Asked about the distance from shore and how far he swam, Kirk said he could not be sure because he had lost his eyeglasses in the water.The press should fact check every single thing he says or has said.

Asked how he knows the exact water temperature and body temperature, Kirk said he could not remember where he got the numbers. His campaign later provided a statement from his mother saying she remembered his body temperature was in the 80s when she saw him under a warming blanket at the hospital.

But medical experts said it was extremely unlikely Kirk's body temperature dropped to 82 in the half-hour plus he was in the water, even if it was 42 degrees as Kirk has said. As the body cools below the normal 98.6 degrees Fahrenheit, shivering sets in and hypothermia begins at a much earlier stage -- 95 degrees, experts say.

Had Kirk's temperature reached 82 degrees, he likely would have been unable to swim and would have lost consciousness, three experts told the Tribune.

"It seems unlikely he could exert himself," said Dr. David Beiser, a University of Chicago doctor who specializes in emergency medicine. "That temperature is the temperature at which you have a high likelihood of your heart stopping."

Dr. Alan Steinman, former director of health and safety for the U.S. Coast Guard and an expert in sea survival, said, "Swimming a mile in 42-degree water is not realistic."

"Not only would he likely lose consciousness from severe hypothermia before he reached a mile distance, but it's probable he would have been unable to use his arms and legs effectively to swim for an hour in 42-degree water," Steinman said. "Whether his core temperature cooled to 82 degrees is still questionable, and if he were that severely hypothermic -- and likely unconscious -- it is unlikely the hospital would have treated and released him."

Saturday, July 24, 2010

Mark Kirk, Republican candidate for the open Illinois Senate seat - keeps making stuff up. First it was his military record, then his teaching experience, now the Chicago Tribune reports there are conflicting details about one of the "most important events" in his life. The story - about how he survived a near-drowning in Lake Michigan 34 years ago when he was 16 - is one he has told repeatedly on the campaign trail. He says the event inspired him to choose a life in public service. From the Tribune article:

They Learned Their Lessons Well

Krugman directs us to this David Pilling column on Asia's Keynesian response to the crisis.

Krugman directs us to this David Pilling column on Asia's Keynesian response to the crisis.

However much Asians trumpet the value of parsimony, their governments have been as bold as any in opening the fiscal sluices. One reason is the bitter memory of the 1997 Asian financial crisis when the International Monetary Fund imposed fiscal austerity on several Asian countries. Those measures are now almost universally seen as a blunder that unnecessarily exacerbated economic misery.

Asian governments have taken the lesson to heart. According to Fitch Ratings, fiscal stimulus packages as a percentage of gross domestic product amounted to 6.9 per cent for Vietnam, 7.7 per cent for Thailand, 8 per cent for Singapore, 13.5 per cent for China, and a whopping 14.6 per cent for Japan. Taiwan, with a relatively modest stimulus of 3.8 per cent, gave $100 spending vouchers to each of its 23m inhabitants, including convicts. The Singaporean government subsidised businesses that retained staff. In China, the mother of all stimulus packages funnelled $585bn of spending into the economy, and even more through directing state-controlled banks to increase credit.

The scale of Asia’s stimulus may have matched, even surpassed, the west. But the context has been entirely different. Asian governments had plumped-up their fiscal cushions after the 1997 crisis, building a formidable pool of reserves. Such "prudence" meant, rather bizarrely, that poor countries such as China were foregoing spending and investment in order to facilitate rich foreigner’ binge-buying. But it also meant that, when the crunch came, they had the wherewithal to spend.

...

Japan looks like a cautionary tale for the west. But those peering into the Japanese mirror will see the reflection they want to find. Keynesians will argue that Japan’s fiscal stimulus was not wrong in principle, but badly implemented and undermined by half-hearted policy. For the fiscal hawks, Japan is proof that everlasting stimulus does not work. Japan’s nominal output has hardly budged in two decades, but its gross debt pile now towers at nearly 200 per cent of GDP. Twenty years after its bubble collapsed, Japan has still not crawled from the rubble. Western governments pondering what to do next must worry that this could be their fate.Krugman adds:

There are several interesting things about this table; one is the fact that in the face of the crisis, Germany’s actions were very different from its rhetoric; it was pretty Keynesian in the crunch. I have no idea what was going on in Russia. But the main point here is that Korea and China both engaged in much more aggressive stimulus than any Western nation -- and it has worked out well.

Part of the reason Asians felt empowered to do this was the fact that during the good years they did what you’re supposed to do. Keynesian economics is often caricatured as a policy of deficit spending always; but as I’ve tried to explain, deficit spending is what you should do only when the economy is depressed and interest rates are at or near the zero lower bound. When times are good, you should be paying debt down.

The Output Gap

Krugman blogs:

Krugman blogs:

So what we want to do is compare output with what the economy could be producing. And to estimate that, it’s a good rule of thumb to extrapolate from the last business cycle peak. Why? Because at the peak of the business cycle, the economy is usually operating close to capacity -- in part because central banks try to throttle growth back when they think the economy is in danger of running too hot, leading to inflation. It’s standard practice to assess economic trends with peak-to-peak interpolation, because the peaks are a reasonable estimate of the economy’s capacity, while other points on the business cycle don’t convey anything like that information.If resources hadn't been misallocated into the housing bubble, couldn't they have been allocated to something more productive and forward-looking like "CleanTech" or education, etc.? Would the capacity of the economy have been the same, just the resources allocated to different sectors?

So I measure my trends from the last business cycle peak.

But, say some readers, what if growth at that peak was inflated by a bubble? OK, that’s confusing supply and demand. Bubbles drive demand -- they don’t increase the economy’s capacity (if anything they reduce it). They drive capacity utilization, so that a bubble may drive the economy to a peak; but that peak is still a good indicator of how much the economy can produce, no matter if it’s producing stuff people shouldn’t be buying.

So I know what I’m doing with these trend lines.

