The end of a glittering career.... by Dan Davies

Showing posts with label positive outlook. Show all posts

Showing posts with label positive outlook. Show all posts

Saturday, August 16, 2014

Monday, July 14, 2014

Thursday, July 03, 2014

positive outlook

A BOFFO JOBS REPORT, BUT PUZZLES LINGER BY JOHN CASSIDY

Is this the jobs recovery we’ve been looking for? by Matt O'Brien

Is this the jobs recovery we’ve been looking for? by Matt O'Brien

Wednesday, July 02, 2014

positive outlook

Maybe Lucy won't snatch the ball away this time.

"Yellen conceded that policymakers “failed to anticipate” the ensuing global financial crisis but also argued that monetary policy would have been “insufficient” to address the problems that caused it. Higher rates would not have beefed up regulation or increased the transparency of the exotic new financial instruments at the heart of the crisis -- or the firms that helped generate them.

In fact, Yellen said that raising rates would likely have caused greater unemployment, which would likely have led to more people defaulting on their debts."

2) John Williams predicts stronger growth in the 2nd half and over 3 percent the next 2 years. Could be good for the Democratic candidate in 2016.

can't attach much meaning to profit share drop

written by Dean, July 02, 2014 2:53

1) Yellen making the right sounds. Rhetorically swats John Taylor.

In fact, Yellen said that raising rates would likely have caused greater unemployment, which would likely have led to more people defaulting on their debts."

2) John Williams predicts stronger growth in the 2nd half and over 3 percent the next 2 years. Could be good for the Democratic candidate in 2016.

3) Dean Baker:

