little a bit closer you're my kind of man so big and so strong

So I started walking her way

She belonged to bad man Jose

And I knew, yes I knew I should leave

When I heard her say, yeah

Come a little bit closer

You're my kind of man

So big and so strong

Come a little bit closer

I'm all alone and the night is so long

She belonged to bad man Jose

And I knew, yes I knew I should leave

When I heard her say, yeah

Come a little bit closer

You're my kind of man

So big and so strong

Come a little bit closer

I'm all alone and the night is so long

Monday, December 18, 2017

what? Kevin Drum on how racist America is.

Return of the Empire?

Now as America experiences a blue wave, America is exceptional and not as racist as people say. Oh but it is pretty still racist.

Sunday, December 17, 2017

Thursday, December 14, 2017

Yggies on Bruenig's SWL (social wealth fund) and his response

Why Social Wealth Funds Are Not Just Taxes by Matt Bruenig

Collective ownership of the means of production by Matt Yglesias

Revisiting the Meidner Plan by Peter Gowan and Mio Tastas Viktorsson

The Red and the Black by Seth Ackerman

Models For Worker Codetermination In Europe by Peter Gowan

Collective ownership of the means of production by Matt Yglesias

Tackling Wealth Inequality Like A Swede by Peter Gowan and Mio Tastas Viktorsson

Tuesday, December 12, 2017

Saturday, December 02, 2017

krugman on economic anxiety

The longer high unemployment drags on, the greater the odds that crazy people will win big in the midterm elections — dooming us to economic policy failure on a truly grand scale.Interest rates: the phantom menace

Thursday, November 30, 2017

Tuesday, November 28, 2017

Sunday, November 26, 2017

Thursday, November 23, 2017

loanable funds theory

WHAT IS THE LOANABLE FUNDS THEORY?

According to Keynes: " It is the interaction of supply and demand in the bond market – not the ‘loanable funds’ market – which determines the rate of interest."

Wednesday, November 22, 2017

interest rates and expectations

A New Conundrum in the Bond Market? by Michael D. Bauer

Interest Rates and Expectations: Responses and Further Thoughts by JW Mason

Interest Rates and (In)elastic Expectations by JW Mason

Sunday, November 19, 2017

Thursday, November 16, 2017

Wednesday, November 15, 2017

Saturday, November 11, 2017

Friday, November 10, 2017

Monday, November 06, 2017

Sunday, November 05, 2017

Brazile

In a September 2015 email obtained by The Washington Post, a lawyer from Perkins Coie, a law firm representing both the DNC and the Clinton campaign, wrote the Sanders campaign with a copy of what was presented as a “standard joint fundraising agreement.”Democrats express outrage over allegations of early party control for Clinton in 2016

Donna Brazile's bombshell tell-all could inspire DNC reforms

Donna Brazile: I considered replacing Clinton with Biden as 2016 Democratic nominee

Donna Brazile: I considered replacing Clinton with Biden as 2016 Democratic nominee

Saturday, November 04, 2017

On Safari in Trump's America by Molly Ball

On Safari in Trump's America by Molly Ball

Politics, though, was not the focus of the Third Way interviewers, who believed there was more to be gained by asking neutral, open-ended questions. In accordance with Third Way’s ideology, they believed that political partisanship was not most people’s primary concern. But sometimes the Wisconsinites brought up politics anyway.

At the Labor Temple Lounge in Eau Claire, nine gruff, tough-looking union men sat around a table. One had the acronym of his guild, the Laborers International Union of North America, tattooed on a bulging bicep. The men pinned the blame for most of their problems squarely on Republicans, from Trump to Governor Scott Walker. School funding, the minimum wage, college debt, income inequality, gerrymandering, health care, union rights: It was all, in their view, the GOP’s fault. A member of the bricklayers’ union lamented Walker’s cuts to public services: “If we can’t help each other,” he said, “what are we, a pack of wolves—we eat the weakest one? It’s shameful.”

But their negativity toward Republicans didn’t translate to rosy feelings for the Democrats, who, they said, too frequently ignored working-class people. And some of the blame, they said, fell on their fellow workers, many of whom supported Republicans against their own interests. “The membership”—the union rank-and-file—“voted for these Republicans because of them damn guns,” a Laborers Union official said. “You cannot push it out of their head. A lot of ‘em loved it when Walker kicked our ass.”(h/t Chapo Trap House)

Friday, November 03, 2017

Monday, October 30, 2017

Fed on potential GDP

The Fed Chair Should Be a ‘Principled Populist’ By STEPHANIE KELTON and PAUL MCCULLEY

McCulley: I think it should be a collaborative venture between the Fed and Congress. Yes, I used the word “collaborative,” which I think applies in a more general way to the relationship between Congress and the Fed.

The Fed’s operational independence is grounded in the thesis that the legislature cannot be trusted with monetary policy, as the electoral process is inherently biased to inflation, of overstimulating the economy with too much spending relative to taxation, running inflationary budget deficits.

That simply has not been the case for a long, long time. Yes, we’ve had large deficits, but inflation has been too low, not too high. Thus, I’m not convinced by the argument that strict Fed independence is always and everywhere needed to discipline the fiscal authorities’ inflationary bias.

Kelton: What about policy today?

McCulley: If President Trump wants to try to boost real growth from 2 percent to 3 percent, there is no reason that the Fed should actively push back. That doesn’t mean that the Fed shouldn’t or wouldn’t respond if such an acceleration in growth were to finally drive unemployment low enough to generate a loud wage and inflationary response.

