A Cautious Case for economic Nationalism by JW Mason

Saturday, October 21, 2017

Friday, October 20, 2017

Thursday, October 19, 2017

Monday, October 16, 2017

Sandbu on macro fail

Bolder rethinking needed on macroeconomic policy by Martin Sandbu

The Peterson Institute conference on “Rethinking Macroeconomic Policy”, which we alerted readers to last week, was well worth watching. The marvel of the internet is that virtuous event organisers such as Peterson can give global access by posting online the agenda, papers and recordings of the presentations, including the panel discussions, which were as interesting as the presentations themselves.

I recommend everyone to take a look — but with a disappointment spoiler up front. For while some of the world’s most brilliant economists took part, which alone makes it worth a view, the promised “rethinking” was often more incremental (even marginal) than radical.

The opening paper and presentation by Olivier Blanchard and Larry Summers is a tour de force in terms of stating where the debate stands today in a range of key policy areas. They were followed by former Federal Reserve chair Ben Bernanke, who headlined the panel on monetary policy (here is his paper and video recording of his presentation).

I will focus here on monetary policy issues (the conference covered many other things as well).

As my colleague Chris Giles expertly laid out last week, there is a crisis in central bank theory and practice, which can be briefly summarised as follows: western economies are far from where central bankers thought they would have been by now, still either below capacity or not convincingly at full capacity. Worse yet, they do not understand why. In this context, one might have hoped for some deep soul-searching in a conference of this calibre.

In terms of concrete “deliverables”, there were few new proposals for how to do monetary policy differently. The main contribution was Bernanke’s discussion of complementing the current framework of targeting inflation rates by targeting price levels. Targeting levels rather than rates of change has the advantage of built-in “memory”: in a situation where prices have fallen short of expectations, like today, price level targeting (PLT) would have the central bank aim to make up for lost ground, and thus command more aggressive monetary policy.

But as Bernanke pointed out, in the reverse situation of an inflation overshoot — say, because of a one-off rise in commodity prices or a fall in the exchange rate — PLT would require the central bank to slow down economic activity to keep inflation below target for a while. That would be neither desirable nor credible. His conclusion is that the current framework should be complemented with an announcement in normal times that PLT would be introduced if, and for as long as, interest rates were at zero, and suspended otherwise. This would no doubt improve on the current situation. But it feels little more than a tweak.

There was surprisingly little discussion of national income level targeting — where a central bank targets a path for the nominal size of an economy rather than prices — which does not have the same problem as PLT. Nor was there much engagement with the problem with all proposals for new targets that would be more stimulative, which is that central banks have failed to meet the targets they currently have. If they cannot engineer 2 per cent inflation rates today, why should their commitment to achieve a price level or national income target be any more credible?

Another disappointment on the discussion was how the top of the economics profession takes for granted the impossibility of more negative nominal interest rates. Blanchard and Summers capture the professional consensus when they write that “there is little question that the binding lower bound on short-term nominal interest rates (zero, or slightly negative) limited the scope of monetary policy to sustain demand during the recovery”.

But the fact is that those central banks that have tried to go negative have had no problems doing so, and that techniques for limiting a rush into physical cash exist. There is so far no empirical basis for believing in a near-zero lower bound on central bank interest rates. One would have hoped the luminaries of the field would have been more adventurous in exploring the use of more steeply negative rates.

Most profoundly, there was little sense of urgency that more radical rethinking was needed. Adam Posen, who convened the conference, was one of few who made a point out of this. He suggested that it was both ahistorical to think of asset purchases by central banks as unconventional (which implies that central bank action has been less innovative since the financial crisis than central bankers like to claim) and that more radical policy change was needed.

The closest to a proposal for how to do monetary policy differently was Bernanke’s proposal for pre-announced PLT in predefined exceptional times. But when Blanchard asked panellists whether, if conditions are “back to normal” 10 years from now, they thought central banks would think any differently about monetary policy, the shared expectation seemed to be that a normalisation of the economy would and should lead to a normalisation of policy thinking too, but with a preparedness for a possible return to abnormal situations.

That view is oddly forgetful of recent history. It does not acknowledge that the failure to forecast the crisis could indicate that something is deeply wrong in how we think about monetary policy even in normal times. Even if one tacks on a precommitment to do things differently should a new deflationary crisis occur, à la Bernanke’s proposal or some other readiness to return to “unconventional” tools, that largely presupposes that we have by now figured out how to deal with protracted slow demand growth with very low interest rates.

In other words, expecting future monetary policy to be largely as before, with some newly exploited crisis tools in the toolbox, rather takes as given that monetary policy has performed close to the best it could have done both before and after the crisis. That is, if nothing else, a self-flattering view for monetary policymakers to take. But it is not very reassuring. For central bankers, as for everyone else, admitting one has got things badly wrong is a prerequisite for doing better.

Sunday, October 15, 2017

Atrios on recovery

Dustbowl

I think it will be the forgotten depression. The triumphalism of neoliberal capitalism and Fed independence made this unpossible, and the unquestionable stewardship of Obama/Geithner rendered it moot. I'm not sure that even historians - decades later, as is their privilege - will grapple with this fact.

Empires fall.

THURSDAY, OCTOBER 12, 2017

Dustbowl

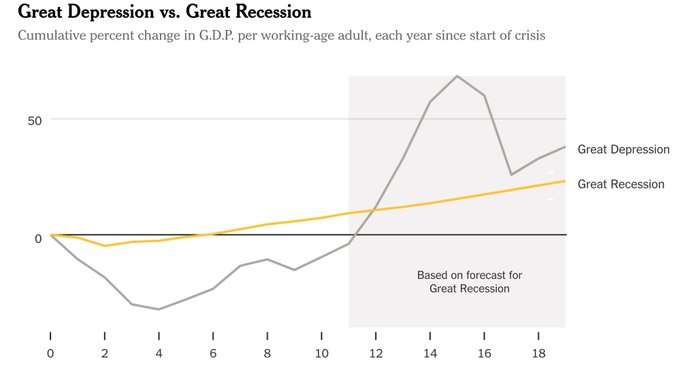

A decade later, it looks like the Great Recession may be worse than the Great Depression https://nyti.ms/2kJUSnd

I think it will be the forgotten depression. The triumphalism of neoliberal capitalism and Fed independence made this unpossible, and the unquestionable stewardship of Obama/Geithner rendered it moot. I'm not sure that even historians - decades later, as is their privilege - will grapple with this fact.

Empires fall.

Subscribe to:

Comments (Atom)