NYTimes commenter:

"Central bank power really is an illusion, to some extent. In extremis, the market can trump that power..."

Harpooning Ben Bernanke by Krugman

MOBY BEN, OR, THE WASHINGTON SUPER-WHALE: HEDGE FUNDIES, THE FEDERAL RESERVE, AND BERNANKE-HATRED

by DeLong

In February 2012, a number of hedge fund traders noted one particular index--CDX IG 9--that seemed to be underpriced. It seemed to be cheaper to buy credit default protection on the 125 companies that made the index by buying the index than by buying protection on the 125 companies one by one. This was an obvious short-term moneymaking opportunity: Buy the index, sell its component short, in short order either the index will rise or the components will fall in value, and then you will be able to quickly close out your position with a large profit.

But February passed, and March passed, and April rolled in, and the gap between the price of CDX IG 9 and what the hedge fund traders thought it should be grew. And their bosses asked them questions, like: "Shouldn't this trade have converged by now?" "Have you missed something?" "How much longer do you want to tie up our risk-bearing capacity here?" "Isn't it time to liquidate--albeit at a loss?"

So the hedge fund traders began asking who their counterparty was. It seemed that they all had the same counterparty. And so they began calling their counterparty "the London Whale". They kept buying. And the London Whale kept selling. And so they had no opportunity to even begin to liquidate their positions and their mark-to-market losses grew, and the risk they had exposed their firms to grew.

So they got annoyed.

And they went public, hoping that they could induce the bosses of the London Whale to force him to unwind his possession, in which case they would profit immensely not just when the value of CDX IG 9 returned to its fundamental but by price pressure as the London Whale had to find people to transact with. And so we had 'London Whale' Rattles Debt Market, and similar stories

The London Whale was Bruno Iksil. He had been losing, and rolling double or nothing, and losing again for months. His boss, Ina Drew, took a look at his positions. They found they had a choice: they could hold the portfolio and thus go all-in, or they could fold. They could hold CDX IG 9 until maturity--make a fortune if a fewer-than-expected number of its 125 companies went bankrupt, and lose J.P. Morgan Chase entirely to bankruptcy if more did. Or they could take their $6 billion loss and go home. They could either take their losses, or sing "Luck, Be a Lady Tonight!" and bet J.P. Morgan Chase on a single crapshoot. After all, what could they do if the bet went wrong and they had to eat losses at maturity? J.P. Morgan Chase couldn't print money. So Drew stood Iksil down, and the hedge fund traders had their happy ending.

In late 2008, the Treasury bond went haywire. The interest rate on the Ten Year Nominal Treasury bond fell to 2.1% in the panic--clearly overpriced. In the late 1990s with the debt-to-annual-GDP ratio on the decline the Treasury bond had traded between 5% and 7%. In the 2000s with a weak economy the Treasury bond had traded between 4% and 5%. With the Federal debt exploding even faster than it had around 1990, it seemed to hedge fund traders very clear that the long-term fundamental value of the Ten-Year Treasury bond probably carried an interest rate of 7%, or more--and was at the very least more than 5%. So smart hedge fund traders shorted Treasuries, and waited for the Treasury Bond to return to its fundamental value.

And they ran into the widowmaker.

So they scrambled around, wondering: "Why did the interest rate on the Ten-Year Treasury peak at 4%? And why has it gone down since then? And why won't it go back to its 5%-7% fundamental." And they looked around. And they found Ben Bernanke:

The Washington Super-Whale.

He had printed-up reserve deposits, and used them to buy Treasury Bonds, and in so doing, they thought, had pushed the price of Treasuries up well beyond their fundamentals. Yet rather than easing off, taking his lumps, and letting the market "clear" he kept buying and buying and buying and buying, leaving the hedge fund traders with larger and larger and larger short positions in Treasuries that had to be carried at a loss. And every year that they carry those positions is a -2% times the size of the long leg negative entry in their cash flow.

Bruno Iksil, they thought, had been pulled up short by his boss Ina Drew's unwillingness to bet the firm and risk bankruptcy. Ben Bernanke, they thought, ought to have been pulled up short by his regard for financial stability--by his promise to keep inflation at its target, for the counterpart to J.P. Morgan Chase's bankruptcy and liquidation would be the national bankruptcy that is another episode of inflation like the 1970s. But Ben Bernanke wasn't pulled up short by the risk of inflation. He had no supervising CEO. And he dominated the Federal Open Market Committee.

But what Bernanke was doing, they thought, was as unprofessional as it would have been for Ina Drew to tell Bruno Iksil: "You turn out to have made a large directional bet that we can sell unhedged protection and profit? Let's see if you are right: let it ride!"

And so they went public with the Washington Super-Whale, as they had gone public with the London Whale. Perhaps somewhere out there was an equivalent of Jamie Dimon who could tell Bernanke that it was time to unwind the Federal Reserve's balance sheet now? Jeremy Stein, perhaps?

