Sunday, March 19, 2017

center-left and Zack Beauchamp

Any answer to right-wing populism requires left-wing economics

by eshhou

Bottom line

Assuming the Democratic party does not totally abandon redistributive politics, racism will always pose a problem. The question then is: what redistributive programs and policies are most capable of overcoming this and generating cross-racial coalitions? There is little reason to believe that the means-tested programs favored by the Democratic mainstream are more capable of doing this than the more universal programs favored by those on the Left.

Why Zack Beauchamp’s piece arguing otherwise is wrong

Zack Beauchamp of Vox has written an article entitled “No easy answers: why left-wing economics is not the answer to right-wing populism.” In this piece, he argues that “tacking to the left on economics won’t give Democrats a silver bullet to use against the racial resentment powering Trump’s success [and] could actually wind up [making] Trump [stronger.]” Matt Bruenighas written about the piece’s odd moral implications; I want to discuss some of the evidence Beauchamp provides, and why I don’t find it all that convincing.

Zack Beauchamp of Vox has written an article entitled “No easy answers: why left-wing economics is not the answer to right-wing populism.” In this piece, he argues that “tacking to the left on economics won’t give Democrats a silver bullet to use against the racial resentment powering Trump’s success [and] could actually wind up [making] Trump [stronger.]” Matt Bruenighas written about the piece’s odd moral implications; I want to discuss some of the evidence Beauchamp provides, and why I don’t find it all that convincing.

...

Assuming the Democratic party does not totally abandon redistributive politics, racism will always pose a problem. The question then is: what redistributive programs and policies are most capable of overcoming this and generating cross-racial coalitions? There is little reason to believe that the means-tested programs favored by the Democratic mainstream are more capable of doing this than the more universal programs favored by those on the Left.

Saturday, March 18, 2017

Sanders, Vox vs. leftist economics

Everyone loves Bernie Sanders. Except, it seems, the Democratic party by Trevor Timm

No Easy Answers, Just Bad History by Marshall Steinbaum

The Great Recession clearly gave rise to right-wing populism by Ryan Cooper

Thursday, March 16, 2017

Lisa Hannigan cover of Bowie on Legion

Oh you Pretty Things

Don't you know you're driving your

Mamas and Papas insane

JW Mason: misc thoughts including on health care

JW Mason:

The health policy tightrope. The Republican plan health care plan, the CBO says, would increase the number of uninsured Americans by 24 million. I don’t know any reason to question this number. By some estimates, this will result in 40,000 additional deaths a year. By the same estimate, the Democratic status quo leaves 28 million people uninsured, implying a similar body count. Paul Ryan’s idea that health care should be a commodity to be bought in the market is cruel and absurd but the Democrats’ idea that heath insurance should be a commodity bought in the market is not obviously less so. Personally, I’m struggling to find the right balance between these two sets of facts. I suppose the first should get more weight right now, but I can’t let go of the second. Adam Gaffney does an admirable job managing this tightrope act in his assessment of the Obama health care legacy inJacobin. (But I think he’s absolutely right, strategically, to focus on the Republicans for the Guardian’s different readership .)

Tuesday, March 14, 2017

Krugman and the center-left

Populism and the Politics of Health by Krugman

"This ties in with an important recent piece by Zack Beauchamp on the striking degree to which left-wing economics fails, in practice, to counter right-wing populism; basically, Sandersism has failed everywhere it has been tried. Why?

The answer, presumably, is that what we call populism is really in large degree white identity politics, which can’t be addressed by promising universal benefits. Among other things, these “populist” voters now live in a media bubble, getting their news from sources that play to their identity-politics desires, which means that even if you offer them a better deal, they won’t hear about it or believe it if told. For sure many if not most of those who gained health coverage thanks to Obamacare have no idea that’s what happened.

That said, taking the benefits away would probably get their attention, and maybe even open their eyes to the extent to which they are suffering to provide tax cuts to the rich.

In Europe, right-wing parties probably don’t face the same dilemma; they’re preaching herrenvolk social democracy, a welfare state but only for people who look like you. In America, however, Trumpism is faux populism that appeals to white identity but actually serves plutocrats. That fundamental contradiction is now out in the open."

"This ties in with an important recent piece by Zack Beauchamp on the striking degree to which left-wing economics fails, in practice, to counter right-wing populism; basically, Sandersism has failed everywhere it has been tried. Why?

The answer, presumably, is that what we call populism is really in large degree white identity politics, which can’t be addressed by promising universal benefits. Among other things, these “populist” voters now live in a media bubble, getting their news from sources that play to their identity-politics desires, which means that even if you offer them a better deal, they won’t hear about it or believe it if told. For sure many if not most of those who gained health coverage thanks to Obamacare have no idea that’s what happened.

That said, taking the benefits away would probably get their attention, and maybe even open their eyes to the extent to which they are suffering to provide tax cuts to the rich.

In Europe, right-wing parties probably don’t face the same dilemma; they’re preaching herrenvolk social democracy, a welfare state but only for people who look like you. In America, however, Trumpism is faux populism that appeals to white identity but actually serves plutocrats. That fundamental contradiction is now out in the open."

Monday, March 13, 2017

Sunday, March 05, 2017

Sunday, February 26, 2017

Dillow on productivity and Sandwichman

NEOLIBERALISM & PRODUCTIVITY by Chris Dillow

Ponzilocks and the Twenty-Four Trillion Dollar Question by Sandwichman

Friday, February 24, 2017

Thursday, February 23, 2017

"I bet you could operate a nice gas shower."