Take Your Pick of the Data

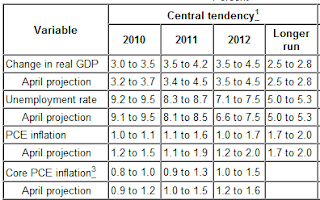

The IMF forecasts 9.5 percent unemployment for this year and 2011.

The Federal Reserve Bank forecasts 9.5 percent unemployment for this year, 8.7 percent for 2011 and 7.5 percent for 2012.

The White House's Office of Management and Budget predicts 9.5 percent this year and 9 percent in 2011. The jobless rate is expected to drop to 8.1 percent in 2012.

Joe Nocera writes about FICO scores and the big three credit bureaus.

----------------

*I have tickets to see the Heartless Bastards play at the Bottom Lounge tonight.

The IMF forecasts 9.5 percent unemployment for this year and 2011.

The Federal Reserve Bank forecasts 9.5 percent unemployment for this year, 8.7 percent for 2011 and 7.5 percent for 2012.

The White House's Office of Management and Budget predicts 9.5 percent this year and 9 percent in 2011. The jobless rate is expected to drop to 8.1 percent in 2012.

The White House’s Office of Management and Budget projected that the deficit for the fiscal year ending Sept. 30 would be $1.47 trillion, $84 billion lower than it estimated in February but still a record in dollar terms. Much of the reduction stemmed from lower than anticipated outlays for unemployment insurance.Thanks to the filibustering Republicans I would guess. (What heartless bastards.*)

Joe Nocera writes about FICO scores and the big three credit bureaus.

They gather input about the prospective borrower’s lending history from various lenders like credit card companies and auto dealers, plug them into a formula and derive a credit score.

You would think, given the critical importance of an accurate score, that there would be rules about the information that is submitted to them. There aren’t. Lenders can submit information about your credit history to one of the bureaus, all of them or none of them. Some of them turn over information right away; some take months; some don’t do it at all. Some are sticklers for accuracy; others are sloppy. The point is that the credit score is derived after an information-gathering process that is anything but rigorous.

Or, rather, I should say, the three different numbers that are derived. Almost always there is a difference -- sometimes a big difference -- in the credit scores generated by the three bureaus.

...But what I find incredible is that we have imbued credit scores with these magical predictive powers -- and yet the companies coming up with the scores can’t even get the borrower’s address and employer right. It would be funny if it didn’t matter so much.

This was the week, of course, that President Obama signed the financial reform bill into law, which calls for the establishment of a new consumer financial protection agency. The credit scoring business would certainly seem to be a worthy area for the new agency to dive into.

Oh no he didn't!Wouldn’t you agree, Professor Warren?

----------------

*I have tickets to see the Heartless Bastards play at the Bottom Lounge tonight.

Labels:

Elizabeth Warren,

FinReg,

Heartless Bastards,

Pain Caucus

Friday, July 23, 2010

A new report highlights a disturbing trend: heightening economic insecurity over the last 25 years.

I'd submit that in the real world politics plays a large part and wealth is being redistributed upwards as a matter of policy.

An insecure lower and middle class will lower labor's bargaining power, which in turn will make it more difficult for labor to raise real wages and fight for its fair share of a growing pie. Which will in turn make the lower orders more insecure and anxious.

Today the Senate Republicans and Federal Reserve Bank are deliberately weakening labors' bargaining power by keeping unemployment high - the Republicans by refusing further fiscal stimulus and the Fed by refusing further monetary stimulus.

And by weakening labor's bargaining power, they redistribute wealth upwards to the richer, speculative classes and heighten inequality.

The report, which draws on a variety of Census and Federal Reserve data, notes that in 1985, 12.2 percent of Americans experienced an economic loss sufficient to render them economically insecure. During the recession of the early 2000s, the insecurity rose to 17 percent; today it is 25 percent.

...

There are many factors complicit in the increased agitation of the American middle class, from declining real wages to the three-decade erosion of pensions and health plans and the new insistence of corporate boards on reducing company matches for 401(k) plans.

Obviously the economy is very complicated. Is it really reasonable though to assume that the the middle fifth, top ten and one percent are being compensated in line with their contributions to the economy? Maybe the middle is.Overall income and family wealth has grown during this time. But the gains are far from equal. After-tax income rose by 21 percent for the middle fifth of American households, but increased by 112 percent for the richest 10 percent of households and by 256 percent for the top 1 percent, according to Mr. Hacker’s report.

I'd submit that in the real world politics plays a large part and wealth is being redistributed upwards as a matter of policy.

An insecure lower and middle class will lower labor's bargaining power, which in turn will make it more difficult for labor to raise real wages and fight for its fair share of a growing pie. Which will in turn make the lower orders more insecure and anxious.

Today the Senate Republicans and Federal Reserve Bank are deliberately weakening labors' bargaining power by keeping unemployment high - the Republicans by refusing further fiscal stimulus and the Fed by refusing further monetary stimulus.

And by weakening labor's bargaining power, they redistribute wealth upwards to the richer, speculative classes and heighten inequality.

Socialists for Balanced Budgets

DeLong recommends Christopher Hayes's piece on the Pain Caucus which is provocatively titled "Are Depressions Necessary?"

Hayes singles out Robert Samuelson* as a particularly vocal member of the puritanical "No Pain No Gain" squad whereas Krugman is singled out for praise as a prescient voice of reason.

---------------------

* a member of my rogues gallery.

** Keynes's phrase for the gold standard

*** wouldn't want to upset the invisible bond vigilantes

DeLong recommends Christopher Hayes's piece on the Pain Caucus which is provocatively titled "Are Depressions Necessary?"

Hayes singles out Robert Samuelson* as a particularly vocal member of the puritanical "No Pain No Gain" squad whereas Krugman is singled out for praise as a prescient voice of reason.