From my perspective, of course, the hedge fundies' analogy between the London Whale and the Washington Super-Whale is all wrong--the hedge fundies are thinking partial-equilibrium when they should be thinking general equilibrium. CDX IG 9 has a well-defined fundamental value: the payouts should each of the 125 companies go bankrupt times the chance that they will. What Bruno Iksil does does not affect that fundamental value. He can bet, and drive the price, but he cannot change the fundamental.

But the Washington Super-Whale is different.

In a healthy economy, the Ten-Year Treasury Bond does have a well-defined fundamental. When the economy is healthy enough that pricing power reverts to workers and keeping inflation from rising is job #1 for the Federal Reserve, the level of the Federal Funds rate now and in the future is pinned down by the requirement to hit the inflation target. And the fundamental of the Ten-Year Treasury Bond is then the expected value over the bond's lifetime of the future Federal Funds rate plus the appropriate ex ante duration risk premium.

But when the economy is depressed, like now? When market appetite for short-term cash at a zero interest rate is unlimited, like now? When workers have no pricing power, and so wage inflation is subdued, like now? The Federal Reserve is not J.P. Morgan Chase. It is not a highly-leveraged financial institution that must worry about holding too much duration risk. As Glenn Rudebusch once said:

Our business model here at the Fed is simple: (i) print reserve deposits that cost us 0 (OK. 0.25%/yer), (2) invest them in interest-paying bonds that we then hold to maturity, (3) PROFIT!!

And the more quantitative easing the Fed undertakes and the larger is its balance sheet the larger is the amount of money the Federal Reserve makes on its portfolio, without running any risks--as long as the economy remains depressed.

The Federal Reserve, you see, is unlike J.P. Morgan Chase: the Federal Reserve does print money.

But, the hedge fundies say: "What if the economy recovers and starts to boom? What if inflation shoots up? The Fed could loose $500 billion on its portfolio as it moves to control inflation! Why doesn't that fear that?"

The Fed does not fear that. That is what it is aiming for. The Fed is charged by law with "promot[ing] effectively the goals of maximum employment, stable prices, and moderate long term interest rates". A full-employment economy is not something to be feared but something to be welcomed. And a $500 billion mark-to-market loss on its current portfolio? The Fed has given $500 billion to the Treasury, as a present, over the past decade. It is not a profit-making private bank. It is a central bank charged with "promot[ing] effectively the goals of maximum employment, stable prices, and moderate long term interest rates".

"But," the hedgies say, "George Soros! The Bank of England held the pound sterling away from fundamentals in 1992, and George Soros bet against them and they could not maintain the parity and George Soros took them for $2 billion! Why aren't we doing the same?" Ah. But George Soros took $2 billion from the Bank of England because its political masters told it to stand down: "We will not," they said, "defend the ERM pound parity at the price of bringing on a deep recession and mass unemployment." Who do the hedgies imagine are the Fed's political masters who will tell it to shift and adopt policies that will bring on even massier unemployment? Rand Paul?

There is a reason that the trade of shorting the bonds of a sovereign issuer of a global reserve currency in a depressed economy is called "the widowmaker".

Saturday, July 05, 2014

Sweden and monetary policy

Why leaning against the wind is the wrong monetary policy for Sweden by Lars E.O. Svensson

Swedish Sadomonetarist Setback by Krugman

OK, this is fairly amazing. I’ve written often about sadomonetarism among central bankers — the evident urge to find some reason, any reason, to raise interest rates despite high unemployment and low inflation. The most influential hive of this kind of thinking is the Bank for International Settlements, which for some reason commands great respect even though it offers an ever-changing rationale — inflation! Any day now! Or maybe not! Financial stability! — for its never-changing advocacy of tight money. But the place where policy makers most dramatically gave in to this urge is Sweden, where the majority at the Riksbank decided to indulge its rate-hike vice while freezing out one of the world’s leading experts on deflation risks, my friend and former colleague Lars Svensson.

Well, guess what: Lars has been proved so dramatically right by events — raising rates didn’t curb rising debt, but it did push Sweden into deflation — that the Riksbank has done an abrupt U-turn, slashing rates (and overruling the governor and first deputy governor).

Actually, the drama of this U-turn may be a very good thing, since it might convince investors that this is a real regime change.

Friday, July 04, 2014

low interest rates, the BIS, and Cochrane

The Rentier Would Prefer Not to Be Euthanized by J.W. Mason

John Cochrane on the Failure of Macroeconomics by David Glasner

John Cochrane on the Failure of Macroeconomics by David Glasner

Yellen

Transcript of Yellen and Lagarde Comments at IMF Event

Chair Yellen's press conference

Chair Yellen's press conference

BINYAMIN APPELBAUM. Binya Appelbaum, New York Times. You’ve spoken about\ the sense that the recession has done permanent damage to the economic output and you’ve reduced gradually over time your forecast of long-term growth. I am curious to know to what extent you think stronger monetary and/or fiscal policy could reverse those trends. Are we stuck with slower growth? Is there something that you can do about it? If so, what? If not, why?