"I bet you could operate a nice gas shower.

I could see you with a couple of Ses on your collar

Stiff goose in your step."

I could see you with a couple of Ses on your collar

Stiff goose in your step."

Tuesday, February 21, 2017

Trump and trade, Dean Baker

Trump and Trade: He’s Largely Right by Dean Baker

There are an awful lot of things to really dislike about Donald Trump and his conduct as president to date, but that doesn’t mean everything his administration does is wrong. In particular, there is considerable truth to what he has said about trade costing a large number of good paying manufacturing jobs and hurting the living standards of the middle class.

Unfortunately, rather than acknowledging this point, the media show the same determination as global warming denialists in saying that trade cannot be a problem. We got two examples of this sort of denialism in recent days.

The first was a piece in the Washington Post criticizing Trump adviser Peter Navarro’s view of trade and the trade deficit. While Navarro makes many questionable arguments in pushing his views on trade, his point that the trade deficit can reduce growth and employment is absolutely correct.

Ever since the crash in 2008 the bulk of economics profession has agreed that we faced a situation of “secular stagnation,” where the economy faced a persistent shortfall of demand. In this context, anything that boosts demand, such as an increase in government spending, private consumption, or a reduction in the trade deficit, leads to more output and employment.

In this context, the piece’s comment, taken from Harvard University economics professor N. Gregory Mankiw, “that a smaller trade deficit means lower investment along with possibly higher interest rates and less consumption” is completely wrong. If the economy is operating below full employment, as it certainly has been through most of the period from 2008 then reducing the trade deficit certainly can be a net addition to growth. As Mankiw says, “even a freshman at the end of ec 10 knows that.”

In this context, Navarro’s claim that a lower trade deficit could bring in $1.74 trillion in tax revenue over the course of a decade cannot be so easily dismissed even though the Post tells us:

“Hooey, say economists across the political spectrum.”

The key question here is whether the economy is now at potential GDP and whether it is likely to be over the next decade, even with a trade deficit that is close to 3.0 percent of GDP ($538 billion in the most recent quarter). On this question, the Congressional Budget Office (CBO) might be on the side of Navarro.

According to CBO, potential GDP for the 4th quarter of 2016 was $19,049 billion. This is 1.0 percent higher than the estimate of GDP for the quarter of $18,860.8 billion. This means that if CBO is right, if there had been more demand in the economy, for example due to imports being replaced by domestically produced goods, GDP could have been 1.0 percent higher last quarter.

Of course CBO’s estimates of potential GDP are not especially accurate. Its most recent estimates for potential GDP in 2016 are more than 10 percent below what it had projected for potential GDP in 2016 back in 2008, before the severity of the crash was recognized. It is possible it overstated potential by a huge amount in 2008, but it is also possible it is understating potential today. It also hugely understated potential GDP in the mid-1990s, with 2000 GDP coming in more than 5 percent above the estimate of potential that CBO made in 1996. In other words, it would not be absurd to think that the economy could sustain a level of output that is 2.0 percent above the current level. (The fact that the employment rate of prime age workers [ages 25-54] is still 4.0 percentage points below the 2000 peak is certainly consistent with this view.)

Suppose that GDP were consistently 2.0 percent higher than current projections over the next decade due to a lower trade deficit. This would imply an additional $4.6 trillion in output over this period. If the government captures 30 percent of this in higher taxes and lower spending on transfer programs like unemployment insurance and food stamps, this would imply a reduction in the projected deficit of $1.38 trillion over the decade. That’s not quite the $1.74 trillion projected by Navarro, but close enough to make the derision unwarranted.

In terms of how you get a lower trade deficit, Navarro’s strategy of beating up on China is probably not the best way to go. But there is in fact precedent for the United States negotiating a lower value for the dollar under President Reagan, which had the desired effect of reducing the trade deficit.

There is no obvious reason it could not pursue a similar path today, especially since it is widely claimed in business circles that China actually wants to raise the value of its currency. The U.S. could help it.

The second area of seemingly gratuitous Trump trade bashing comes from a Wall Street Journal news article on the Trump administration’s efforts to correct for re-exports in trade measures. Before getting to the article, it is important to understand what is at issue.

Most of what the United States exports to countries like Mexico, Japan, or elsewhere are goods and services produced in the United States. However, some portion of the goods that we export to these countries consists of items imported from other countries which are just transshipped through the United States.

The classic example would be if we offloaded 100 BMWs on a ship in New York and then 20 were immediately sent up to Canada to be sold there. The way we currently count exports and imports, we would count the 20 BMWs as exports to Canada and also as imports from Germany. These re-exports have zero impact on our aggregate trade balance, but they do exaggerate out exports to Canada and our imports from Germany.

If we wanted better data on bilateral trade flows, then it would be desirable to pull out the re-exports from both our exports to Canada and our imports from Germany. This adjustment would make our trade deficit with Canada appear larger and trade deficit with Germany smaller, but would leave our total trade balance unchanged.

This better measure of trade flows would be useful information to have if we wanted to know what happened to trade with a specific country following a policy change, for example the signing of a trade deal like NAFTA. The inclusion of re-exports in our export data would distort what had happened to actual flows of domestically produced exports and imports for domestic consumption.

The United States International Trade Commission already produces a measure of trade balances that excludes imports that are re-exported. However this measure is still not an accurate measure of bilateral trade balances since it still includes the re-exports on the import side. In the case mentioned above, it would include the BMWs imported from Germany that were immediately sent to Canada, as imports. In principle, we should be able to construct a measure that excludes these items on the import side as well. If this is what the Trump administration is trying to do, then it is asking for a perfectly reasonable adjustment to the data.