But for Samuelson, inflation is enemy number one, so much so that wringing it out of a system makes recessions look not so bad. "Recessions also have often-overlooked benefits," he wrote in his Newsweek column last year, echoing, in an albeit softer tone, Mellon and Schumpeter. "They dampen inflation. In weak markets, companies can't easily raise prices or workers' wages. Similarly, recessions punish reckless financial speculation and poor corporate investments. Bad bets don't pay off."

With the unemployment sword of Damocles hanging over their heads, workers will think twice about asking for a raise, and all of this will lead to a robust kind of capitalism for the capitalists: one with low inflation, low interest rates and very high return to capital. If that sounds familiar, it's an apt description of the economy of at least the last two decades, a kind of capitalism recently proven far less stable than it may have appeared, but one for which Samuelson is an unapologetic partisan: "The new economic order," Samuelson writes, "is indeed inferior to the imagined and romanticized version of the old order. But it's superior to the old order as it actually operated."Samuelson is far from alone.

...Low inflation became a central obsession of the so called "Washington Consensus," the term given for the uniform prescription of stiff free-market medicine -- balanced budgets, privatization of government services, and tight monetary policy -- that dominated global economic policy in the 1980s and 1990s.

At least Samuelson isn't calling for a return to the gold standard. According to Liaquat Ahamed's Lords of Finance, which is focused on that "barbarous relic,"** back in the 1930s even Socialists were for a balanced budget in the face of depression:What animated much of this advice was not just a rigid and dogmatic economic consensus, but also the puritanical normative assessment that a wicked economy must now pay its penance. (Of course said penance was never paid by those who caused the crisis: It was paid out of the pockets of the starving, the poor and working class.)

As the Depression in Britain had deepened, the budget had slipped into deficit and was running around $600 million, 2.5 percent of GDP -- a modest gap given the circumstances.... In the light of what we now know about the way the economy works, it was completely absurd for the committee to propose the solution to Britain's economic problems, with 2.5 million men out of work, production down 20 percent, and prices falling at a rate of 7 percent a year, was to cut unemployment benefits and raise taxes. But at the time, the prevailing orthodoxy held that budget deficits were always bad, even in a depression.*** Maynard Keynes called the May report "the most foolish document I have ever had the misfortune to read."

The committee's recommendations split the cabinet. The majority, led by the prime minister, Ramsay McDonald, and the chancellor, Philip Snowden, though all fervent and committed Socialists, were wedded to the belief that the budget must be balanced, no matter that Britain was in Depression.So we've made progress thanks to jaunty types like Keynes and Roosevelt. Though it remains the case that the obsession with inflation and the obsession with the deficit when a Democrat is in the White House are the "gold fetters" of today.

---------------------

* a member of my rogues gallery.

** Keynes's phrase for the gold standard

*** wouldn't want to upset the invisible bond vigilantes

Floyd Norris on Elizabeth Warren (Bureau of Consumer Financial Protection or BCFP) and Mary Schapiro (SEC).

It has been reported that Geithner is opposing Warren's nomination for whatever reasons, but at least he's saying the Bush tax cuts for "top earners" shouldn't be extended even in the face of a weak recovery.

Since unemployment is so high, middle class tax cuts should be extended with a trigger, as DeLong has suggested.

It has been reported that Geithner is opposing Warren's nomination for whatever reasons, but at least he's saying the Bush tax cuts for "top earners" shouldn't be extended even in the face of a weak recovery.

Since unemployment is so high, middle class tax cuts should be extended with a trigger, as DeLong has suggested.

Economy picking up

This is good news but something still needs to be done to get unemployment down quickly. I sympathize with other progressives' tendency to hype bad news and ignore good news in order to give weight to their policy prescriptions but we need to be accurate.

It's always easy to spin data politically one way or the other. For instance the Obama administration can now say, "Look, we haven't frightened the business community with our reforms of the health care and financial sectors. In fact our actions have encouraged business and will help to create jobs."

Corporations from AT&T to U.P.S. say business is finally picking up -- and investors are cheering.Strong Economic Data Stokes Optimism in Britain and Germany

Robust quarterly results from some of the nation’s bellwether companies galvanized Wall Street on Thursday. Stocks soared in a broad rally that lifted the Dow Jones industrial average more than 200 points.

Big names like AT&T, Caterpillar, U.P.S. and 3M posted surprisingly strong sales and profit figures for the second quarter. Even more encouraging, many also issued upbeat forecasts for the rest of the year, suggesting that, for them at least, a recovery of sorts was at last taking hold.

This is good news but something still needs to be done to get unemployment down quickly. I sympathize with other progressives' tendency to hype bad news and ignore good news in order to give weight to their policy prescriptions but we need to be accurate.

It's always easy to spin data politically one way or the other. For instance the Obama administration can now say, "Look, we haven't frightened the business community with our reforms of the health care and financial sectors. In fact our actions have encouraged business and will help to create jobs."

Thursday, July 22, 2010

DeLong, Krugman, and Thoma recommend Joseph E. Gagnon's advice to Bernanke and the Fed.

In his testimony to the Congress this week, Fed Chairman Ben Bernanke left the door open to further monetary stimulus but made it clear that such action is not imminent. This reluctance to act may seem puzzling given the widespread view that the economic recovery is too weak.... The Federal Reserve's own forecast shows that it will take at least three or four years for employment to return to its long-run sustainable level. This extended period of high unemployment represents a massive waste of productive labor and untold personal suffering of unemployed workers. The Fed should be aiming to get us back on track within two years. And the urgency of Fed action is all the more important because Congress has refused to provide more stimulus....

Clearly, the case for monetary stimulus is strong. But what form should it take?... [T]he Fed... should return to its traditional roles of lending to the banking system and buying Treasury securities.... [T]he Fed should lower the interest rate it pays on bank reserves to zero.... [T]he Fed should bring down the rates on longer-term Treasury securities by targeting the interest rate on 3-year Treasury notes at 0.25 percent and aggressively purchasing such securities whenever their yield exceeds the target.... Finally, the Fed could bolster the stimulative effects of these actions by establishing a full-allotment lending facility to enable banks to borrow (with high-quality collateral) at terms of up to 24 months at a fixed interest rate of 0.25 percent.