My point is that there is no reason for the Fed to prevent the “experiment,” if Mr. Trump and the Republican Congress want to run it.

Sunday, October 29, 2017

Friday, October 27, 2017

Thursday, October 26, 2017

Matt Levine on Marxist indexing

Bitcoin Dividends and Marxist Indexing by Matt Levine

Should index funds be illegal / Are index funds Marxist?

Here is a Jacobin interview with leftist economist J.W. Mason about "finance's role in capitalist society" that is fascinating throughout. Mason endorses a "functional view of finance, as the enforcement arm of the capitalist class as a whole":

There are people and institutions whose job it is to ensure that corporations remain within capitalist logic, that they remain oriented towards production for sale and for profit. On some level, this is the fundamental role of shareholders and their advocates, and of institutions like private equity.

I think that a lot of quite mainstream financial people would agree that one thing that shareholders do is ensure that the corporations they own "remain within capitalist logic," sure. But Mason also points to the rise of index funds as undercutting capitalist logic: If all the companies are owned by the same handful of big diversified investing institutions, and if those institutions have no interest in competition between the companies they own, then what is the point of capitalism?

If you take competition out of the mix, it’s unclear what function private ownership is supposed to accomplish. If the evolution of finance gets you to a situation where you have a single set of institutions — or in the long run, maybe a single institution — that owns all of these firms, then pressure from shareholders is going to be against competition. They don’t want to see these firms trying to gain market share or anything else at each other’s expense.

Seth Ackerman, the Jacobin interviewer, responds:

It’s hard to listen to what you just said without thinking of the debates that took place in the late nineteenth and early twentieth centuries, where many people — arguably including Marx — predicted either that firms would be consolidated into the hand of a very small number of controllers or that the underlying wealth would be concentrated into the hands of fewer and fewer people. And in either case, it would undermine the basic logic that made capitalism an economically and politically successful system in the first place.

Virtually no one that I talk to in or around the financial industry really believes the "common ownership of companies by mutual funds undercuts competition" theory. It just seems too attenuated: Sure, it might be in BlackRock's and Vanguard's interests if the companies they own don't slash prices to compete with each other, but it's not (usually) like they call up executives to tell them that. Plus "competition" is usually a more nebulous concept than price-cutting: It might be in shareholders' interests to keep prices high, but it is also in shareholders' interests to see more innovation and more competition on quality. If you own the entire economic pie, your interest is in growing that pie, not in keeping each company's slices the same. And the way the pie grows is through the normal capitalist processes of innovation and competition and creative destruction and so forth.

Still I am so desperately fond of this theory. What I love -- what is made so clear in Jacobin's discussion -- is how it wraps capitalism all the way around to socialism. Index funds are in many ways a perfection of financial capitalism: Not only are they the result of scientific finance (modern portfolio theory, the efficient markets hypothesis, etc.) replacing earlier and less rigorous forms of investing, but they also concentrate and align shareholders with each other, and corporate managers with shareholders, in a way that seems like it would be well suited to "ensure that corporations remain within capitalist logic." And the result is something that both Marxists and also financial analysts think is quasi-communist, that "undermines the basic logic that made capitalism an economically and politically successful system in the first place." What if Marx was right that capitalism would ultimately destroy itself, but the way that it does so is through index funds?

Anyway, happy 100th anniversary of Red October, I guess.

Elsewhere: "David Einhorn Is Wondering If Value Investing Even Works Anymore." And here is an excerpt from his letter to Greenlight Capital investors:

What if equity value has nothing to do with current or future profits and instead is derived from a company’s ability to be disruptive, to provide social change, or to advance new beneficial technologies, even when doing so results in current and future economic loss? It’s clear that a number of companies provide products and services to customers that come with a subsidy from equity holders. And yet, on a mark-to-market basis, the equity holders are doing just fine.

That is an alternative perfection of capitalism, I guess, if the capitalist class is subsidizing consumers without actually losing any money.

---------------------

Emphasized: Mason disagrees with the "but" in that sentence. Marx was right all along.

Tuesday, October 24, 2017

Cowen on NGDP targeting; Mason on financialization

The Only Fed Rule Is That There Are No Fed Rules by Tyler Cowen

Interview with J.W. Mason by Seth Ackerman

Sunday, October 22, 2017

Saturday, October 21, 2017

Friday, October 20, 2017

Thursday, October 19, 2017

Monday, October 16, 2017

Sandbu on macro fail

Bolder rethinking needed on macroeconomic policy by Martin Sandbu

The Peterson Institute conference on “Rethinking Macroeconomic Policy”, which we alerted readers to last week, was well worth watching. The marvel of the internet is that virtuous event organisers such as Peterson can give global access by posting online the agenda, papers and recordings of the presentations, including the panel discussions, which were as interesting as the presentations themselves.

I recommend everyone to take a look — but with a disappointment spoiler up front. For while some of the world’s most brilliant economists took part, which alone makes it worth a view, the promised “rethinking” was often more incremental (even marginal) than radical.

The opening paper and presentation by Olivier Blanchard and Larry Summers is a tour de force in terms of stating where the debate stands today in a range of key policy areas. They were followed by former Federal Reserve chair Ben Bernanke, who headlined the panel on monetary policy (here is his paper and video recording of his presentation).

I will focus here on monetary policy issues (the conference covered many other things as well).

As my colleague Chris Giles expertly laid out last week, there is a crisis in central bank theory and practice, which can be briefly summarised as follows: western economies are far from where central bankers thought they would have been by now, still either below capacity or not convincingly at full capacity. Worse yet, they do not understand why. In this context, one might have hoped for some deep soul-searching in a conference of this calibre.