This is where we get to the WSJ article. According to the piece, the Trump administration was asking the Commerce Department to produce measures of bilateral trade balances that took out the re-exports on the export side, but left them in on the import side. This would have the effect of artificially inflating our trade deficit with a bogus number. If this is in fact what the Trump administration is trying to do, then we should be shooting at them with all guns. (This is metaphorical folks, I’m not advocating violence.)

However some skepticism might be warranted at this point. No one with a name actually said the Trump administration asked for this bogus measure of trade balances. The sole source listed is “one person familiar with the discussions.”

There was an official statement from the Commerce Department’s Bureau of Economic Analysis (BEA), which collects and compiles the data:

“Any internal discussions about data collection methods are no more than the continuation of a longstanding debate and are part of the bureau’s normal process as we strive to provide the most precise statistics possible.”

I take very seriously efforts to mess with the data. We are fortunate to have independent statistical agencies with dedicated civil servants who take their work very seriously. However we should wait until we have a bit more solid evidence before assuming that the Trump administration is trying to interfere in their independence, as opposed to trying to make a totally legitimate adjustment to the data that the BEA staff would almost certainly agree is an improvement.

There are an awful lot of things to really dislike about Donald Trump and his conduct as president to date, but that doesn’t mean everything his administration does is wrong. In particular, there is considerable truth to what he has said about trade costing a large number of good paying manufacturing jobs and hurting the living standards of the middle class.

Unfortunately, rather than acknowledging this point, the media show the same determination as global warming denialists in saying that trade cannot be a problem. We got two examples of this sort of denialism in recent days.

The first was a piece in the Washington Post criticizing Trump adviser Peter Navarro’s view of trade and the trade deficit. While Navarro makes many questionable arguments in pushing his views on trade, his point that the trade deficit can reduce growth and employment is absolutely correct.

Ever since the crash in 2008 the bulk of economics profession has agreed that we faced a situation of “secular stagnation,” where the economy faced a persistent shortfall of demand. In this context, anything that boosts demand, such as an increase in government spending, private consumption, or a reduction in the trade deficit, leads to more output and employment.

In this context, the piece’s comment, taken from Harvard University economics professor N. Gregory Mankiw, “that a smaller trade deficit means lower investment along with possibly higher interest rates and less consumption” is completely wrong. If the economy is operating below full employment, as it certainly has been through most of the period from 2008 then reducing the trade deficit certainly can be a net addition to growth. As Mankiw says, “even a freshman at the end of ec 10 knows that.”

In this context, Navarro’s claim that a lower trade deficit could bring in $1.74 trillion in tax revenue over the course of a decade cannot be so easily dismissed even though the Post tells us:

“Hooey, say economists across the political spectrum.”

The key question here is whether the economy is now at potential GDP and whether it is likely to be over the next decade, even with a trade deficit that is close to 3.0 percent of GDP ($538 billion in the most recent quarter). On this question, the Congressional Budget Office (CBO) might be on the side of Navarro.

According to CBO, potential GDP for the 4th quarter of 2016 was $19,049 billion. This is 1.0 percent higher than the estimate of GDP for the quarter of $18,860.8 billion. This means that if CBO is right, if there had been more demand in the economy, for example due to imports being replaced by domestically produced goods, GDP could have been 1.0 percent higher last quarter.

Of course CBO’s estimates of potential GDP are not especially accurate. Its most recent estimates for potential GDP in 2016 are more than 10 percent below what it had projected for potential GDP in 2016 back in 2008, before the severity of the crash was recognized. It is possible it overstated potential by a huge amount in 2008, but it is also possible it is understating potential today. It also hugely understated potential GDP in the mid-1990s, with 2000 GDP coming in more than 5 percent above the estimate of potential that CBO made in 1996. In other words, it would not be absurd to think that the economy could sustain a level of output that is 2.0 percent above the current level. (The fact that the employment rate of prime age workers [ages 25-54] is still 4.0 percentage points below the 2000 peak is certainly consistent with this view.)

Suppose that GDP were consistently 2.0 percent higher than current projections over the next decade due to a lower trade deficit. This would imply an additional $4.6 trillion in output over this period. If the government captures 30 percent of this in higher taxes and lower spending on transfer programs like unemployment insurance and food stamps, this would imply a reduction in the projected deficit of $1.38 trillion over the decade. That’s not quite the $1.74 trillion projected by Navarro, but close enough to make the derision unwarranted.

In terms of how you get a lower trade deficit, Navarro’s strategy of beating up on China is probably not the best way to go. But there is in fact precedent for the United States negotiating a lower value for the dollar under President Reagan, which had the desired effect of reducing the trade deficit.

There is no obvious reason it could not pursue a similar path today, especially since it is widely claimed in business circles that China actually wants to raise the value of its currency. The U.S. could help it.

The second area of seemingly gratuitous Trump trade bashing comes from a Wall Street Journal news article on the Trump administration’s efforts to correct for re-exports in trade measures. Before getting to the article, it is important to understand what is at issue.

Most of what the United States exports to countries like Mexico, Japan, or elsewhere are goods and services produced in the United States. However, some portion of the goods that we export to these countries consists of items imported from other countries which are just transshipped through the United States.