These measures are all within the Federal Reserve's established powers. They pose essentially no risk to the Fed's balance sheet. They would reduce unemployment roughly as much as a 2-year $600 billion fiscal package and yet they would actually reduce the federal budget deficit. And they can be reversed quickly should the balance of risks shift from deflation to inflation.

Sewell Chan reports:Given the unsatisfactory outlook for unemployment and inflation and the lack of action by Congress, that is the right medicine for the US economy now.

The Fed has already held the main short-term interest rate it controls at nearly zero since December 2008, and bought more than $1.5 trillion in mortgage-backed securities and other government debts to place downward pressure on long-term interest rates.

Mr. Bernanke outlined on Thursday three options being discussed by the Fed, but told Mr. Watt, "The effectiveness of these actions would depend in part on financial conditions. If financial conditions became more stressed, I think those steps would be more effective, relatively speaking"

First, he said, the Fed could make clear to the markets that it planned to keep the federal funds rate, currently set at zero to 0.25 percent, for even longer than the "extended period" it has been projecting for months.

Second, the Fed could lower the interest rate it pays on excess reserves -- deposits banks hold at the Fed in excess of what they are required to -- from its current level of 0.25 percent.

Krugman blogs:Third, the Fed could expand its balance sheet, which already stands at $2.3 trillion, primarily by purchasing additional assets, whether in the form of additional government debts and mortgage bonds, or in the form of new assets, like municipal bonds.

We don’t know how well the Gagnon plan would actually work -- but there’s no harm in trying, and large potential benefits. The only possible reason for the Fed not to be more aggressive now is fear of embarrassment, of not getting big results. And that’s no reason to sit still while the Fedfail Index keeps deteriorating.

Wednesday, July 21, 2010

One subject I've changed my mind on is the usefulness of sanctions, like the sanctions on Iraq. They wrecked the country - technically Saddam plus sanctions did - which made "nation building" so much more difficult after regime change.

Andrew Cockburn reviews Invisible War: The United States and the Iraq Sanctions by Joy Gordon.

Tariq Ali on the recent killings in Kashmir.

India bullies Pakistan over water rights in Kashmir and increases tensions.

Andrew Cockburn reviews Invisible War: The United States and the Iraq Sanctions by Joy Gordon.

Tariq Ali on the recent killings in Kashmir.

India bullies Pakistan over water rights in Kashmir and increases tensions.

Calculated Risk on Bernanke's testimony.

So that's 1,700,000 units excess plus 337,500 new units for Q2-Q4 equals 1,925,000 in total.

1,100,000 new households a year means 825,000 units bought up Q2-Q4 which means the total excess for 2010 is 1,925,000 minus 825,000 equals 1,100,000.

Next year if 550,000 units are built plus the 1.1 million excess , the new total is 1.65 million minus 1.1 million new households which equals 550k excess at the end of 2011.

For 2012, 550k new plus 550k excess equals 1.1 million total minus 1.1 million new households equals ZERO excess at the end of 2012. Then employment in the economy should then pick up with 1.1 million new units need to be built to keep up with demand. Add in the mulitplier effect and private demand should rise. (In the mean time, other sectors should pick up with moderate growth in the economy.) If there are less new housing starts each year, of course the excess will be used up more quickly but the economy and employment will hurt more short term.

Again I wonder how this compares with Japan's experience during its lost decade and beyond.

Fed Chairman Ben Bernanke was asked today why he thought companies with significant cash weren't investing. His answer was that most companies currently have excess capacity.

Bernanke was also asked about small companies having trouble getting financing, and he pointed out that small companies reported their number one problem is "lack of customers", not difficulties in obtaining financing.

This excess capacity or lack of demand - and therefore lack of new investment - is a key reason why the recovery is sluggish.

...

There is some good news:

- Homebuilders are on track to deliver the fewest housing units this year since the Census Bureau started tracking housing starts in 1959 (1see analysis below).

- The U.S. population is still growing and new households are being formed. Based on normal household formation to population ratios, there would usually be over 1.1 million net new households formed per year. Because of financial distress, the number of households formed in 2010 will probably be lower then normal. But this is real pent up demand - people don't want to double up with friends or live in their parent's basement forever!

However the bad news is

Usually the key sector for job creation and household formation in the early stages of a recovery is residential investment. But this sector isn't participating (as expected), and this weakness is contributing to the sluggish labor market.

- There are still a substantial number of excess housing units (my estimate is around 1.7 million as of Q1).

- Eventually this excess supply will be absorbed, and new residential investment will increase - but that will not happen until the excess inventory is reduced significantly.

1Analysis: Housing Units added to stock in 2010

Yesterday the Census Bureau reported housing starts fell in June to a 549 thousand seasonally adjusted annual rate. As I noted yesterday, this is good news for the housing market longer term (because of the excess housing units), but bad news for the economy and employment short term.

If I understand this correctly, the estimate of excess housing units is 1.7 million units for Q1. This year around 550,000 new units in total will be built if the pace remains steady (maybe it will slow down?).

So that's 1,700,000 units excess plus 337,500 new units for Q2-Q4 equals 1,925,000 in total.

1,100,000 new households a year means 825,000 units bought up Q2-Q4 which means the total excess for 2010 is 1,925,000 minus 825,000 equals 1,100,000.

Next year if 550,000 units are built plus the 1.1 million excess , the new total is 1.65 million minus 1.1 million new households which equals 550k excess at the end of 2011.

For 2012, 550k new plus 550k excess equals 1.1 million total minus 1.1 million new households equals ZERO excess at the end of 2012. Then employment in the economy should then pick up with 1.1 million new units need to be built to keep up with demand. Add in the mulitplier effect and private demand should rise. (In the mean time, other sectors should pick up with moderate growth in the economy.) If there are less new housing starts each year, of course the excess will be used up more quickly but the economy and employment will hurt more short term.