CHAIR YELLEN. Well, I think part of the reason that we are seeing slower growth in potential output may reflect the fact that capital investment has been very weak during the downturn in the long recovery that we’re experiencing. So, a diminished contribution from capital formation to growth does make a negative contribution to growth. And as the economy picks up, I certainly would hope to see that contribution restored. So, I think that’s one of the factors that’s been operative. Of course, we’ve had unusually long duration unemployment. A very large fraction of those unemployed have been unemployed for more than six months. And there is the fear that those individuals find it harder to gain employment, that their attachment to the labor force may diminish over time and the networks of contacts that are—they have that are helpful in gaining employment can begin to erode over time. We could see what’s known as hysteresis, where individuals, because they haven’t had jobs for a long time, find themselves permanently outside the labor force. My hope would be that as—and my expectation is that as the economy recovers, we will see some repair of that, that many of those individuals who were long-term unemployed or those who are now counted as out of the labor force would take jobs if the economy is stronger and would be drawn back in again, but it is conceivable that there is some permanent damage there to them, to their own well-being, their family’s well-being, and the economy’s potential.

CHAIR YELLEN. Well, I think part of the reason that we are seeing slower growth in potential output may reflect the fact that capital investment has been very weak during the downturn in the long recovery that we’re experiencing. So, a diminished contribution from capital formation to growth does make a negative contribution to growth. And as the economy picks up, I certainly would hope to see that contribution restored. So, I think that’s one of the factors that’s been operative. Of course, we’ve had unusually long duration unemployment. A very large fraction of those unemployed have been unemployed for more than six months. And there is the fear that those individuals find it harder to gain employment, that their attachment to the labor force may diminish over time and the networks of contacts that are—they have that are helpful in gaining employment can begin to erode over time. We could see what’s known as hysteresis, where individuals, because they haven’t had jobs for a long time, find themselves permanently outside the labor force. My hope would be that as—and my expectation is that as the economy recovers, we will see some repair of that, that many of those individuals who were long-term unemployed or those who are now counted as out of the labor force would take jobs if the economy is stronger and would be drawn back in again, but it is conceivable that there is some permanent damage there to them, to their own well-being, their family’s well-being, and the economy’s potential.

Me: Strong monterary and/or fiscal policy can do a reverese hysteresis.

Obummer (thanks Obama!)

Obama's greatest failure: The rapidly falling deficit by Ryan Cooper

Ever since 2009, when the recession and the stimulus package pushed the annual budget deficit to a peak of nearly $1.5 trillion, it has been falling steadily. Last year it came in at$680 billion; this year it is projected to total $492 billion.

This is an absolute disaster. It is President Obama's single greatest failure, representing the fact that he, and the rest of the American government, did not adequately respond to the Great Recession. It means that millions of Americans were kept out of work, that trillions in potential output was flushed down the toilet, and that the American economy was very seriously damaged, probably permanently, for no reason at all.

Simply keeping government employment on the Bush-era course would have directly created 1.5 million more jobs, and hundreds of thousands more through the multiplier effect, in which jobs beget jobs through increased consumer spending. Another stimulus would have had us at full employment years ago (and possibly would have even paid for itself in fiscal terms).

Instead, we've slashed spending and fired hundreds of thousands of government workers.

Of course, the situation is not entirely Obama's fault, given the pressure he was under from all sides to lower the deficit. His major failing was threefold: underestimating how dangerous undershooting the stimulus would be (despite being warned at the time), banking on a Grand Bargain to shore up his bipartisan credentials in the run-up to the 2012 election, and failing to understand how irresistible austerity would be to Washington insiders. Think of austerity as a big shiny bag of crystal meth, and D.C. elites as a bunch of jittery speed freaks who haven't had a fix in weeks.

As Mike Grunwald convincingly demonstrated in his book, it was "centrist" senators like Arlen Specter who negotiated the stimulus down to $800 billion for no reason. However, that Obama didn't even try to win a bigger stimulus through a much bigger ask, or implement other mechanisms like a trigger that would keep spending flowing so long as unemployment was high, demonstrates his commitment to fixing the economy was weak at best.

Because after the stimulus was passed, Obama pivoted immediately to austerity, trying repeatedly to strike a Grand Bargain with Republicans. It was only total GOP intransigence that repeatedly saved our threadbare social insurance programs from being slashed.

For my money, the crazed bipartisan panic over the budget deficit that swept the political class in 2010 is the singlemost contemptible political event of the Obama era.

But as the unemployment rate has inched down with agonizing slowness, Obama and the Democratic Party have continued to implicitly rate deficit reduction as more important than jobs. The White House always trumpets proudly the latest deficit figures. Their jobs proposals are always deficit neutral. And they regard insinuations that ObamaCare might increase the deficit as the gravest slander.