In terms of concrete “deliverables”, there were few new proposals for how to do monetary policy differently. The main contribution was Bernanke’s discussion of complementing the current framework of targeting inflation rates by targeting price levels. Targeting levels rather than rates of change has the advantage of built-in “memory”: in a situation where prices have fallen short of expectations, like today, price level targeting (PLT) would have the central bank aim to make up for lost ground, and thus command more aggressive monetary policy.

But as Bernanke pointed out, in the reverse situation of an inflation overshoot — say, because of a one-off rise in commodity prices or a fall in the exchange rate — PLT would require the central bank to slow down economic activity to keep inflation below target for a while. That would be neither desirable nor credible. His conclusion is that the current framework should be complemented with an announcement in normal times that PLT would be introduced if, and for as long as, interest rates were at zero, and suspended otherwise. This would no doubt improve on the current situation. But it feels little more than a tweak.

There was surprisingly little discussion of national income level targeting — where a central bank targets a path for the nominal size of an economy rather than prices — which does not have the same problem as PLT. Nor was there much engagement with the problem with all proposals for new targets that would be more stimulative, which is that central banks have failed to meet the targets they currently have. If they cannot engineer 2 per cent inflation rates today, why should their commitment to achieve a price level or national income target be any more credible?

Another disappointment on the discussion was how the top of the economics profession takes for granted the impossibility of more negative nominal interest rates. Blanchard and Summers capture the professional consensus when they write that “there is little question that the binding lower bound on short-term nominal interest rates (zero, or slightly negative) limited the scope of monetary policy to sustain demand during the recovery”.

But the fact is that those central banks that have tried to go negative have had no problems doing so, and that techniques for limiting a rush into physical cash exist. There is so far no empirical basis for believing in a near-zero lower bound on central bank interest rates. One would have hoped the luminaries of the field would have been more adventurous in exploring the use of more steeply negative rates.

Most profoundly, there was little sense of urgency that more radical rethinking was needed. Adam Posen, who convened the conference, was one of few who made a point out of this. He suggested that it was both ahistorical to think of asset purchases by central banks as unconventional (which implies that central bank action has been less innovative since the financial crisis than central bankers like to claim) and that more radical policy change was needed.

The closest to a proposal for how to do monetary policy differently was Bernanke’s proposal for pre-announced PLT in predefined exceptional times. But when Blanchard asked panellists whether, if conditions are “back to normal” 10 years from now, they thought central banks would think any differently about monetary policy, the shared expectation seemed to be that a normalisation of the economy would and should lead to a normalisation of policy thinking too, but with a preparedness for a possible return to abnormal situations.

That view is oddly forgetful of recent history. It does not acknowledge that the failure to forecast the crisis could indicate that something is deeply wrong in how we think about monetary policy even in normal times. Even if one tacks on a precommitment to do things differently should a new deflationary crisis occur, à la Bernanke’s proposal or some other readiness to return to “unconventional” tools, that largely presupposes that we have by now figured out how to deal with protracted slow demand growth with very low interest rates.

In other words, expecting future monetary policy to be largely as before, with some newly exploited crisis tools in the toolbox, rather takes as given that monetary policy has performed close to the best it could have done both before and after the crisis. That is, if nothing else, a self-flattering view for monetary policymakers to take. But it is not very reassuring. For central bankers, as for everyone else, admitting one has got things badly wrong is a prerequisite for doing better.

Sunday, October 15, 2017

Atrios on recovery

Dustbowl

I think it will be the forgotten depression. The triumphalism of neoliberal capitalism and Fed independence made this unpossible, and the unquestionable stewardship of Obama/Geithner rendered it moot. I'm not sure that even historians - decades later, as is their privilege - will grapple with this fact.

Empires fall.

THURSDAY, OCTOBER 12, 2017

Dustbowl

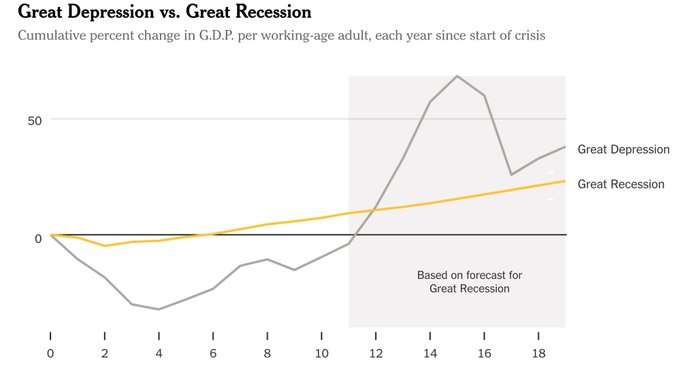

A decade later, it looks like the Great Recession may be worse than the Great Depression https://nyti.ms/2kJUSnd

I think it will be the forgotten depression. The triumphalism of neoliberal capitalism and Fed independence made this unpossible, and the unquestionable stewardship of Obama/Geithner rendered it moot. I'm not sure that even historians - decades later, as is their privilege - will grapple with this fact.

Empires fall.

Saturday, October 14, 2017

socialism versus neoliberalism

government interference in economy. neoliberalism = one dollar one vote; socialism = rising living standards for everyone. socialism = tight labor markets neoliberals open up to foreign investment and foreign trade, cut taxes on businesses, prioritize corporations, corporate trade agreements, patents and copyrights, monopolies and oligopolies,

Friday, October 13, 2017

this week on Twitter: I didn't really get

I did get that Neera Tanden, Joy Reid and the Eight Percenters went after the Women's March convention in Detroit for asking Sanders to speak the first night.