Again I wonder how this compares with Japan's experience during its lost decade and beyond.

Helicopter Ben Is Monitoring the Situation

(or waiting on the private sector)

Krugman's thoughts on Bernanke's testimony.

Bernanke says moderate growth will continue and the economy will improve very slowly. He says we're not Japan because our economy has higher productivity and our banking sector is in much better health than theirs was. He said consumer spending was increasing.

The IMF is forecasting unemployment of 9.5 percent until 2012, whereas the Fed is predicting that the economy will continue to heal (see above). However Bernanke admitted a lot uncertainty exists and will "get to the chopper" if need be.

About Europe, Bernanke said:

One factor underlying the Committee's somewhat weaker outlook is that financial conditions--though much improved since the depth of the financial crisis--have become less supportive of economic growth in recent months. Notably, concerns about the ability of Greece and a number of other euro-area countries to manage their sizable budget deficits and high levels of public debt spurred a broad-based withdrawal from risk-taking in global financial markets in the spring, resulting in lower stock prices and wider risk spreads in the United States.But Europe has seem to stabilized and he highly doubts that Greece will default. Maybe the Euro isn't dead after all. About the Federal deficit, he didn't seem terribly concerned. The government shouldn't withdraw stimulus until the private sector starts taking over supplying demand.

Bernanke also applauded the "landmark financial regulation legislation" Obama signed this morning.

Obama was also able to get the unemployment benefits extension through the Senate today.

Henwood on Dodd-Frank.

The Volcker Rule by John Cassidy

Volcker’s skepticism about bankers and other financiers dates back to his days at the Fed, where he opposed the Reagan Administration’s efforts to deregulate the banking system. In 1982, Congress passed the Garn-St. Germain Depository Institutions Act, which gave struggling thrift banks (also known as savings and loans) the right to make commercial loans. (Previously, they had been restricted to residential lending.) The legislation was intended to enable thrifts to earn higher profits, and it was strongly supported by Treasury Secretary Donald Regan, the former head of Merrill Lynch. Volcker repeatedly disagreed with Regan and with other members of the Administration. Referring to the S. & L.s, he told his staff, "Give ’em commercial lending power, and they’ll end up with all the bad loans."

This is precisely what happened, and Volcker regards the S. & L. crisis, which ended up costing taxpayers about a hundred and eighty billion dollars in today’s money, as a template for the financial catastrophe of 2007-08. Unlike many economists, who regard financial innovation as generally a good thing, he is suspicious of many things that today’s big financial institutions do, such as creating complex securities and building elaborate mathematical models. Last December, at a conference in England for banking executives, he said that the most important banking innovation of recent decades was the A.T.M.

...

"It does show leadership in the United States, which will help encourage actions abroad. Without the U.S. stepping up, you’d never get a coherent response." He pointed out that the language banning proprietary trading was strong and that even the much weaker language on hedge funds and private-equity funds still contained some safeguards that would force big banks to change how they do business. He also cited the crackdown on derivatives trading and a clause, which he had campaigned for, that creates a position for a second vice-chairman of the Fed, who will be explicitly responsible to Congress for financial regulation. "I think that might turn out to be one of the most important things in there," he said. "It focusses the responsibility on one person."

Anthony Dowd [Volker's chief of staff] added, "We both felt like we got kind of excluded at the very end. But, when you step back, there were fifty-four lobbying firms and three hundred million dollars spent against us. So we didn’t do too badly."To summarize, the bursting of the housing bubble caused a loss of aggregate demand and turned many loans bad which caused firms like Bear Stearns, Lehman Brothers, A.I.G., etc. etc. to collapse. Which caused a chain reaction and panic - no one trusted anyone else's accounting until the "stress tests" - which further reduced aggregate demand in a vicious circle. And then the governments of the world stepped in.

The economy is growing again, yet there's risk of it slipping into a double dip recession. Many in the Pain Caucus - who don't like seeing all of this government action and deficit spending even during a recession - argue the economy needs no more help from the government or central banks and will continue to grow on its own.

Inflation Fears

Ken Rogoff is a professor at Harvard and dues-paying member of the Pain Caucus. Not surprisingly he has worked at the IMF. Brad DeLong debates him in the Financial Times where he writes "Rogoff sees the economy now as suffering from structural maladjustments generated by the expansion of the 2000s in which workers must be trained in new kinds of jobs and shifted over to different sectors in which they have no previous experience, and that that process cannot proceed rapidly without generating inflationary pressures that will destabilise confidence in price stability." Maybe the bubbliciousness of the 2000s came in part from the profits made off of shipping jobs overseas?

Sewell Chan writes that the "Fed is in the Hot Seat," as Bernanke testifies before Congress today.

With unemployment high and inflation low, a question is being asked more often and more loudly: Can and should the Federal Reserve do more to get the economy moving?

...Why was that talk premature, as in why where they overly optimistic? That's what I would ask Bernanke after pointing out that the Fed missed the housing bubble which cost the economy trillions. Since the Fed has been consistently wrong, is it possible the Fed has a bias? (As Dean Baker points out, the IMF has been consistently wrong which suggests it's policy recommendations are politically motivated.)

So far, the debate within the Fed has occurred largely outside of public view, but it reflects how the economic picture has darkened from just a few months ago, when the prospects for a gradually improving economy and a robust stock market seemed more hopeful. Back then, the dominant talk was when to start tightening monetary policy and selling assets on the Fed’s balance sheet.

"Now there is a general recognition that that talk was premature," said Peter N. Ireland, a professor of economics at Boston College and a former economist at the Federal Reserve Bank of Richmond.

Sewell Chan:

In addition, although core inflation, which excludes the highly volatile prices of food and energy, has been running at about half of the Fed’s target of nearly 2 percent, inflation expectations "have not come down nearly as much as one would expect, given how much slack there is in the economy," Ms. Dynan said.