Despite the absolute intellectual collapse of austerity as an economic program, it continues to hold cultural hegemony over most of the American elite. As with meth, the damage is immediate and staggering, but they just can't quit. It's well past time Democrats stopped enshrining deficit reduction as the most important policy goal.

Thursday, July 03, 2014

positive outlook

A BOFFO JOBS REPORT, BUT PUZZLES LINGER BY JOHN CASSIDY

Is this the jobs recovery we’ve been looking for? by Matt O'Brien

Is this the jobs recovery we’ve been looking for? by Matt O'Brien

Yellen

Yellen talked up macroprudential policy and smacked down critics led by John Taylor who has yet to respond.

Apropos Piketty, macroprudential policy controls interest rates and returns that wealthier, more connected investors and savers can earn. The Fed funds rate is linked more to everyone else.

Apropos Piketty, macroprudential policy controls interest rates and returns that wealthier, more connected investors and savers can earn. The Fed funds rate is linked more to everyone else.

Labels:

conservatism,

macroeconomics,

macroprudential policy,

Yellen

Corporations as people

The Corporate Congress bad timeline moves closer.

A Bad Coincidence: The Hobby Lobby SCOTUS Decision And the 50th Anniversary Of The Civil Rights Act by Barkley Rosser

A Bad Coincidence: The Hobby Lobby SCOTUS Decision And the 50th Anniversary Of The Civil Rights Act by Barkley Rosser

This one is so bad you might think somebody made it up. So, prior to the Civil Rights Act 50 years ago, many segregationists in the South defended their conduct on religious grounds, indeed this was used to justify slavery itself, that Africans were descended from Ham who was cursed in Genesis for having shamed his father Noah by not covering him up when he had too much to drink. Barry Goldwater opposed the Act precisely on libertarian grounds of business owners ought to be free to serve whom or whomever they choose on whatever grounds. The Civil Rights Act said no, you cannot refuse people service on the basis of their race.

So, now with this latest SCOTUS decision we have "closely held corporations" being allowed to not provide insurance coverage for birth control if it violates the corporation's religious views, with the personhood of corporations being extended to new lengths. Heck, given the weirdly arbitrary definition of this, that not more than five people own more than 50% of the stock, why not just say all of them can do so? I mean, how do we know who the heck is making the decisions in these outfits? At least with a single proprietorship, we think we do know, but even they were not allowed religious exemptions to choose not to serve African Americans.

Of course, as Justice Ginsburg warned in her dissent, who noticed the parallel with the Civil Rights Act, we now have a bunch of groups run by religiously oriented businesses demanding the right to fire gay people. This is getting even closer to what the Civil Rights Act was all about. I am sorry that Martin Luther King, Jr. and LBJ are probably rolling over in their graves on this one.

Intertubes and Ignatieff

GEOPOLITICS: THE IGNATIEFF WHO CRIED "WOLF!!": EQUITABLE GROWTH: THURSDAY FOCUS FOR JULY 3, 2014

At least he has a good take on Stiglitz at the end. Obama's ambassador to the UN, Samantha Power, was a disciple of Ignatieff's.

The best thing the U.S. and Europe could do to combat the autocrats in Russia, China and Egypt, etc. would be to create prosperous, free societies that serve as examples to the peoples of those regions. (Obamacare and the recent 9-0 Supreme Court decision in favor of privacy rights are brights spots Ignatieff doesn't mention.)

I'm curious about the extent of Germany's trade in the years leading up to 1914. China depends upon the U.S. consumer market (they have a loaded water pistol pointing at our heads) and doesn't Russia depend on Europe to buy its natural resources?

The best thing would be for the Fed to target 4 percent inflation and help Europe adjust.

At least he has a good take on Stiglitz at the end. Obama's ambassador to the UN, Samantha Power, was a disciple of Ignatieff's.

The best thing the U.S. and Europe could do to combat the autocrats in Russia, China and Egypt, etc. would be to create prosperous, free societies that serve as examples to the peoples of those regions. (Obamacare and the recent 9-0 Supreme Court decision in favor of privacy rights are brights spots Ignatieff doesn't mention.)

I'm curious about the extent of Germany's trade in the years leading up to 1914. China depends upon the U.S. consumer market (they have a loaded water pistol pointing at our heads) and doesn't Russia depend on Europe to buy its natural resources?

The best thing would be for the Fed to target 4 percent inflation and help Europe adjust.

This is what humanitarian internationalists like Power should be in favor of. The U.S. is missing out on a trillion dollars a year in lost output since the Great Clusterfuck. Some of that could be spent on things short of war to help ameliorate the humanitarian disasters in Africa and the Middle East. If the Republican Party was defeated or neutered, China could be brought in to have more of a says at the IMF and World Bank.

What an Elizabeth Warren should run on.

Between 1948 and 1979, real median family income increased by 117.6%, while between 1979 and 2012 real median family income increased by a mere 7.8%.

Thomas Palley on Friedman.