Women's March on making Bernie opening speaker: “We all know how busy women leaders are”

Women's March on making Bernie opening speaker: “We all know how busy women leaders are”

Chapo Trap House guys made a joke that upset people. They apologized and I still don't know what it was. Something about rape and Bill Cosby within the context of Harvey Weinstein. They deleted it.

Dan Harmon got pilloried for something he tweeted after some of his fans rioted over McDonalds running out of their Szechuan sauce during a one day promotion. Genius marketing on their part. All that money they don't pay their workers well spent on marketing. Packets from McDonalds going for a grand on eBay. Late capitalism culture at its finest.

Thursday, October 12, 2017

Monday, October 09, 2017

Sunday, October 08, 2017

Friday, October 06, 2017

Krugman on Fed; Corbyn

Get Ready for Prime Minister Jeremy Corbyn by Rachel Shabi

Will Trump Trumpify the Fed? by Krugman

For more than a decade the Fed chair has been a distinguished academic economist — first Ben Bernanke, then Janet Yellen. You might wonder how such people, who have never been in the business world, who have never met a payroll, would deal with real-world economic problems; the answer, in both cases: superbly.

In particular, both Bernanke and Yellen responded effectively to a once-in-three-generations economic crisis despite constant heckling from back-seat drivers in Congress and on the political right in general. And their intellectual and moral courage has been completely vindicated by events.

Monday, October 02, 2017

The Disastrous Decline of the European Center-Left

The Disastrous Decline of the European Center-Left

Among the many worrying outcomes of the recent German elections was the further collapse of the main center-left party, the Social Democrats, which received only 20.5 percent of the vote, its worst performance since World War II.

Across Europe, social democratic or center-left parties are in decline. In elections this year in France and the Netherlands, the socialist and labor parties did so poorly that many question their future existence. Even in Scandinavia, considered the world’s social democratic stronghold, long-dominant parties have been reduced to vote shares in the high 20s and low 30s.

Even if you don’t support the left, this should be cause for concern. Social democratic parties were crucial to rebuilding democracy in Western Europe after 1945. They remain essential to democracy on the Continent today.

During the postwar years, social democratic parties acknowledged capitalism’s upsides and downsides. In contrast to Communists, center-left parties recognized that markets were the most effective engine for producing economic growth and prosperity. But in contrast to classical liberals and many conservatives, social democrats did not embrace markets wholeheartedly. Instead, the center-left insisted that it was possible — indeed, necessary — for governments to cushion markets’ most destabilizing effects. Capitalism would be kept subservient to the goals of social stability and solidarity, rather than the other way around.

By the late 20th century, this distinctive message had been mostly discarded. Instead, the left became dominated by two camps.

The first was epitomized by Tony Blair of Britain and Gerhard Schröder of Germany. These new center-left politicians celebrated the market’s upsides but ignored its downsides. They differed from classical liberals and conservatives by supporting a social safety net to buffer markets’ worst effects, but they didn’t offer a fundamental critique of capitalism or any sense that market forces should be redirected to protect social needs. When the financial crisis hit in 2008, this attitude repelled those who viewed globalization as the cause of their suffering and wanted not merely renewed growth, but also less inequality and instability.

The second camp is an anti-globalization far left, represented by the Occupy movement, Jeremy Corbyn’s wing of Britain’s Labour Party and Syriza in Greece. This camp took seriously the market’s downsides but saw few upsides. Lacking a conviction that capitalism can and should be reformed, these parties generally offer an impractical mishmash of attacks on the wealthy, protectionism, increased welfare spending and high taxes. These policies may appeal to the angry and frustrated, but they turn off voters looking for viable policy and a progressive, rather than utopian, view of the future.

During the postwar decades, social democracy promoted solidarity and a sense of shared national purpose so as to avoid the fractures that undermined European democracy during the late 19th and early 20th centuries. In contrast to Communists, who exclusively focused on class conflict, the center-left built bridges between workers and others. And in contrast to the individualism of classical liberals and many conservatives, the center-left’s emphasis was on citizens’ obligations to one another and the government’s duty to promote the good of society.

By the late 20th century, however, this understanding of social democracy’s goals had been largely abandoned. Some failed to address concerns generated by social and cultural change, either out of lack of understanding or out of a hope that solving economic problems would make them disappear. Others uncritically embraced these changes, promoting both cosmopolitanism and the interests and cultural distinctiveness of minority groups. This camp became associated with the politically deadly idea that strong national identities were anachronistic, even dangerous, and citizens made uneasy by their erosion were bigots.

These attitudes have fragmented the left’s constituency and made it impossible to rebuild the social solidarity or sense of shared national purpose necessary to support high taxes, robust welfare programs and activist governments.

But the decline of the center-left has larger implications. Most obviously, it has created a space for a populist right whose commitment to liberalism, and even democracy, is questionable. In many European countries, now including Germany, these parties have succeeded in part by attracting groups that have historically supported the center-left, like workers and the uneducated, by forthrightly addressing the economic fears generated by globalization as well as those generated by social and cultural change.

During the postwar period, European politics was dominated by competition between a center-left and center-right that offered real policy differences but agreed on the basic framework of liberal, capitalist democracy. These parties were large enough to form governments, set agendas and get policies enacted. But as the outcome of the recent German elections makes clear, the center-left’s electoral demise has rendered it unable to form stable, coherent governments — which makes it more difficult to solve problems and leaves voters more frustrated with traditional parties and institutions.