The classic example would be if we offloaded 100 BMWs on a ship in New York and then 20 were immediately sent up to Canada to be sold there. The way we currently count exports and imports, we would count the 20 BMWs as exports to Canada and also as imports from Germany. These re-exports have zero impact on our aggregate trade balance, but they do exaggerate out exports to Canada and our imports from Germany.

If we wanted better data on bilateral trade flows, then it would be desirable to pull out the re-exports from both our exports to Canada and our imports from Germany. This adjustment would make our trade deficit with Canada appear larger and trade deficit with Germany smaller, but would leave our total trade balance unchanged.

This better measure of trade flows would be useful information to have if we wanted to know what happened to trade with a specific country following a policy change, for example the signing of a trade deal like NAFTA. The inclusion of re-exports in our export data would distort what had happened to actual flows of domestically produced exports and imports for domestic consumption.

The United States International Trade Commission already produces a measure of trade balances that excludes imports that are re-exported. However this measure is still not an accurate measure of bilateral trade balances since it still includes the re-exports on the import side. In the case mentioned above, it would include the BMWs imported from Germany that were immediately sent to Canada, as imports. In principle, we should be able to construct a measure that excludes these items on the import side as well. If this is what the Trump administration is trying to do, then it is asking for a perfectly reasonable adjustment to the data.

This is where we get to the WSJ article. According to the piece, the Trump administration was asking the Commerce Department to produce measures of bilateral trade balances that took out the re-exports on the export side, but left them in on the import side. This would have the effect of artificially inflating our trade deficit with a bogus number. If this is in fact what the Trump administration is trying to do, then we should be shooting at them with all guns. (This is metaphorical folks, I’m not advocating violence.)

However some skepticism might be warranted at this point. No one with a name actually said the Trump administration asked for this bogus measure of trade balances. The sole source listed is “one person familiar with the discussions.”

There was an official statement from the Commerce Department’s Bureau of Economic Analysis (BEA), which collects and compiles the data:

“Any internal discussions about data collection methods are no more than the continuation of a longstanding debate and are part of the bureau’s normal process as we strive to provide the most precise statistics possible.”

I take very seriously efforts to mess with the data. We are fortunate to have independent statistical agencies with dedicated civil servants who take their work very seriously. However we should wait until we have a bit more solid evidence before assuming that the Trump administration is trying to interfere in their independence, as opposed to trying to make a totally legitimate adjustment to the data that the BEA staff would almost certainly agree is an improvement.

Monday, February 20, 2017

hikikomori

4chan: The Skeleton Key to the Rise of Trump

It was still a group of hikikomori — a group of primarily young males who spent a lot of the time at the computer, so much so they had retreated into virtual worlds of games, T.V., and now the networks of the internet. This was where most or all of their interaction, social or otherwise took place. The real world, by contrast, above their mothers’ basements, was a place they did not succeed, perhaps a place they did not fundamentally understand.

Sunday, February 19, 2017

Krugman 38 depression, Bernstein dynamic scoring

New Deal economics by Krugman

Limited fiscal force

Limited fiscal force

NOVEMBER 8, 2008

Limited fiscal force

Limited fiscal force

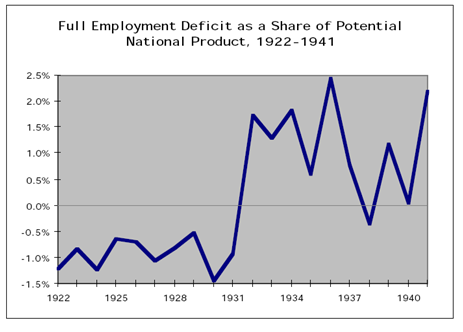

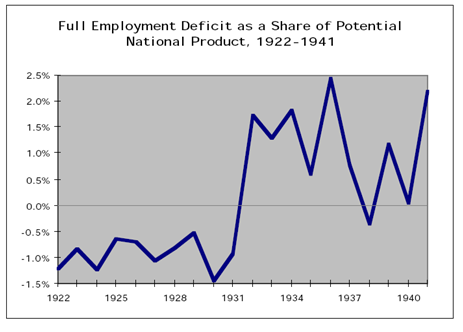

Now, you might say that the incomplete recovery shows that “pump-priming”, Keynesian fiscal policy doesn’t work. Except that the New Deal didn’t pursue Keynesian policies. Properly measured, that is, by using the cyclically adjusted deficit, fiscal policy was only modestly expansionary, at least compared with the depth of the slump. Here’s the Cary Brown estimates, from Brad DeLong:

Net stimulus of around 3 percent of GDP — not much, when you’ve got a 42 percent output gap. FDR might have been more of a Keynesian if Keynesian economics had existed — The General Theory wasn’t published until 1936. Note in particular that in 1937-38 FDR was persuaded to do the “responsible” thing and cut back — and that’s what led to the bad year in 1938, which to the WSJ crowd defines the New Deal.

If only we could apply dynamic scoring to the rest of life by Jared BernsteinBaker on taxes, Reich on Republican plan, Weregild, Corey Robin

A Progressive Way to End Corporate Taxes by Dean Baker

It’s time to start thinking about a realignment: 2 things for the left to do by Corey Robin

Republican tax sham by Robert Reich

Weregild and the Price of People by Elaine

Sunday, February 12, 2017

Baker on Tax reform, Fernholz on DBCFT

Neil Irwin Warns of Financial Crisis from Corporate Tax Reform by Dean Baker

This is the Republican plot to kill the US corporate income tax as we know it by Tim Fernholz

This is the Republican plot to kill the US corporate income tax as we know it by Tim Fernholz

Yet border adjustment—and the consumption tax behind it—deserves consideration because it is what Trump might propose if he were interested in crafting policy not with the aim of offending trade partners, liberals, and the Republican establishment, but rather with the goal of bringing investment back to the US while still conceding the reality of a globalized economy. It also would fit with the world view of his trade advisor Peter Navarro, who is eager to tear down the global supply chains that undergird the success of US multinationals today. And, together with the other big changes under consideration in Congress, it might actually shift more investment toward the US without the negative consequences of punitive tariffs or the ad hoc cronyism of Trump’s twitter bullying.