If the thirty-year period from 1945-1975 was the “Age of Keynes”, then the thirty-year period from 1975 - 2005 can legitimately be called the “Age of Friedman”

2008 on, the "Age of Piketty?"

Thomas Palley on Friedman.

If the thirty-year period from 1945-1975 was the “Age of Keynes”, then the thirty-year period from 1975 - 2005 can legitimately be called the “Age of Friedman”

2008 on, the "Age of Piketty?"

Wednesday, July 02, 2014

positive outlook

Maybe Lucy won't snatch the ball away this time.

"Yellen conceded that policymakers “failed to anticipate” the ensuing global financial crisis but also argued that monetary policy would have been “insufficient” to address the problems that caused it. Higher rates would not have beefed up regulation or increased the transparency of the exotic new financial instruments at the heart of the crisis -- or the firms that helped generate them.

In fact, Yellen said that raising rates would likely have caused greater unemployment, which would likely have led to more people defaulting on their debts."

2) John Williams predicts stronger growth in the 2nd half and over 3 percent the next 2 years. Could be good for the Democratic candidate in 2016.

can't attach much meaning to profit share drop

written by Dean, July 02, 2014 2:53

1) Yellen making the right sounds. Rhetorically swats John Taylor.

In fact, Yellen said that raising rates would likely have caused greater unemployment, which would likely have led to more people defaulting on their debts."

2) John Williams predicts stronger growth in the 2nd half and over 3 percent the next 2 years. Could be good for the Democratic candidate in 2016.

3) Dean Baker:

Big Drop in Profit Share in First Quarter GDP

Tuesday, 01 July 2014 13:24

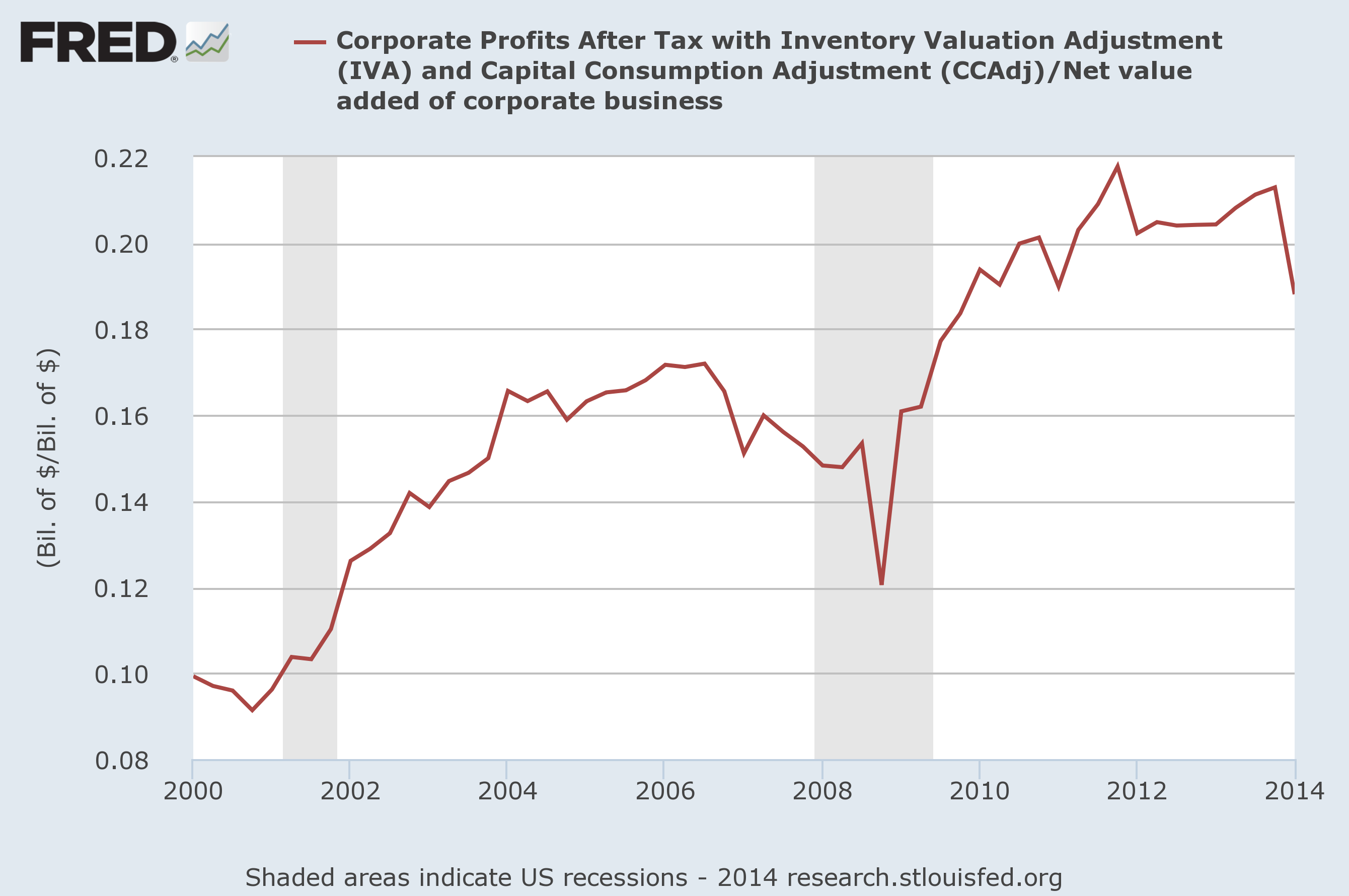

Quarterly GDP data are erratic and profit data in particular are subject to large revisions, but hey it's still worth noting a big drop in profit shares reported for the first quarter of 2014. The data released by the Commerce Department last week showed the profit share falling from just over 21 percent of net value added in the corporate sector in the last quarter of 2013 to less than 19 percent in the first quarter of 2014. Here's the picture.

It's too early to make much of this drop in profit shares. It is also a bit disconcerting that it is all attributable to a drop in the capital consumption adjustment, the difference between accounting depreciation and economic depreciation as measured by the Commerce Department. (In other words, the Commerce Department is showing a larger gap between what firms record for accounting purposes and the actual rate of depreciation of capital.) Anyhow, with all the appropriate caveats, this may be the first sign that the sharp rise in profit shares in this century is being reversed, or as Gerald Ford once said, our long national nightmare is over. |

And he adds in comments:

written by Dean, July 02, 2014 2:53

Ideally the drop in profit shares would mean that workers are getting a share of the gains from growth, meaning higher wages. But, the data for the first quarter show the economy shrinking, which means there were no gains to be shared. So we really can't draw much from this picture yet. However, if the profit share stays down and we get decent growth the rest of this year, that would mean that workers will finally be seeing some wage growth.

Intertubes eating my comments

Krugman argues in this blog post that conservatism basiscally got their ideas through - slash the safety-net, slash taxes on high incomes, deregulation - and the result is slower growth and greater inequality.

I think a lot of the blame should go to Greenspan as well. He was loose on macroprudential policies "there's no bubble" and too tight overall. Inflation has been too low for a long time.

Greenspan, with help from Rubin, talked Clinton out of his Middle Class spending bill and fiscal stimulus, saying they would cause higher bond prices. He was talked into doing deficit reduction instead. Really Greenspan was threatening Clinton blackfmail: cut the deficit or I'll raise rates.

http://krugman.blogs.nytimes.com/2014/07/02/trick-or-tweak/

Sam Tanenhaus asks, “Can the G.O.P. Be a Party of Ideas?”

Why, no. This is another edition of simple answers to simple questions.

More specifically, the “reform conservatives” seem mainly to be offering supposedly new ideas for the sake of being seen to offer new ideas. And there isn’t much there there; can you find anything in the Tanenhaus piece that sounds like an important new idea rather than a minor tweak on the current conservative catechism? I can’t. I mean, converting federal poverty programs into bloc grants is supposed to be a major departure?

But then, the whole notion that new ideas are what politics is about is greatly overrated. Governing isn’t like selling smartphones; the underlying shape of the problems you have to confront changes quite slowly, and the basics of policy debate are quite stable.

In particular, the central policy debate in US politics hasn’t changed in decades, nor should it. Liberals want a strong social safety net, financed with relatively high taxes, especially on high incomes. Conservatives want much less of a safety net, and much lower taxes on the affluent.

Thirty-five years ago conservatives did produce a new argument — the claim that high taxes and generous benefits were producing such a drag on the economy that even lower-income Americans would be better off if we slashed all of that. And they got most of what they wanted — much lower taxes on top incomes, an end to welfare as we knew it, though not to the big middle-class programs. But growth failed to take off while inequality soared, so that the income of typical families grew much more slowly after the conservative revolution than before:

Photo

Credit EPI

So much for that big idea. Is there anything like that on the horizon? No — and it’s not clear why you should expect anything of the kind. What’s certain is that tweaking policy at the edges isn’t going to do much.

And I suspect that at some level the reform conservatives know this. The point of their proposed policy tweaks, I’d argue, is less to achieve results than to let the GOP dissociate itself from soaring inequality and stagnating incomes, without changing its fundamental policy stance. And it’s not a trick that’s likely to work.

---------

I think a lot of the blame should go to Greenspan as well. He was loose on macroprudential policies "there's no bubble" and too tight overall. Inflation has been too low for a long time.

Greenspan, with help from Rubin, talked Clinton out of his Middle Class spending bill and fiscal stimulus, saying they would cause higher bond prices. He was talked into doing deficit reduction instead. Really Greenspan was threatening Clinton blackfmail: cut the deficit or I'll raise rates.

http://krugman.blogs.nytimes.com/2014/07/02/trick-or-tweak/

Sam Tanenhaus asks, “Can the G.O.P. Be a Party of Ideas?”