This is one part of what has allowed populists to make inroads, as was clear during the German elections, where the far-right Alternative for Germany party promoted itself as the true “alternative” to the status quo. Even many within the Social Democrats acknowledged their party lacked a vision of where it wanted Germany to go.

by Sheri Berman (10.2.17)

Across Europe, social democratic or center-left parties are in decline. In elections this year in France and the Netherlands, the socialist and labor parties did so poorly that many question their future existence. Even in Scandinavia, considered the world’s social democratic stronghold, long-dominant parties have been reduced to vote shares in the high 20s and low 30s.

Even if you don’t support the left, this should be cause for concern. Social democratic parties were crucial to rebuilding democracy in Western Europe after 1945. They remain essential to democracy on the Continent today.

During the postwar years, social democratic parties acknowledged capitalism’s upsides and downsides. In contrast to Communists, center-left parties recognized that markets were the most effective engine for producing economic growth and prosperity. But in contrast to classical liberals and many conservatives, social democrats did not embrace markets wholeheartedly. Instead, the center-left insisted that it was possible — indeed, necessary — for governments to cushion markets’ most destabilizing effects. Capitalism would be kept subservient to the goals of social stability and solidarity, rather than the other way around.

By the late 20th century, this distinctive message had been mostly discarded. Instead, the left became dominated by two camps.

During the postwar decades, social democracy promoted solidarity and a sense of shared national purpose so as to avoid the fractures that undermined European democracy during the late 19th and early 20th centuries. In contrast to Communists, who exclusively focused on class conflict, the center-left built bridges between workers and others. And in contrast to the individualism of classical liberals and many conservatives, the center-left’s emphasis was on citizens’ obligations to one another and the government’s duty to promote the good of society.

By the late 20th century, however, this understanding of social democracy’s goals had been largely abandoned. Some failed to address concerns generated by social and cultural change, either out of lack of understanding or out of a hope that solving economic problems would make them disappear. Others uncritically embraced these changes, promoting both cosmopolitanism and the interests and cultural distinctiveness of minority groups. This camp became associated with the politically deadly idea that strong national identities were anachronistic, even dangerous, and citizens made uneasy by their erosion were bigots.

These attitudes have fragmented the left’s constituency and made it impossible to rebuild the social solidarity or sense of shared national purpose necessary to support high taxes, robust welfare programs and activist governments.

During the postwar period, European politics was dominated by competition between a center-left and center-right that offered real policy differences but agreed on the basic framework of liberal, capitalist democracy. These parties were large enough to form governments, set agendas and get policies enacted. But as the outcome of the recent German elections makes clear, the center-left’s electoral demise has rendered it unable to form stable, coherent governments — which makes it more difficult to solve problems and leaves voters more frustrated with traditional parties and institutions.

This is one part of what has allowed populists to make inroads, as was clear during the German elections, where the far-right Alternative for Germany party promoted itself as the true “alternative” to the status quo. Even many within the Social Democrats acknowledged their party lacked a vision of where it wanted Germany to go.

If the Social Democrats and other center-left parties are unable once again to offer voters solutions to the challenges their countries face, their decline will continue, populism will flourish and democracy will decay.

Friday, September 29, 2017

Tuesday, September 26, 2017

Doug Henwood on Hillary's What Happened

Doug Henwood Dispatches Hillary and Her New Book to Remainder Bin of History

She actually says (though maybe it was her three ghostwriters): “Bernie proved again that it’s important to set lofty goals that people can organize around and dream about, even if it takes generations to achieve them.” Rejecting a generation of neoliberal orthodoxy, she continues:

Democrats should reevaluate a lot of our assumptions about which policies are politically viable. These trends make universal programs even more appealing than we previously thought. I mean programs like Social Security and Medicare, which benefit every American, as opposed to Medicaid, food stamps, and other initiatives targeted to the poor. Targeted programs may be more efficient and progressive, and that’s why during the primaries I criticized Bernie’s “ free college for all ” plan as providing wasteful taxpayer-funded giveaways to rich kids. But it’s precisely because they don’t benefit everyone that targeted programs are so easily stigmatized and demagogued…. Democrats should redouble our efforts to develop bold, creative ideas that offer broad-based benefits for the whole country.

Thursday, September 21, 2017

Saturday, September 16, 2017

corn cob fail: Drum, DeLong, PGL

Should-Read: Keven Drum: Here's Why I Never Warmed Up to Bernie Sanders: "As Bill Scher points out, the revolution that Bernie called for didn't show up...

...In fact, it's worse than that: we were never going to get a revolution, and Bernie knew it all along. Think about it: has there ever been an economic revolution in the United States? Stretching things a bit, I can think of two: (1) The destruction of the Southern slave economy following the Civil War. (2) The New Deal. The first of these was 50+ years in the making and, in the end, required a bloody, four-year war to bring to a conclusion. The second happened only after an utter collapse of the economy... unemployment at 25 percent....

We're light years away from that right now. Unemployment? Yes, two or three percent of the working-age population has dropped out of the labor force, but the headline unemployment rate is 5 percent. Wages? They've been stagnant since the turn of the century, but the average family still makes close to 30,000, only 27 percent are dissatisfied with their personal lives. Like it or not, you don't build a revolution on top of an economy like this. Period. If you want to get anything done, you're going to have to do it the old-fashioned way: through the slow boring of hard wood.