Big Drop in Profit Share in First Quarter GDP

Tuesday, 01 July 2014 13:24

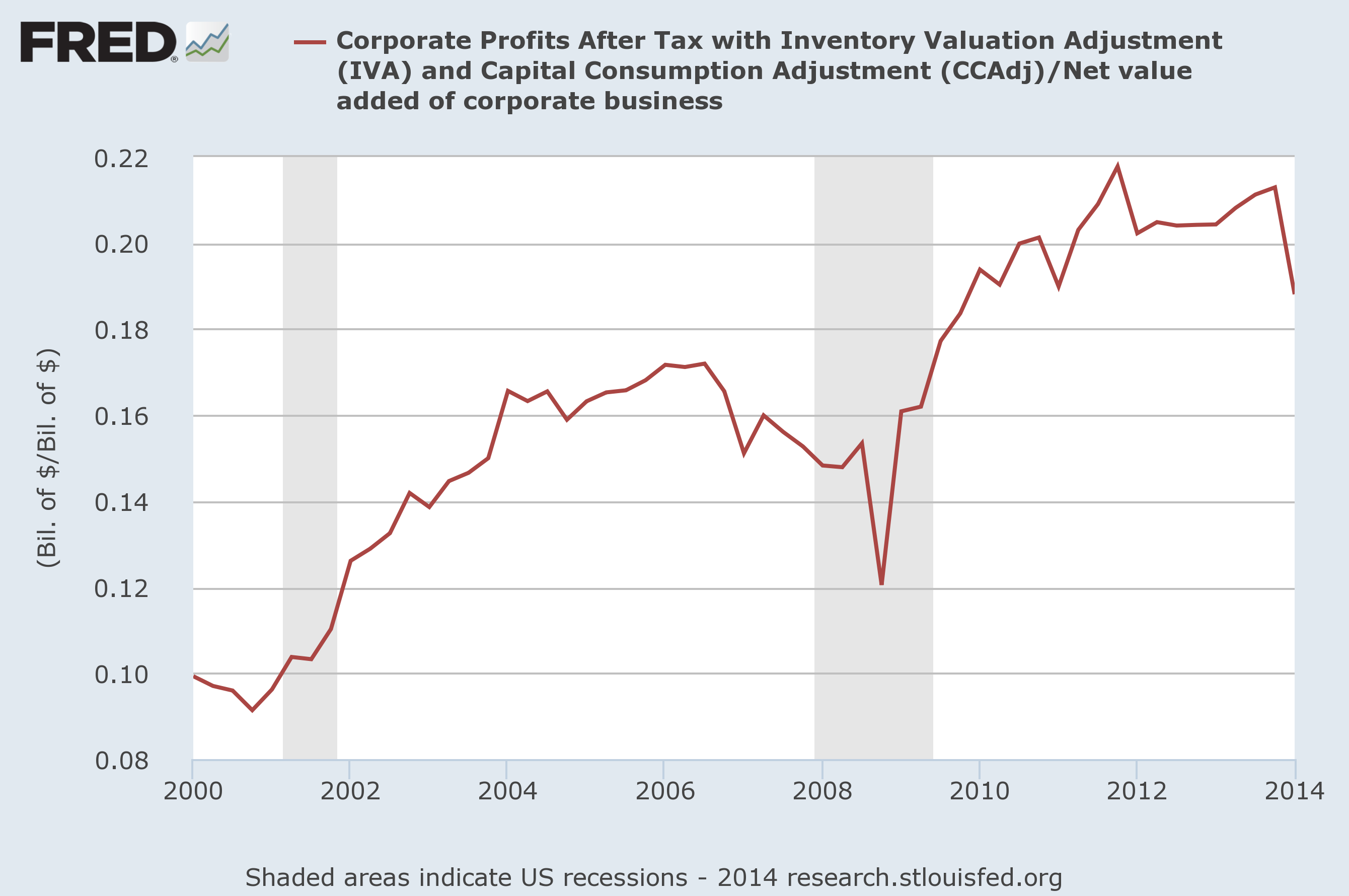

Quarterly GDP data are erratic and profit data in particular are subject to large revisions, but hey it's still worth noting a big drop in profit shares reported for the first quarter of 2014. The data released by the Commerce Department last week showed the profit share falling from just over 21 percent of net value added in the corporate sector in the last quarter of 2013 to less than 19 percent in the first quarter of 2014. Here's the picture.

It's too early to make much of this drop in profit shares. It is also a bit disconcerting that it is all attributable to a drop in the capital consumption adjustment, the difference between accounting depreciation and economic depreciation as measured by the Commerce Department. (In other words, the Commerce Department is showing a larger gap between what firms record for accounting purposes and the actual rate of depreciation of capital.) Anyhow, with all the appropriate caveats, this may be the first sign that the sharp rise in profit shares in this century is being reversed, or as Gerald Ford once said, our long national nightmare is over. |

And he adds in comments:

written by Dean, July 02, 2014 2:53

Ideally the drop in profit shares would mean that workers are getting a share of the gains from growth, meaning higher wages. But, the data for the first quarter show the economy shrinking, which means there were no gains to be shared. So we really can't draw much from this picture yet. However, if the profit share stays down and we get decent growth the rest of this year, that would mean that workers will finally be seeing some wage growth.

Friday, June 27, 2014

San Francsico

Oh I wish I lived in or near San Francisco:

Last year, Writers With Drinks brought you the special event, "An Evening of Uncomfortable Sex Talk." Now, we bring you "An Evening of Oversharing About Money"!

When: Saturday, July 12, from 7:30 PM to 9:30 PM, doors open 6:30 PM

Who: J. Bradford DeLong, Carol Queen, Farhad Manjoo, Frances Lefkowitz and Charlie Jane Anders

How much: $5 to $20, all proceeds benefit the Center for Sex and Culture.

Where: The Make Out Room, 3225 22nd. St., San Francisco

Last year, Writers With Drinks brought you the special event, "An Evening of Uncomfortable Sex Talk." Now, we bring you "An Evening of Oversharing About Money"!

When: Saturday, July 12, from 7:30 PM to 9:30 PM, doors open 6:30 PM

Who: J. Bradford DeLong, Carol Queen, Farhad Manjoo, Frances Lefkowitz and Charlie Jane Anders

How much: $5 to $20, all proceeds benefit the Center for Sex and Culture.