Why, no. This is another edition of simple answers to simple questions.

More specifically, the “reform conservatives” seem mainly to be offering supposedly new ideas for the sake of being seen to offer new ideas. And there isn’t much there there; can you find anything in the Tanenhaus piece that sounds like an important new idea rather than a minor tweak on the current conservative catechism? I can’t. I mean, converting federal poverty programs into bloc grants is supposed to be a major departure?

But then, the whole notion that new ideas are what politics is about is greatly overrated. Governing isn’t like selling smartphones; the underlying shape of the problems you have to confront changes quite slowly, and the basics of policy debate are quite stable.

In particular, the central policy debate in US politics hasn’t changed in decades, nor should it. Liberals want a strong social safety net, financed with relatively high taxes, especially on high incomes. Conservatives want much less of a safety net, and much lower taxes on the affluent.

Thirty-five years ago conservatives did produce a new argument — the claim that high taxes and generous benefits were producing such a drag on the economy that even lower-income Americans would be better off if we slashed all of that. And they got most of what they wanted — much lower taxes on top incomes, an end to welfare as we knew it, though not to the big middle-class programs. But growth failed to take off while inequality soared, so that the income of typical families grew much more slowly after the conservative revolution than before:

Photo

Credit EPI

So much for that big idea. Is there anything like that on the horizon? No — and it’s not clear why you should expect anything of the kind. What’s certain is that tweaking policy at the edges isn’t going to do much.

And I suspect that at some level the reform conservatives know this. The point of their proposed policy tweaks, I’d argue, is less to achieve results than to let the GOP dissociate itself from soaring inequality and stagnating incomes, without changing its fundamental policy stance. And it’s not a trick that’s likely to work.

---------

Yellen

"...Yellen argued that those weapons would likely be more effective than the blunt tool of monetary policy. To make her point, she rebutted a common criticism that the Fed primed the stage for the Great Recession by waiting too long to raise interest rates, allowing home prices to rise unabated and encouraging investors to pile on risk.

Yellen conceded that policymakers “failed to anticipate” the ensuing global financial crisis but also argued that monetary policy would have been “insufficient” to address the problems that caused it. Higher rates would not have beefed up regulation or increased the transparency of the exotic new financial instruments at the heart of the crisis -- or the firms that helped generate them.

In fact, Yellen said that raising rates would likely have caused greater unemployment, which would likely have led to more people defaulting on their debts."

How does John Taylor respond?

Tea Party conservatives

DAVID BRAT, THE ELIZABETH WARREN OF THE RIGHT by RYAN LIZZA

Difference is Warren's ideas work, Brat's don't.

Tuesday, July 01, 2014

Plaza Accord

Plaza Accord

Background

Between 1980 and 1985 the dollar had appreciated by about 50% against the Japanese yen, Deutsche Mark, French Franc and British pound, the currencies of the next four biggest economies at the time.[citation needed] This caused considerable difficulties for American industry but at first their lobbying was largely ignored by government. The financial sector was able to profit from the rising dollar, and a depreciation would have run counter to Ronald Reagan's administration's plans for bringing down inflation. A broad alliance of manufacturers, service providers, and farmers responded by running an increasingly high profile campaign asking for protection against foreign competition.

Major players included grain exporters, car producers, engineering companies like Caterpillar Inc., as well as high-tech companies including IBM and Motorola. By 1985, their campaign had acquired sufficient traction for Congress to begin considering passing protectionist laws. The prospect of trade restrictions spurred the White House to begin the negotiations that led to the Plaza Accord.[1][2]

The justification for the dollar's devaluation was twofold: to reduce the U.S. current account deficit, which had reached 3.5% of the GDP, and to help the U.S. economy to emerge from a serious recession that began in the early 1980s. The U.S. Federal Reserve System under Paul Volcker had halted the stagflation crisis of the 1970s by raising interest rates, but this resulted in the dollar becoming overvalued to the extent that it made industry in the U.S. (particularly the automobile industry) less competitive in the global market.

Effects[edit]

Devaluing the dollar made U.S. exports cheaper to purchase for its trading partners, which in turn allegedly meant that other countries would buy more American-made goods andservices.

The exchange rate value of the dollar versus the yen declined by 51% from 1985 to 1987. Most of this devaluation was due to the $10 billion spent by the participating central banks.[citation needed] Currency speculation caused the dollar to continue its fall after the end of coordinated interventions. Unlike some similar financial crises, such as the Mexican and the Argentine financial crises of 1994 and 2001 respectively, this devaluation was planned, done in an orderly, pre-announced manner and did not lead to financial panic in the world markets. The Plaza Accord was successful in reducing the U.S. trade deficit with Western European nations but largely failed to fulfill its primary objective of alleviating the trade deficit with Japan. This deficit was due to structural conditions that were insensitive to monetary policy, specifically trade conditions.