Atrios, DBCFT, Buttigieg

Your Moment Of Zen

Liberals Can’t Wait for Republicans to Adopt the Border-Adjusted Tax by VERONIQUE DE RUGY

Deluded Republicans are accidentally pushing for progressive corporation tax reform by Ben Chu

Everything You Ever Wanted to Know about Border-Adjustable Taxation, but Were Afraid (or too Bored) to Ask by Dan Mitchell

Trump Calls House GOP Tax Plan ‘Too Complicated.’ He May Be Right. by Dan Mitchell

Indiana Mayor Running for D.N.C. Chairman

Joseph A. Buttigieg, professor at Notre Dame.

"He is also the editor and translator of the multi-volume complete critical edition of Antonio Gramsci's Prison Notebooks, a project that has been supported by a major grant from the National Endowment for the Humanities. Several of his articles on Gramsci have been translated into Italian, German, Spanish, Portuguese, and Japanese. He was a founding member of the International Gramsci Society of which he is president. The Italian Minister of Culture appointed him to a commission of experts to oversee the preparation of the "edizione nazionale" of Gramsci's writings. Buttigieg serves on the editorial and advisory boards of various journals, and he is a member of the editorial collective of boundary 2."

Tuesday, February 07, 2017

Setser on Germany

Brad Setser:

I suspect the politics around trade would be a bit different in the U.S. if the goods-exporting sector had grown in parallel with imports.

That is one key difference between the U.S. and Germany. Manufacturing jobs fell during reunification—and Germany went through a difficult adjustment in the early 2000s. But over the last ten years the number of jobs in Germany’s export sector grew, keeping the number of people employed in manufacturing roughly constant over the last ten years even with rising productivity. Part of the “trade” adjustment was a shift from import-competing to exporting sectors, not just a shift out of the goods producing tradables sector. Of course, not everyone can run a German sized surplus in manufactures—but it seems likely the low U.S. share of manufacturing employment (relative to Germany and Japan) is in part a function of the size and persistence of the U.S. trade deficit in manufactures. (It is also in part a function of the fact that the U.S. no longer needs to trade manufactures for imported energy on any significant scale; the U.S. has more jobs in oil and gas production, for example, than Germany or Japan).

demagogues and stagnation

We’re re-learning today what we should have learned in the 30s…economic stagnation breeds reaction and intoleranceChris Dillow

Monday, February 06, 2017

Sunday, February 05, 2017

Saturday, February 04, 2017

Trump voters

The Fight in the Borderlands by Josh Marshall

We hear people constantly saying 'Nothing will change his supporters' minds. They're with him no matter what.' First of all this is enervating defeatism which is demoralizing and loserish. But it also misses the point. It is factually wrong. For the supporters those people have in mind, they're right. They're true believers, authoritarians who are energized by Trump's destructive behavior. But there are not that many of those people. A big chunk of Trump's voters voted for him in spite of their dislike. Those people can be carved away. But Democrats will regain power by winning it in what amount to our 21st century internal American borderlands, not in the big cities or rural areas mainly but in between. So what's happening now to lay that groundwork for 2018?

Friday, February 03, 2017

Monbiot on neoliberalism

Neoliberalism – the ideology at the root of all our problems by George Monbiot

When, in 1947, Hayek founded the first organisation that would spread the doctrine of neoliberalism – the Mont Pelerin Society – it was supported financially by millionaires and their foundations.

With their help, he began to create what Daniel Stedman Jones describes inMasters of the Universe as “a kind of neoliberal international”: a transatlantic network of academics, businessmen, journalists and activists. The movement’s rich backers funded a series of thinktanks which would refine and promote the ideology. Among them were the American Enterprise Institute, the Heritage Foundation, the Cato Institute, the Institute of Economic Affairs, the Centre for Policy Studies and the Adam Smith Institute. They also financed academic positions and departments, particularly at the universities of Chicago and Virginia.

Thursday, February 02, 2017

DBCFT

THURSDAY, FEBRUARY 2, 2017

The Auerbach Tax and Automobile Multinationals

Bloomberg reports:

A proposed tax on imports that President Donald Trump is said to be warming to could upend the competitive landscape for carmakers, boosting Ford Motor Co. while hindering manufacturers that rely more on overseas factories including Toyota Motor Corp. House Republican leaders have proposed a so-called border-adjusted tax, which would place a levy on vehicles imported into the U.S. and fully exempt those exported. Though Trump initially deemed the idea too complicated, White House Press Secretary Sean Spicer last week said it was under consideration and could help pay for a wall along the Mexico border. The overhaul to the U.S. tax system could hand an advantage to Ford, Honda Motor Co. and General Motors Co., which rely the least on imported vehicles among major automakers. The shake-up would also undermine ToyotaIs Bloomberg assuming a fixed yen/$ exchange rate so these border adjustments boost exports and discourage imports? Greg Mankiw and Paul Krugman take a very different view. Greg breaks down this Destination Based Cash Flow tax as a three-fer:

Impose a retail sales tax on consumer goods and services, both domestic and imported; Use some of the proceeds from the tax to repeal the corporate income tax.; and Use the rest of the proceeds from the tax to significantly cut the payroll tax.Greg is assuming the rise in sales taxes is greater than the cut in income taxes, which is not clear. But let’s hear from Paul:

Greg and I disagree on whether replacing profits taxes with sales taxes is a good idea, but agree that all of this has nothing to do with trade and international competition – because it doesn’t. I suspect, however, that Greg is being naïve here in assuming that we’re just seeing confusion because border tax adjustment sounds as if it must involve competitive games. There’s some of that, for sure, but one reason the competitiveness thing won’t go away is that it’s an essential part of the political pitch. “Let’s eliminate taxes on profits and tax consumers instead” is a hard sell, even if you want to claim that the incidence isn’t what it looks like. Claiming that it’s about eliminating a dire competitive disadvantage plays much better, even though it’s all wrong.Alan Auerbach – the proponent of this idea – joined with Douglas Holtz-Eakin to state why this competitiveness argument is all wrong: These two (AHE) wrote:

Unlike tariffs on imports or subsidies for exports, border adjustments are not trade policy. Instead, they are paired and equal adjustments that create a level tax playing field for domestic and overseas competition; Border adjustments do not distort trade, as exchange rates should react immediately to offset the initial impact of these adjustments. As a corollary, border adjustments do not distort the pattern of domestic sales and purchasesSo if this is not going to advantage Ford and GM to the disadvantage of Toyota, could something else be driving Ford’s support and the opposition from companies like Toyota. I have been looking more at the transfer pricing angle objecting to this claim from AHE:

Border adjustments eliminate the incentive to manipulate transfer prices in order to shift profits to lower-tax jurisdictionsA lot of people read this and think transfer pricing manipulation goes away. But this is clearly wrong if our trading partners have positive corporate tax rates that are sourced based. Even AHE admits this later:

Thus, the multinational would have no incentive to use transfer prices to shift profits away from the United States, even if the tax rate in the foreign country is very low. Indeed, it would benefit by shifting profits to the United States, to reduce the taxes it pays in the low-tax country.Lawrence Summers adds:

Businesses that invest heavily, hire extensively and export a large part of their product will have negative taxable income on a chronic basis .. Fourth, the combination of a sharply lower rate, new opportunities for tax arbitrage and the fact that any revenue gains from bringing overseas cash home are one-shot means the Federal revenue base would erode. The result would be cuts in entitlement payments to consumers who spend heavily, tax hikes on individuals and reductions in government spending. Over time, this will slow growth and burden the middle class.He is correct about the “new opportunities for tax arbitrage" which is what I referring to with my Trump Toaster Oven example where I noted:

While currently Tiffany might want to raise the intercompany price – she knows the IRS could object. Of course Auerbach’s DBCFT would change her incentives as she might want to lower this price to only $80 to eliminate the Canadian income tax – assuming the Canadian Revenue Agency does not object.Of course the Canadian Revenue Agency would strongly object. Toyota is a lot like our example. The Auerbach proposal would raise its U.S. taxes and give it an incentive to ship their cars to the U.S. at cost costs only. Toyota’s 10-K indicates that its 2015 sales were $260 billion with over $100 billion to the U.S. Its operating margin was 10 percent with the U.S. getting about half of that on its U.S. sales. So on U.S sales, Toyota has U.S. profits near $5 billion and Japanese profits near $5 billion – both taxes at fairly high rates. The Auerbach tax would give Toyota the incentive to have all $10 billion sourced in the U.S. But one would certainly expect the Japanese tax authorities to strongly object. Summers example reminds me of Boeing which sells over $90 billion a year with 58 percent of those sales to foreign customers. It currently incurs near $1.9 billion in U.S. taxes given its 7.5 percent profit margin and the fact that it allocates over 95 percent of its income to the U.S. The Auerbach tax would cut this tax bill to zero. It would also cut the U.S. tax bill for companies such as Starbucks. So what about Ford and GM? Alas Dylan Matthews has this all wrong with:

For example, suppose that a car company — let’s just call it, uh, General Motors — makes $1 billion in profit manufacturing cars in the US and selling them domestically and exporting them to subsidiaries abroad. That would normally subject it about $350 million in taxes, since the US has a 35 percent corporate tax rate. But GM could instead have its foreign subsidiaries pay $1 billion less for the cars they buy from the US branch of the company. That wipes out GM’s US profits, leaving it with no US tax liability and shifting the profits to the subsidiaries abroad. If those subsidiaries are in countries with a low or nonexistent corporate income tax, that could wind up being a very good deal ... This makes most tax evasion schemes pointless.I doubt Dylan looked at the 10-K filings of either Ford or GM when he drafted this base erosion fairy tale. Ford sources less than 17 percent of its income to foreign affiliates and GM sources almost none of its income abroad. So the Auerbach tax would represent a major reduction in their U.S. tax bills. These foreign affiliates are not in tax havens unless you think Canada, Mexico, and our European trading partners have zero corporate tax rates (hint – their tax rates are 20 percent or more). Think of their operations as having a European component and a North American component. The European affiliates produce and distribute cars paying royalties back to the U.S. parent. Under the Auerbach proposal, they might want to increase those royalties to bleed their European affiliates dry. But of course the tax authorities in France, Germany, and the UK are not stupid. In North America, Mexican maquiladoras make the components, Detroit assembles, and a Canadian distributor sells to Canadian customers. The Auerbach tax would give Ford and GM the incentives to manipulate transfer pricing to strip all Canadian and Mexican income so the last line from Dylan that I quoted is quite wrong. But it would also be wrong to assume that the Canadian Revenue Agency and the Mexican authorities would just roll over.