Why do I care about this? Because if you want to make a difference in this country, you need to be prepared for a very long, very frustrating slog.... There's a decent chance that Bernie's failure will result in a net increase of cynicism about politics, and that's the last thing we need. I hate the idea that we might lose even a few talented future leaders because they fell for Bernie's spiel and then got discouraged when it didn't pan out.... If you don't want your followers to give up in disgust, your inspiration needs to be in the service of goals that are at least attainable. By offering a chimera instead, Bernie has done the progressive movement no favors...

pgl said...

Sanders lost me when he derided "establishment" economists. I do not trust any politician that picks adviser that only tell him what he wants to hear.

Reply September 11, 2017 at 05:36 AM

...In fact, it's worse than that: we were never going to get a revolution, and Bernie knew it all along. Think about it: has there ever been an economic revolution in the United States? Stretching things a bit, I can think of two: (1) The destruction of the Southern slave economy following the Civil War. (2) The New Deal. The first of these was 50+ years in the making and, in the end, required a bloody, four-year war to bring to a conclusion. The second happened only after an utter collapse of the economy... unemployment at 25 percent....

We're light years away from that right now. Unemployment? Yes, two or three percent of the working-age population has dropped out of the labor force, but the headline unemployment rate is 5 percent. Wages? They've been stagnant since the turn of the century, but the average family still makes close to 30,000, only 27 percent are dissatisfied with their personal lives. Like it or not, you don't build a revolution on top of an economy like this. Period. If you want to get anything done, you're going to have to do it the old-fashioned way: through the slow boring of hard wood.

Why do I care about this? Because if you want to make a difference in this country, you need to be prepared for a very long, very frustrating slog.... There's a decent chance that Bernie's failure will result in a net increase of cynicism about politics, and that's the last thing we need. I hate the idea that we might lose even a few talented future leaders because they fell for Bernie's spiel and then got discouraged when it didn't pan out.... If you don't want your followers to give up in disgust, your inspiration needs to be in the service of goals that are at least attainable. By offering a chimera instead, Bernie has done the progressive movement no favors...

pgl said...

Sanders lost me when he derided "establishment" economists. I do not trust any politician that picks adviser that only tell him what he wants to hear.

Reply September 11, 2017 at 05:36 AM

Juggalos and montary regime change

Class Clowns by ADAM THERON-LEE RENSCH

Monetary Regime Change: Mission Accomplished by David Beckworth

Friday, September 15, 2017

troll wants a revolution

"But those who argue for incrementalism, who want to make the goal more modest, should be asked: “How much longer do millions stay without insurance? How much longer do families have to deal with the insecurity of sky-high health costs? How much longer can anyone’s savings be wiped out because of one accident?”

I am not for incrementalism. Nor is Kurt. In fact, I'm for something to the left of the Sanders proposal.

So when you say I am for incrementalism - you are doing what you always do. Lying. It is all you got. Pathetic!

Tuesday, September 12, 2017

Monday, September 11, 2017

identity politics

black nationalism versus identity politics = equality

What Liberals Get Wrong About Identity Politics by MYCHAL DENZEL SMITH

What Liberals Get Wrong About Identity Politics by MYCHAL DENZEL SMITH

Saturday, September 09, 2017

Jacinda Ardern

In New Zealand, fired up the youth vote w/ free higher education and legalized medical marijuana

Election September 23.

Election September 23.

Thursday, September 07, 2017

Tuesday, September 05, 2017

Sunday, September 03, 2017

The Wire

Wire marathon on HBO. Season 1 episode 3, "The Deal," Avon Barksdale and I share the same birth date. (Same birthday as Jennifer Lawrence.) Also first appearance of Omar.

2020 Gillibrand and Harris

Kamala Harris and Kirsten Gillibrand will lead Democrats to 2020 victory by Michael Starr Hopkins (lawyer and member of the Clinton and Obama campaigns)

Saturday, September 02, 2017

Friday, September 01, 2017

Thursday, August 31, 2017

Sunday, August 27, 2017

Thursday, August 24, 2017

Socialism by Judis

The Socialism America Needs Now by John Judis

On Piketty's Capital: The Sovereign Wealth Fund Solution by Matt Bruenig

Fully Automated Luxury Gay Space Communism

Dean Baker, replace corporate taxes with government holding common ownership shares.

Paine, social dividend to every citizen.

Health care, housing, food, transport, education. Decommodify stuff people need.

Fully Automated Luxury Gay Space Communism

Portugal

No alternative to austerity? That lie has now been nailed by Owen Jones

For years we’ve been told that only deep cuts can save our economy. Portugal’s socialist-led government has proved the opposite

For years we’ve been told that only deep cuts can save our economy. Portugal’s socialist-led government has proved the opposite

Wednesday, August 23, 2017

Tuesday, August 22, 2017

Monday, August 21, 2017

fascism and economic anxiety; centrists

Sunday, August 20, 2017

Saturday, August 19, 2017

Inherent Vice

Was it possible, that at every gathering--concert, peace rally, love-in, be-in, and freak-in, here, up north, back east, wherever--those dark crews had been busy all along, reclaiming the music, the resistance to power, the sexual desire from epic to everyday, all they could sweep up, for the ancient forces of greed and fear?

― Thomas Pynchon, Inherent Vice

Moon the Klan

Molly Ivins:

Our Texas freedom-fighters have been prone to misbehavior ever since. A recent Ku Klux Klan rally in Austin produced an eccentric counter- demonstration. When the fifty Klansmen appeared (they were bused in from Waco) in front of the state capitol, they were greeted by five thousand locals who had turned out for a “Moon the Klan” rally. Citizens dropped trou both singly and in groups, occasionally producing a splendid wave effect. It was a swell do.I was there and participated!