The manufactured goods of the United States became more competitive in the exports market but were still largely unable to succeed in the Japanese domestic market due to Japan's structural restrictions on imports.

The recessionary effects of the strengthened yen in Japan's export-dependent economy created an incentive for the expansionary monetary policies that led to the Japanese asset price bubble of the late 1980s. The Louvre Accord was signed in 1987 to halt the continuing decline of the U.S. dollar.

The signing of the Plaza Accord was significant in that it reflected Japan's emergence as a real player in managing the international monetary system. Yet it is postulated[3] that it contributed to the Japanese asset price bubble, which ended up in a serious recession, the so-called Lost Decade.

Background

Between 1980 and 1985 the dollar had appreciated by about 50% against the Japanese yen, Deutsche Mark, French Franc and British pound, the currencies of the next four biggest economies at the time.[citation needed] This caused considerable difficulties for American industry but at first their lobbying was largely ignored by government. The financial sector was able to profit from the rising dollar, and a depreciation would have run counter to Ronald Reagan's administration's plans for bringing down inflation. A broad alliance of manufacturers, service providers, and farmers responded by running an increasingly high profile campaign asking for protection against foreign competition.

Major players included grain exporters, car producers, engineering companies like Caterpillar Inc., as well as high-tech companies including IBM and Motorola. By 1985, their campaign had acquired sufficient traction for Congress to begin considering passing protectionist laws. The prospect of trade restrictions spurred the White House to begin the negotiations that led to the Plaza Accord.[1][2]

The justification for the dollar's devaluation was twofold: to reduce the U.S. current account deficit, which had reached 3.5% of the GDP, and to help the U.S. economy to emerge from a serious recession that began in the early 1980s. The U.S. Federal Reserve System under Paul Volcker had halted the stagflation crisis of the 1970s by raising interest rates, but this resulted in the dollar becoming overvalued to the extent that it made industry in the U.S. (particularly the automobile industry) less competitive in the global market.

Effects[edit]

Devaluing the dollar made U.S. exports cheaper to purchase for its trading partners, which in turn allegedly meant that other countries would buy more American-made goods andservices.

The exchange rate value of the dollar versus the yen declined by 51% from 1985 to 1987. Most of this devaluation was due to the $10 billion spent by the participating central banks.[citation needed] Currency speculation caused the dollar to continue its fall after the end of coordinated interventions. Unlike some similar financial crises, such as the Mexican and the Argentine financial crises of 1994 and 2001 respectively, this devaluation was planned, done in an orderly, pre-announced manner and did not lead to financial panic in the world markets. The Plaza Accord was successful in reducing the U.S. trade deficit with Western European nations but largely failed to fulfill its primary objective of alleviating the trade deficit with Japan. This deficit was due to structural conditions that were insensitive to monetary policy, specifically trade conditions.

The manufactured goods of the United States became more competitive in the exports market but were still largely unable to succeed in the Japanese domestic market due to Japan's structural restrictions on imports.

The recessionary effects of the strengthened yen in Japan's export-dependent economy created an incentive for the expansionary monetary policies that led to the Japanese asset price bubble of the late 1980s. The Louvre Accord was signed in 1987 to halt the continuing decline of the U.S. dollar.

The signing of the Plaza Accord was significant in that it reflected Japan's emergence as a real player in managing the international monetary system. Yet it is postulated[3] that it contributed to the Japanese asset price bubble, which ended up in a serious recession, the so-called Lost Decade.

Intertubes

My comments are being eaten in the blogosphere. Perhaps I'm being blocked but I don't think so. Anyhow I'll save/copy my mental regurgitations here so they don't simply vanish into the aether.

commenter Darryl FKA Ron:

commenter Darryl FKA Ron:

[The return to capital tax incentives created by a dividends tax credit equal to the lesser of the issuers taxes paid on the dividends amount or the full amount of ordinary income taxes owed on the dividends by its recipient was an old idea going back to 1913 until the Republicans rescinded it in 1954. During the New Deal era this incentive to hold rather than trade speculatively or sell out to the first good proffer that beat the market was enhanced temporarily by higher capital gains tax rates and longer holding term requirements for discounting.

First two LBOs happened in 1955, the year after the dividends tax credit was permanently (had been done 1936-1939, before Congress understood why it was instituted with the income tax in 1913) rescinded.]

The Leftovers, scapegoats, and inflation

The World’s Central Banker by DeLong

AV Club reviews the The Leftovers: “Pilot”

AV Club reviews the The Leftovers: “Pilot”

The Fed needs to target 4 percent inflation or else we'll get the scapegoating of foreigners. If 2 percent of the population disappeared, there'd be an economic boom as labor supply would meet demand and the Fed would have to raise rates.

Labels:

DeLong,

full employment,

inflation,

Onion,

television

Monday, June 30, 2014

Subscribe to:

Comments (Atom)

_-_SWE_-_UNOCHA.svg.png)