Posted by ProGrowthLiberal at 5:51 PM

DBCFT and Gorsuch

The Prospects For Tax Reform in 2017 Are Dimming by Howard Gleckman

DEMOCRATS RUSH INTO A SUPREME COURT BATTLE by John Cassidy

DEMOCRATS RUSH INTO A SUPREME COURT BATTLE by John Cassidy

Wednesday, February 01, 2017

DBCFT

Idiot's Guide to DBCFT, Ryan Style by Allison Christians

Understanding the Republicans’ corporate tax reform by Bill Gale

A Modern Corporate Tax by Alan J. Auerbach (Center for America Progress)

Tuesday, January 31, 2017

trade

JB on Brad DeLong’s Vox piece on trade deals and trade by Jared Bernstein

Trade deficits and real blue-collar manufacturing compensation by Jared Bernstein

Painful Nonsense on Trade by Dean Baker

Truthiness on Trade by Dean Baker

Donald Trump's "paying for the wall by hiking prices on avocados" controversy, explained by Dylan Matthews

How a Clever GOP Tax Plan Managed to Baffle Everyone by Ramesh Ponnuru

Exporters forming coalition to support House GOP border tax

DNC boots candidate from chairman’s race for criticizing Ellison’s Islamic faith

Truthiness on Trade by Dean Baker

The GOP’s radical tax plan by WaPo editorial board

Sunday, January 29, 2017

Republican tax plan

Paul Krugman and the Republican Corporate Income Tax Proposal by Dean Baker

Washington Post Pushed Fear on Corporate Tax Reform by Dean Baker

US tax reform is vital but Trump’s plan is flawed by Larry Summers

My take on the Republicans’ new, interesting corporate tax plan by Jared Bernstein

Second, interest payments to bondholders, banks and other creditors will no longer be deductible.Results from my Twitter poll on the legislative prospects of the DBCFT by Jared Bernstein

Saturday, January 28, 2017

Reagan, too tight monetary policy, appreciating dollar

Must-Read: Dani Rodrik: What Did NAFTA Really Do? by DeLong

As I wrote to Dani: The U.S. went from 30% of its nonfarm employees in manufacturing to 12% because of rapid growth in manufacturing productivity and limited demand, yes? The U.S. went from 12% to 9% because of stupid and destructive macro policies–the Reagan deficits, the strong-dollar policy pushed well past its sell-by date, too-tight monetary policy–that diverted it from its proper role as a net exporter of capital and finance to economies that need to be net sinks rather than net sources of the global flow of funds for investment, yes?

Wednesday, January 25, 2017

Friday, January 20, 2017

Thursday, January 19, 2017

Monday, January 16, 2017

Sunday, January 15, 2017

Friday, January 13, 2017

Thursday, January 12, 2017

Monday, January 02, 2017

Saturday, December 31, 2016

Sunday, December 25, 2016

Milonvic interview

Q: During the US election, a rather strange and heated debate took place between liberals that insisted the rise of Trumpism could be blamed on 'economic anxiety' or on racial resentment, as if it had to be one of the two. How would you theorize the relation between economic motivations for voter rebellion and other perhaps complementary causes for the huge transformations we saw in 2016? Do economic problems cause racism or nativism to emerge, for example? Historically how has this usually worked when inequality gets out of control?

M. I really do not think that the causality runs one way only: either from economic problems to racism, or from racism to economic problems. I think that the two work together. But I think that it was always wrong to blame support that Trump has received only on racism or misogyny. By doing this, one commits two mistakes: first, writes off that portion of the population as “irredeemable” since their racism or misogyny makes them impervious to any rational argumentation; and second, entirely plays down economic factors and thus fails to propose any change in economic policy. The view that nativism alone was responsible for the rise of right-wing populism in the US, or even more bizarrely the view held by some that the “losers” in rich countries should not complain because they are better off than workers in China, were just wrong answers to a very real problem.

Q. This kind of an interpretation has received strong pushback in the United States since Trump's victory, with mainstream Democratic supporters calling it either hopelessly leftist or tantamount to rationalizing away racism. Others point to the fact that many rich people supported Trump (as admittedly often supported other Republican candidates). What do you make of this criticism?

M. I do not understand the pushback. Do they really believe that Trump, Brexit, Le Pen, the rise of many right-wing populist parties in Europe etc. have nothing to do with economics? That suddenly all these weird nationalists and nativists got together thanks to the social media and decided to overthrow the established order? People who believe this remind me of Saul Bellow’s statement that “a great deal of intelligence can be invested in ignorance when the need for illusion is strong”.

Saturday, December 24, 2016

Tuesday, December 20, 2016

Yggies on the white working class

The boring reason policy to help struggling regions won’t win “Rust Belt” votes

It’s not a struggling region. Updated by Matthew Yglesias

It’s not a struggling region. Updated by Matthew Yglesias

Monday, December 19, 2016

UBI in Finland

Free Cash in Finland. Must Be Jobless. by Peter S. Goodman

Finland will soon hand out cash to 2,000 jobless people, free of bureaucracy or limits on side earnings. The idea, universal basic income, is gaining traction worldwide.