Where is Ms. Dynan's data on high inflation expectations? Link please? Again I don't understand where this fear of phantom inflation is coming from. With unemployment high, the economy in a liquidty trap, and aggregate demand weak, everyone should be afraid of deflation. Very afraid.The size of the Fed’s balance sheet, which has more than doubled since the financial crisis of 2008, and the large amount of bank reserves sitting at the Fed has made officials at the central bank nervous about the potential for rapid inflation once banks decide to start lending more vigorously again, she noted.

Labels:

deficit,

DeLong,

Federal Reserve,

FinReg,

Global Financial System,

Great Clusterfuck,

IMF,

Pain Caucus

Tuesday, July 20, 2010

Pace Yglesias, I predict at this early date that Democratic candidate Alexi Giannoulias will win the Illinois Senate race. I witnessed him first hand at a town hall tonight and he was very good. Very good.* Yes he is being outspent** by large margins and the Democratic base is somewhat demoralized, and yet I got that feeling.

Furthermore, people in the know are aware that Matthew Yglesias's predictions are always wrong. His commenters regularly request that he publicly predict the opposite of the desired outcome.

Also, I predicted after an early playoff win that the Blackawks would go all the way, after decades of falling short. I have the exact same feeling about Giannnoulias. Go to that Etrade/betting website (what's it called???) and make large wagers. That's what I'm going to do.

And as Giannoulias said at the town hall tonight, the race may just decide the fate of America.*** Seriously!

----------------------

*And this is coming form a political junkie/nerd. He was good on the filibuster, energy policy, immigration, government transparency, etc., etc. except for Israel. But who can blame him on that?

** Giannoulias has refused contributions from federal political action committees or lobbyists. So it's not a surprise he's behind in raising money, although the polls say the race is even. The Democratic Congressional Campaign Committee, however, is doing a better job raising money than its rival.

*** Conservatives will get a huge morale boost from taking Obama's old Senate seat, plus with Republicans filibustering every chance they get, every Senate seat counts.

Furthermore, people in the know are aware that Matthew Yglesias's predictions are always wrong. His commenters regularly request that he publicly predict the opposite of the desired outcome.

Also, I predicted after an early playoff win that the Blackawks would go all the way, after decades of falling short. I have the exact same feeling about Giannnoulias. Go to that Etrade/betting website (what's it called???) and make large wagers. That's what I'm going to do.

And as Giannoulias said at the town hall tonight, the race may just decide the fate of America.*** Seriously!

----------------------

*And this is coming form a political junkie/nerd. He was good on the filibuster, energy policy, immigration, government transparency, etc., etc. except for Israel. But who can blame him on that?

** Giannoulias has refused contributions from federal political action committees or lobbyists. So it's not a surprise he's behind in raising money, although the polls say the race is even. The Democratic Congressional Campaign Committee, however, is doing a better job raising money than its rival.

*** Conservatives will get a huge morale boost from taking Obama's old Senate seat, plus with Republicans filibustering every chance they get, every Senate seat counts.

Public Option redux

Ezra Klein likes the three front runners to head the new Consumer Financial Protection Bureau - Elizabeth Warren, Gene Kimmelman, and Michael Barr - but ultimately hopes Warren will be nominated.

He believes Warren's nomination is being blown out of proportion by the left. However her selection would keep her inside the tent, pissing out - including forestalling a possible run for election - and it would help "firm up the base" in time for the November elections.

Ezra Klein likes the three front runners to head the new Consumer Financial Protection Bureau - Elizabeth Warren, Gene Kimmelman, and Michael Barr - but ultimately hopes Warren will be nominated.

He believes Warren's nomination is being blown out of proportion by the left. However her selection would keep her inside the tent, pissing out - including forestalling a possible run for election - and it would help "firm up the base" in time for the November elections.

Bobo Puzzles

David Brooks's columns are like puzzles where the goals are to figure out the holes in the argument; to discover the subtle mischaracterizations, exaggerations and biases; and most importantly to find out which issues important to the topic at hand are being left out of the column. They usually skew anti-liberal in favor of a cosmopolitan fiscal (or pro-rich/trickle-down) conservatism, i.e. bourgeois bohemianism or the ideology of the Bobos. His favorite tactic of late is to adopt a philosphical skepticism and cynicism against science and reason and the ability of humanity to employ those two tools to make things a little better, or at least a little less awful.

In his latest column he remarks upon the recent growth of government bureaucracy - 2001 - 2010 (or rather Federal bureaucracy seeing as state and local governments are mercilessly slashing theirs).

The admirable Dana Priest and William M. Arkin have a series in the Washington Post about the metastasizing national security bureaucracy which Brooks discusses. Liberals will applaud him for pointing this out and he does note that much of the expansion includes private companies on the public tit. This huge expansion of big government is a Republican "porkulus" which delivers questionable bang for the buck.

But next Brooks turns to his real targets, Democrats and liberals. He notes that health care reform increased the bureaucracy, but fails to say it was done in response to massive private sector failure. He mentions the recently-passed financial reform law. And again he fails to highlight the massive private sector failure the legislation was a response to. It's as as if the Democrats just decided to increase the bureaucracy for no reason.

Towards the end of the column, Brooks returns to a familiar trope: class war between the common people and elite government technocrats. This is inaccurate. In reality, these technocrats are appointed by representatives of the people, i.e. elected officials. They are appointed by our representatives because the elite of the corporate sphere (and their government enablers) have run roughshod over our health care and financial systems. And if these technocrats don't provide some checks and balances on the rapacious elite whom Brooks never criticizes or even hardly mentions, the entire nation will suffer another crisis. What does Brooks expect us to do? Just lurch from crisis to crisis?