Friday, August 18, 2017

Thursday, August 17, 2017

Wednesday, August 16, 2017

Baffler on "Goodbye, Pepe"

Goodbye, Pepe by Angela Nagle

Similarly, leftists who opposed Hillary Clinton or have stressed the role of “economic anxieties” of downwardly mobile whites in the rise of the Trumpian right may start catching flak for excusing and thus enabling Nazis. Indeed, if any of the great historians of the Nazi period wrote their books today, they’d be denounced for larding their accounts with such interpretive context, as they all did, because context has now been reclassified as blame-shifting.

Dylan Matthews Foppish Vox Hipster

Trump's idea that jobs will solve racism is just wrong by Dylan Matthews

It’s not a totally implausible theory, that the country becomes more tolerant during economic booms and that white Americans become more racially prejudiced during recessions or stagnation.

But the evidence for the theory is mixed at best. In many cases, it’s hard to see much correlation between objective economic conditions and the status of race relations.

Who Were the Counterprotesters in Charlottesville?

Who Were the Counterprotesters in Charlottesville?

In Charlottesville, about 20 members of a group called the Redneck Revolt, which describes itself as an anti-racist, anti-capitalist group dedicated to uniting working-class whites and oppressed minorities, carried rifles and formed a security perimeter around the counterprotesters in Justice Park, according to its website and social media.

The group, which admires John Brown, a white abolitionist who led an armed insurrection in 1859, issued a “call to arms” on its website: “To the fascists and all who stand with them, we’ll be seeing you in Virginia.”

The scholar and activist Cornel West told the newscast “Democracy Now!” that anti-fascists saved his life and the lives of other nonviolent clergy members in Charlottesville. “We would have been crushed like cockroaches were it not for the anarchists and the anti-fascists,” he said on the show. “You had police holding back and just allowing fellow citizens to go at each other.”

The group, which admires John Brown, a white abolitionist who led an armed insurrection in 1859, issued a “call to arms” on its website: “To the fascists and all who stand with them, we’ll be seeing you in Virginia.”

The scholar and activist Cornel West told the newscast “Democracy Now!” that anti-fascists saved his life and the lives of other nonviolent clergy members in Charlottesville. “We would have been crushed like cockroaches were it not for the anarchists and the anti-fascists,” he said on the show. “You had police holding back and just allowing fellow citizens to go at each other.”

Tuesday, August 15, 2017

common owndership argument and fully automated luxury gay space communism

Common Ownership And The New Antitrust Movement by Matt Bruenig

The Simple Clean Route on Corporate Tax Reform by Dean Baker

Add a social wage to be distributed from the corporate tax fund.

NGDP monetary policy rule.

Larry Summers.

NGDP monetary policy rule.

Larry Summers.

Sunday, August 13, 2017

Heather Heyer

Heather Heyer

"economic anxiety," liberals and Trump voters

Economic Anxiety Didn’t Make People Vote Trump, Racism Did by Sean McElwee and Jason McDaniel

Can we finally kill off the zombie lie? Trump’s voters mostly weren’t the “white working class” by CHAUNCEY DEVEGA

Financial Insecurity and the Election of Donald Trump by Diana Elliott and Emma Kalish

Saturday, August 12, 2017

Elizabeth Warren at Vox

Elizabeth Warren fires back at centrist Democrats by Jeff Stein

Yes, the system is rigged – and if you don’t feel like anyone in politics is doing anything to un-rig it, well, that’s how a lot of folks who should have been with us last November wound up voting for Donald Trump.

Barkley Rosser on financial crisis

The Financial Crisis Tenth Anniversary by Barkley Rosser

3) In terms of the behavior of the Fed at the time of the crash, there had been some preparations for it, mostly by people at the New York Fed, and indeed the various alternative entities the Fed rolled out temporarily after the hard crash were cooked up in advance by them. However, the most important thing the Fed did remains widely unknown and unadvertised, although I have posted on it previously, and it has been publicly reported on, it not on front pages anywhere ever. That would be the half a trillion dollar save the Fed did for the European Central Bank, taking a bunch of very bad assets onto the Fed balance sheet, which were then gradually and quietly rolled off over the next six months to be replaced by Mortgage Backed Securities. The euro was crashing, and the ECB was facing the threat that both BNP Paribas and Deutsche Bank were in danger of failing. This was the immediate danger that could have led to a full blown global financial crash of a 1931 level or worse. This save was probably the most important thing the Fed did to keep the crisis from bringing about another Great Depression, although it remains not well known, partly because both the Fed and the ECB did not want it advertised. A good account of this can be found in Neil Irwin’s book, _The Alchemists_.

Friday, August 11, 2017

Thursday, August 10, 2017

agnotology

In 1979, a secret memo from the tobacco industry was revealed to the public. Called the Smoking and Health Proposal, and written a decade earlier by the Brown & Williamson tobacco company, it revealed many of the tactics employed by big tobacco to counter “anti-cigarette forces”.

In one of the paper’s most revealing sections, it looks at how to market cigarettes to the mass public: “Doubt is our product since it is the best means of competing with the ‘body of fact’ that exists in the mind of the general public. It is also the means of establishing a controversy.”

This revelation piqued the interest of Robert Proctor, a science historian from Stanford University, who started delving into the practices of tobacco firms and how they had spread confusion about whether smoking caused cancer.

...

Wednesday, August 09, 2017

4 depressing charts that show why many Americans don’t feel the economy has recovered by Pedro Nicolaci da Costa

Expectations are everything, especially in economics.