Where: The Make Out Room, 3225 22nd. St., San Francisco

Monday, June 09, 2014

Thursday, May 01, 2014

Tuesday, April 29, 2014

Thursday, April 24, 2014

rising Democratic majority

Is the Rising Democratic Majority Doomed? by Jonathan Chait

Washington Post Discovers Worksharing by Dean Baker

Washington Post Discovers Worksharing by Dean Baker

Monday, April 07, 2014

Saturday, January 25, 2014

Tuesday, January 14, 2014

positive outlook

Fiscal Drag and Less Thereof by Jared Bernstein

My guess is that the deficit as a share of GDP will be around the same this year as last year, meaning little or no “negative fiscal impulse.”

So, granted that a lot can still go wrong—debt ceiling!—and that the failure to extend UI benefits would counteract some of the pro-growth results I show here, we may have reached a do-less-harm moment from our elected officials. Woohoo!

Sunday, January 12, 2014

Golden Globes

Khaleesi Emilia Clarke* (and Chris O'Donnell) present Amy Poehler with an award, beating out other favorites Deschanel and Louis-Dreyfus. (I really like Veep where they did filibuster reform.) Tatiana Maslany didn't win in her category unfortunately.

-----------

*She made in interesting-looking film called Spike Island. It's about some young people in 1990 trying to attend the Stone Roses' now "increasingly legendary" gig.

Wikipedia:

-----------

*She made in interesting-looking film called Spike Island. It's about some young people in 1990 trying to attend the Stone Roses' now "increasingly legendary" gig.

Wikipedia:

The Stone Roses' outdoor concert at Spike Island in Widnes on 27 May 1990 was attended by some 27,000 people. The event, considered a failure at the time due to sound problems and bad organisation, has become legendary over the years as a "Woodstock for the baggy generation".[69] In mid-2010 footage of the concert was published on Youtube.

Thursday, January 09, 2014

positive outlook

Is Larry Summers Right About “Secular Stagnation”? by John Cassidy

On this point, I am a bit more optimistic, for a couple of reasons. The comparison with Japan, although worrying, isn’t fully persuasive. For many years after the stock-market and real-estate busts of the early nineties, stricken Japanese banks hoarded money, refusing to lend, and Japanese consumers saved more, crimping consumer spending. In this country, following the Great Recession, banks repaired their balance sheets much more rapidly and started lending again. Indeed, as Summers notes, there are already signs that credit standards are deteriorating again. Consumer spending, after an initial fall, has rebounded surprisingly well.

What has held the economy back is restrictive fiscal policy and a reluctance on the part of businesses to invest in new capacity. (For the first time in decades, gross capital investment has fallen below twenty per cent of G.D.P.) Looking ahead, there are hopeful signs in both areas. The budget deal at the start of the year modified the sequester, and investment, particularly in new home construction, appears to be picking up. Barring some unforeseen calamity, it’s quite likely that 2014 will be the first year since the housing bubble in which G.D.P. growth reaches three per cent. And with plenty of slack left in the economy, there’s no obvious reason why 2015 shouldn’t be another good year.

Saturday, January 04, 2014

Wednesday, January 01, 2014

De Blasio

...“My sense is, he is going to be very intent and dedicated to showing that he can construct this new model of municipal governance,” said Katrina vanden Heuvel, the editor of The Nation, a left-leaning periodical that has dedicated a journalist full time to covering the early days of the new administration.

“He needs to deliver, and he understands that,” Ms. vanden Heuvel added.

...

Cornel West, the professor and political activist who recently returned to New York to teach at Union Theological Seminary, said the mayor represented “a sigh of relief from the reign of Bloomberg.”

But he invoked his own disappointment with President Obama in sounding a note of caution.

“There’s got to be a connection between vision and speeches, and execution and policy,” Dr. West said. “Our beloved president — that brother gives beautiful speeches, but he is milquetoast oftentimes when it comes to execution.”

Dr. West allowed himself a laugh. “We don’t want de Blasio going down that Obama lane, or we’ll be in trouble,” he said.