He writes:

At least he suggests these "tests" might work, although many liberals feel both health care and financial reform were too watered down to pass the test before them. Of course he doesn't mention this. And the second sentence is classic Brooks. "Central regulations" versus "fast-moving information-age societies." Come on! It's more like democratic checks and balances versus highly destructive, secretive, monopolistic corporations that are concerned with nothing but short-term profits.This progressive era amounts to a high-stakes test. If the country remains safe and the health care and financial reforms work, then we will have witnessed a life-altering event. We’ll have received powerful evidence that central regulations can successfully organize fast-moving information-age societies

If the reforms fail -- if they kick off devastating unintended consequences or saddle the country with a maze of sclerotic regulations -- then the popular backlash will be ferocious. Large sectors of the population will feel as if they were subjected to a doomed experiment they did not consent to. They will feel as if their country has been hijacked by a self-serving professional class mostly interested in providing for themselves.Okay, so the public servants of the "professional class" are self-serving and mostly interested in providing for themselves, while the executives of the pharmaceutical, insurance and financial industries are paragons of selflessness working tirelessly for the public good? Give me a fucking break.

If health care reform fails, the government will default on its debts and we'll have whole lot more to worry about than a "popular backlash" against technocrats. If financial reform fails again we will suffer another financial crisis and probably won't be as lucky with the quality of our leadership as we were this time around. An overweening bureaucracy will be least of our concerns.

If that backlash gains strength, well, what’s the 21st-century version of the guillotine?He ends with the typically galling metaphor. As Doug Henwood points out, if things really go south, it usually ends up helping the right wing. See Nazi Germany. Jews like Brooks will be lynched. On rare occasions, like America during the New Deal, the better angels of our nature prevail for the most part. I wouldn't count on it.

Mostly throughout history when things fall apart, tribalism will rear its ugly head. Scapegoats are found and punished. See the partition of colonial India. Reflect on the collapse of the Soviet Union and its sphere of influence.

- Yugoslavia falls apart and genocide occurs in Europe for the fist time since World War II.

- "Roughly 230,000 to 250,000 Georgians were expelled from Abkhazia by Abkhaz separatists and North Caucasians volunteers (including Chechens) in 1992-1993. Around 23,000 Georgians fled South Ossetia as well, and many Ossetian families were forced to abandon their homes in the Borjomi region and move to Russia."

- The Nagorno-Karabakh War between Azerbaijan and those backed by Armenia.

- 20 years after the collaspse of communism, there are continued clashes between Uzbeks and Kyrgyz in Kyrgyzstan.

- etcetera

Monday, July 19, 2010

Buillon

I'm much of the way through Lords of Finance and Liaquat Ahamed's narrative is as follows:

1. 1927, Britain is on the gold standard and suffering. The Fed cuts rates to help out the pound and sets off a stock bubble (that leads to the crash 2 years later.)

2. Commodity prices fall and there's a shortage of gold.

3. In the scramble for gold, central banks raise interest rates.

4. There's a world wide slowdown with the U.S. stock market entering a speculative bubble. It crashes in 1929 and causes a further slowdown. Unemployment rises.

5. The Fed acts a little bit, but refuses to do more fearing another speculative bubble.

6. "Far more damaging than the effect of the protectionist Smoot-Hawley Act was the collapse of capital flows. Capital in search of security was flowing into those countries with already large gold reserves - such as the U.S. and France - and out of countries with only modest reserves - such as Britain and Germany."

7. U.S. banks started going under as the Federal Reserve refused to prop up insolvent banks, which undermined public confidence and caused the credit system to freeze up.

Polarization

Clive Crook says that Obama's big mistake was refusing to "disown the left." Krugman is right to disagree.

Obama has been moderately leftish. With interest rates at zero and the economy needing a jump-start, Obama did a stimulus but failed to take the left's advice to make it sufficiently large. Maybe he didn't have the votes.

Obama passed health care reform with its liberal goal of fixing the malfunctioning private sector and fiscally conservative goal of fixing the long term deficit problem. However he did not follow the left's advice and include a public option. Maybe he didn't have the votes.

Obama passed reform of the banking and financial system in response to the Great Clusterfuck of 2008. He didn't follow the left's advice and nationalize and/or break up the biggest "zombie" banks. This could have caused panic and further damage at a time when the global economy was fragile. Or it could helped the banks deleverage in an orderly manner and saved the taxpayers money. For me it's an open question. (They did end up performing "stress tests" to boost confidence, something the Europeans are copying in response to their sovereign debt crisis.) If we enter a "lost decade" it could be seen as a missed opportunity. Although a lot of banks have been liquified and/or absorbed into other banks, something the Firebaggers refuse to acknowlege.

Obama did follow the left's advice in creating a financial consumer protection agency, but housed it in the Federal Reserve Bank and might not back Elizabeth Warren's appointment to head it.

Jonathan Chait points out that Republicans have been unapologeticaly embracing the far Right and will lose elections in November because of this.

Clive Crook says that Obama's big mistake was refusing to "disown the left." Krugman is right to disagree.

Obama has been moderately leftish. With interest rates at zero and the economy needing a jump-start, Obama did a stimulus but failed to take the left's advice to make it sufficiently large. Maybe he didn't have the votes.

Obama passed health care reform with its liberal goal of fixing the malfunctioning private sector and fiscally conservative goal of fixing the long term deficit problem. However he did not follow the left's advice and include a public option. Maybe he didn't have the votes.

Obama passed reform of the banking and financial system in response to the Great Clusterfuck of 2008. He didn't follow the left's advice and nationalize and/or break up the biggest "zombie" banks. This could have caused panic and further damage at a time when the global economy was fragile. Or it could helped the banks deleverage in an orderly manner and saved the taxpayers money. For me it's an open question. (They did end up performing "stress tests" to boost confidence, something the Europeans are copying in response to their sovereign debt crisis.) If we enter a "lost decade" it could be seen as a missed opportunity. Although a lot of banks have been liquified and/or absorbed into other banks, something the Firebaggers refuse to acknowlege.

Obama did follow the left's advice in creating a financial consumer protection agency, but housed it in the Federal Reserve Bank and might not back Elizabeth Warren's appointment to head it.