That’s why a distinct lack of progress in a few basic measures of economic progress, particularly relative to pre-crisis expectations, has left many Americans questioning how much they have personally benefitted from the economic recovery.

A new report from the Roosevelt Institute, a liberal think tank in Washington, highlights a number of ways in which "the recovery since 2009 is, in a sense, a statistical illusion."

The study finds the nation’s total economic output, its gross domestic product, "remains about 15% below the pre-recession trend, a larger gap than at the bottom of the recession." The first chart below shows that lag, while the second offers insights into just how badly the crisis dented expectations about the future.

Strong employment gains in recent months have brought the jobless rate down to a historically-low 4.3%. However, this decline has not been accompanied by rising incomes or consumer prices, generally associated with a sustainable economic boom. Some Federal Reserve policymakers have found this trend puzzling, while many labor economists point to underlying weaknesses in the job market, including high levels of underemployment and long-term joblessness, as drags on income.

Stagnant wages amid rising profits have meant that the wage share in US national income has fallen from 63% to 57% in the last 15 years, according to the report.

"It is impossible for the wage share to ever rise if the central bank will not allow a period of 'excessive' wage growth," writes J.W. Mason, who authored the report. "A rise in the wage share necessarily requires a period in which wages rise faster than would be consistent with longterm macroeconomic stability."

In other words, if Fed officials tighten monetary policy at the first sign of wage increases, they will never allow the imbalances that have built up, including deep income disparities, to be torn down. Average hourly earnings rose just 2.5% on a yearly basis in July, nothing to write home about and certainly not enough to begin the ground lost over the last decade and more.

Business investment, which is key to long-run economic growth, has also been dismal during the now eight-year expansion.

"There is no precedent for the weakness of investment in the current cycle. Nearly ten years later, real investment spending remains less than 10% above its 2007 peak," Mason writes.

"This is slow even relative to the anemic pace of GDP growth, and extremely low by historical standards. In the three previous [economic] cycles lasting that long, real investment spending had increased anywhere from 30% to 80%. Even shorter cycles saw substantially greater investment growth." Roosevelt 3 investment growth Roosevelt Institute

Finally, Mason looks at whether the economy is at risk of running hot, generating inflation, which central bank officials cite to justify interest rate increases. The Fed has raised interest rates three times since December 2015 to a range of 1% to 1.25%.

"On the contrary, we argue, while a myopic focus on one or another data series might support a story of binding supply constraints, the behavior of the economy as a whole is much more consistent with a situation of depressed demand—an extended recession," the report concludes.

"The overall picture also makes it unclear what actual danger is posed by overheating in the conventional sense. Most of the obvious costs of overheating — higher inflation, higher interest rates, a rising wage share — would be desirable under current circumstances."

Expectations are everything, especially in economics.

That’s why a distinct lack of progress in a few basic measures of economic progress, particularly relative to pre-crisis expectations, has left many Americans questioning how much they have personally benefitted from the economic recovery.

A new report from the Roosevelt Institute, a liberal think tank in Washington, highlights a number of ways in which "the recovery since 2009 is, in a sense, a statistical illusion."

The study finds the nation’s total economic output, its gross domestic product, "remains about 15% below the pre-recession trend, a larger gap than at the bottom of the recession." The first chart below shows that lag, while the second offers insights into just how badly the crisis dented expectations about the future.

Strong employment gains in recent months have brought the jobless rate down to a historically-low 4.3%. However, this decline has not been accompanied by rising incomes or consumer prices, generally associated with a sustainable economic boom. Some Federal Reserve policymakers have found this trend puzzling, while many labor economists point to underlying weaknesses in the job market, including high levels of underemployment and long-term joblessness, as drags on income.

Stagnant wages amid rising profits have meant that the wage share in US national income has fallen from 63% to 57% in the last 15 years, according to the report.

"It is impossible for the wage share to ever rise if the central bank will not allow a period of 'excessive' wage growth," writes J.W. Mason, who authored the report. "A rise in the wage share necessarily requires a period in which wages rise faster than would be consistent with longterm macroeconomic stability."

In other words, if Fed officials tighten monetary policy at the first sign of wage increases, they will never allow the imbalances that have built up, including deep income disparities, to be torn down. Average hourly earnings rose just 2.5% on a yearly basis in July, nothing to write home about and certainly not enough to begin the ground lost over the last decade and more.

Business investment, which is key to long-run economic growth, has also been dismal during the now eight-year expansion.

"There is no precedent for the weakness of investment in the current cycle. Nearly ten years later, real investment spending remains less than 10% above its 2007 peak," Mason writes.

"This is slow even relative to the anemic pace of GDP growth, and extremely low by historical standards. In the three previous [economic] cycles lasting that long, real investment spending had increased anywhere from 30% to 80%. Even shorter cycles saw substantially greater investment growth." Roosevelt 3 investment growth Roosevelt Institute

Finally, Mason looks at whether the economy is at risk of running hot, generating inflation, which central bank officials cite to justify interest rate increases. The Fed has raised interest rates three times since December 2015 to a range of 1% to 1.25%.

"On the contrary, we argue, while a myopic focus on one or another data series might support a story of binding supply constraints, the behavior of the economy as a whole is much more consistent with a situation of depressed demand—an extended recession," the report concludes.

"The overall picture also makes it unclear what actual danger is posed by overheating in the conventional sense. Most of the obvious costs of overheating — higher inflation, higher interest rates, a rising wage share — would be desirable under current circumstances."

Subscribe to:

Posts (Atom)