Monday, December 30, 2013

positive outlook

Good news from Krugman:

Fiscal Fever Breaks

Bankers Beaten Back A Bit

Obamacare Not A Total Disaster, Continued

Fiscal Fever Breaks

Bankers Beaten Back A Bit

Obamacare Not A Total Disaster, Continued

Wednesday, December 25, 2013

upgrade

Q4 GDP: Here come the Upgrades by Bill McBride

And based on the November Personal Income and Outlays report:

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Via the WSJ:

Macroeconomic

Advisers ... [raised] its estimate for fourth-quarter growth. It now

forecasts gross domestic product to expand at an annualized rate of 2.6%

in the final three months of the year, up three-tenths of a percentage

point from an earlier estimate.

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Macroeconomic Advisers ... [raised] its estimate for fourth-quarter growth. It now forecasts gross domestic product to expand at an annualized rate of 2.6% in the final three months of the year, up three-tenths of a percentage point from an earlier estimate.And Goldman Sachs has increased their Q4 GDP tracking to 2.4% annualized growth.

And based on the November Personal Income and Outlays report:

Using the two-month method to estimate Q4 PCE growth (first two months of the quarter), PCE was increasing at a 4.1% annual rate in Q4 2013. This suggests solid PCE growth in Q4.Of course the contribution from private inventories will probably be negative in Q4, but final demand should be solid.

Macroeconomic

Advisers ... [raised] its estimate for fourth-quarter growth. It now

forecasts gross domestic product to expand at an annualized rate of 2.6%

in the final three months of the year, up three-tenths of a percentage

point from an earlier estimate.

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Macroeconomic Advisers ... [raised] its estimate for fourth-quarter growth. It now forecasts gross domestic product to expand at an annualized rate of 2.6% in the final three months of the year, up three-tenths of a percentage point from an earlier estimate.And Goldman Sachs has increased their Q4 GDP tracking to 2.4% annualized growth.

And based on the November Personal Income and Outlays report:

Using the two-month method to estimate Q4 PCE growth (first two months of the quarter), PCE was increasing at a 4.1% annual rate in Q4 2013. This suggests solid PCE growth in Q4.Of course the contribution from private inventories will probably be negative in Q4, but final demand should be solid.

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Via the WSJ:

And based on the November Personal Income and Outlays report:

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Macroeconomic Advisers ... [raised] its estimate for fourth-quarter growth. It now forecasts gross domestic product to expand at an annualized rate of 2.6% in the final three months of the year, up three-tenths of a percentage point from an earlier estimate.And Goldman Sachs has increased their Q4 GDP tracking to 2.4% annualized growth.

And based on the November Personal Income and Outlays report:

Using the two-month method to estimate Q4 PCE growth (first two months of the quarter), PCE was increasing at a 4.1% annual rate in Q4 2013. This suggests solid PCE growth in Q4.Of course the contribution from private inventories will probably be negative in Q4, but final demand should be solid.

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Via the WSJ:

And based on the November Personal Income and Outlays report:

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Macroeconomic Advisers ... [raised] its estimate for fourth-quarter growth. It now forecasts gross domestic product to expand at an annualized rate of 2.6% in the final three months of the year, up three-tenths of a percentage point from an earlier estimate.And Goldman Sachs has increased their Q4 GDP tracking to 2.4% annualized growth.

And based on the November Personal Income and Outlays report:

Using the two-month method to estimate Q4 PCE growth (first two months of the quarter), PCE was increasing at a 4.1% annual rate in Q4 2013. This suggests solid PCE growth in Q4.Of course the contribution from private inventories will probably be negative in Q4, but final demand should be solid.

Read more at http://www.calculatedriskblog.com/#QUoS2HZRXvTD5Pcx.99

Tuesday, December 24, 2013

positive outlook?

Reason for Optimism? by Menzie Chinn

Finally, I think the factor that makes the growth more likely to be sustainable going forward, barring another debt-ceiling crisis or some sort of financial crisis overseas, is the fact that real household net worth has nearly reattained pre-crisis levels.

Subscribe to:

Posts (Atom)