Jonathan Chait points out that Republicans have been unapologeticaly embracing the far Right and will lose elections in November because of this.

...The Nevada Senate race is a prime example. Harry Reid, once a dead man walking, is now sitting on a nice lead because Republicans nominated a lunatic to oppose him. "A total f*** up by the state and national Republicans to allow Angle to get nominated," a source notes to Ben Smith.

But of course there are numerous such fuckups. In Kentucky, Republicans turned a rock-solid safe seat into a toss up by nominating ultra-radical Rand Paul over party hack Trey Grayson. In Pennsylvania, they turned a relatively safe seat in Arlen Specter, who had been almost completely housebroken by the right since 2004, into another toss-up. (More importantly, they drove Specter from the party and made him the 60th Senate seat, allowing the passage of health care reform.) And in Florida, they turned another safe hold into a toss-up by challenging, and driving from the party, Charlie Crist.

Florida is actually the closest thing to a rational move for the right. First, I think Crist's current lead is far from safe, because the Democratic vote is likely to consolidate above its current abysmal level and that will come out of Crist's hide. Second, Crist is a genuine moderate, so there really was a more reasonable risk-reward calculation for conservatives looking to gain a more ideologically reliable Senator at the risk of losing the seat altogether. There's at least a strong chance that the Rubio challenge will burn them.

This is four Senate seats put at serious risk by running right-wing primary challenges, plus one enormous liberal domestic policy accomplishment. In all these instances, conservatives either celebrated the right-wing primary challenge or, at the very least, quietly accepted it. There was very little pushback at the time from the party establishment, other than a feeble effort in Kentucky. I have seen no recriminations whatsoever in hindsight. And yet it seems perfectly clear that the effect of these challenges has been a disaster from the conservative perspective. You don't have to love Sue Lowden to understand that a 90% chance of Lowden winning is better than a 20% chance of Sharron Angle winning.

Sunday, July 18, 2010

Libertarian Tyler Cowen notes that "It is also well understood in German political discourse that tax cuts need to be paid for" in an article about the German economy. This makes a nice contrast with American conservatives. However, Cowen demonstrates he is a member of the "Pain Caucus" by arguing that Germany's competitiveness is a result of labor policies he likes:

Regarding Cowen's argument against fiscal stimulus, Paul Krugman notes the many ways Cowen's example of German reunification is a poor one to use.

Krugman writes that Cowen's commentary is despair inducing, but is it really that surprising? I was skimming Isaac Asimov's memoir and he gives a concise account of why he considered himself a liberal:

Policy makers have returned to long-run planning, and during the last decade have liberalized their labor markets, introduced greater wage flexibility and recently passed a constitutional amendment for a nearly balanced budget by 2016, meaning that the structural deficit should not exceed 0.35 percent of gross domestic product.And by attempting to argue against the effectiveness of fiscal stimulus. As I understand it, Germany's labor policies are still much better than America's, even if they have been "liberalizing" them. They have more cause to worry about inflation - but not much more - with their "automatic stabilizers" being much more robust (not to mention fair and just). This keeps up demand in Germany proper with an automatic stimulus even as demand plummets in the periphery as austerity measures are enacted.

Regarding Cowen's argument against fiscal stimulus, Paul Krugman notes the many ways Cowen's example of German reunification is a poor one to use.

1. This was not an effort at fiscal stimulus; it was a supply policy, not a demand policy. The German government wasn’t trying to pump up demand -- it was trying to rebuild East German infrastructure to raise the region’s productivity.

2. The West German economy was not suffering from high unemployment -- on the contrary, it was running hot, and the Bundesbank feared inflation.

3. The zero lower bound was not a concern. In fact, the Bundesbank was in the process of raising rates to head off inflation risks -- the discount rate went from 4 percent in early 1989 to 8.75 percent in the summer of 1992. In part, this rate rise was a deliberate effort to choke off the additional demand created by spending on East Germany, to such an extent that the German mix of deficit spending and tight money is widely blamed for the European exchange rate crises of 1992-1993.

In short, it’s hard to think of a case less suited to tell us anything at all about fiscal stimulus under the conditions we now face.To reiterate, America's fiscal stimulus was demand side; we are in a liquidity trap/up against the zero bound; and finally we are suffering from high unemployment and possible deflation. The German reunification scenario contains none of these three elements.

Krugman writes that Cowen's commentary is despair inducing, but is it really that surprising? I was skimming Isaac Asimov's memoir and he gives a concise account of why he considered himself a liberal:

That is, conservatives tend to like people who resemble themselves and distrust others. In my youth, in the United States the backbone of social, economic, and political power rested with an establishment consisting almost entirely of people of Northwestern European extraction, and the conservatives making up that establishment were contemptuous of others. Among others, they were contemptuous of Jews and in the Hitler years they were not very troubled by the Nazis, whom they considered a bulwark against Communism.

...

I wanted to see the United States changed and made more civilized, more humane, truer to its own proclaimed traditions. I wanted to see all Americans judged as individuals and not as stereotypes. I wanted society to feel a reasonable concern for the welfare of the poor, the unemployed, the sick, the aged, the hopeless.Having elected a black President, America has improved. But there has been some backsliding in other ways.

Robert Heinlein, however, who was a burning liberal during the war, became a burning conservative afterward, the change coming at about the time he swapped wives from the liberal Leslyn to the conservative Virginia. I doubt that Heinlein would call himself a conservative, of course. He always pictured himself a libertarian, which to my way of thinking means: "I want the liberty to grow rich and you can have the liberty to starve." It's easy to believe that no one should depend on society for help when you yourself happen not to need such help.When thinking about the Reagan era, Asimov - who died in 1992 - quotes these lines from Oliver Goldsmith:

Where wealth accumulates, and men decay.

Ill fares the land, to hastening ills a prey,

Subscribe to:

Comments (Atom)

.svg.png)