Saturday, December 17, 2016

midwest/rustbelt and the new social darwinists

Thursday, December 15, 2016

DeLong disagrees with Yellen and Krugman

Must-Read: Let me disagree a bit with Paul: although evidence does suggest that we are near full employment, we are not at full employment--and the suggestion that we are near full employment is a very weak one. The unemployment rate is 4.6%--and six years ago I would have said that 5% unemployment is full employment. The prime-age employment-to-population ratio is 78.1%--and six years ago I would have said that an 80% prime-age employment-to-population ratio is full employment. It is possible to reconcile the two by saying that hysteresis has permanently knocked 2% of the prime-age population out of the labor force. But that claim is, itself, uncertain.

Paul rests his case for continued monetary policy at the zero lower bound and for fiscal expansion on the "precautionary motive". That case is there, and is very strong. But IMHO there is still a very strong case for continued monetary policy at the zero lower bound and fiscal expansion resulting from recognition of our uncertainty about the current state of the economy.

The downsides of further expansionary policy to see if full employment is an 80% prime-age employment-to-population ratio are small. The upsides are large. We should follow Rikki-Tikki-Tavi, and run and find out.and

More Expansionary FIscal Policy Is Needed: The Only Question Is Whether for a Short-Term Full Employment Attainment or a Medium-Term Full-Employment Maintenance Purpose

If the Federal Reserve wants to have the ammunition to fight the next recession when it happens, it needs the short-term safe nominal interest rate to be 5% or more when the recession hits. I believe that is very unlikely to happen withoutsubstantial fiscal expansion. No, at least in the world that Janet Yellen sees, "fiscal policy is not needed to provide stimulus to get us back to full employment." But fiscal policy stimulus is needed to create a situation in which full employment can be maintained. It would be a rash economist indeed who would forecast a short-term safe nominal interest rate above 3% when the time for the next loosening cycle arrives:

[chart]

Thus if we do not shift to a more expansionary fiscal policy--and the higher neutral rate of interest that it brings--now, what do we envision will happen when the next recession arrives? Do we trust that congress and the president will then understand and react appropriately in a timely fashion and at the right scale to deal with the slump in aggregate demand?

Once again, it would be a very rash economist who would forecast that. An FOMC that does not press strongly for more expansionary fiscal policy now is an FOMC that is adopting a policy that threatens to make life very difficult indeed for their successors between two and six years from now.

And, of course, there is the chance--I see it as a substantial chance--that full employment is attained at a prime-age employment-to-population ratio of not 78% but 80%--or 81.5%. In that case, Janet Yellen is wrong to say that "fiscal policy is not needed to provide stimulus to get us back to full employment."

Friday, December 09, 2016

Monday, December 05, 2016

Duy, Bernstein, Kweku and Baker

Desperately Searching For A New Strategy by Tim Duy

Yes, the Rust Belt demands an answer. But does anyone know what it is? by Jared Bernstein

HOW TO BEAT WHITE NATIONALISM AT THE POLLS by EZEKIEL KWEKU

Trade, Trump, and the Economy: What Does Greg Mankiw's Textbook Say? by Dean Baker

Yes, the Rust Belt demands an answer. But does anyone know what it is? by Jared Bernstein

Friday, December 02, 2016

current account surpluses

If the Chinese can buy US Treasuries to appreciate the dollar, why can't the US buy Chinese and German government bonds in order to reduce the trade deficit?

If they wont' allow it, then dont allow them to buy US Treasuries.

If they wont' allow it, then dont allow them to buy US Treasuries.

Thursday, December 01, 2016

Waldman, Mason and Trump voters

The economic geography of a universal basic income by Steve Randy Waldman

Socialize Finance by JW Mason

Blame the identity apostles – they led us down this path to populism by Simon Jenkins

Liberal Anti-Politics by Shuja Haider

Everybody Hates Cornel West by Connor Kilpatrick

Socialize Finance by JW Mason

Blame the identity apostles – they led us down this path to populism by Simon Jenkins

Wednesday, November 30, 2016

Rubin and the strong dollar

Big Deficit, Bob Rubin, and the Strong Dollar by Dean Baker

Rubin or Trump as the Strong Dollar Type by PGL

Two Generations of Trade Deficits: A Wee Complaint with Jared Bernstein by PGL

Needed: Plain Talk About the Dollar by Christina Romer

MONDAY, MAY 23, 2011

Strong Dollar = Strong Economy ?

An excellent column from Christy Romer.

Strong Dollar = Strong Economy ?

An excellent column from Christy Romer.

Tuesday, November 29, 2016

Sunday, November 27, 2016

Wednesday, November 23, 2016

Sunday, November 13, 2016

The Totebaggers who gave us Trump are in denial

EMichael, Trump and Obamacare

If the White Working Class Is the Problem, What's the Solution? by Kevin Drum

Trump Won a Lot of White Working-Class Voters Who Backed Obama by Eric Levitz

On Wisconsin! by Barkley Rosser

It's Rarely One Thing by Duncan Black

they’re going to keep losing by Freddie deBoer

It's Rarely One Thing by Duncan Black

they’re going to keep losing by Freddie deBoer

Clinton suffered her biggest losses in the places where Obama was strongest among white voters. It's not a simple racism story

Monday, November 07, 2016

Friday, November 04, 2016

Tuesday, November 01, 2016

Sunday, October 23, 2016

Tuesday, October 18, 2016

Monday, October 17, 2016

Sunday, October 16, 2016

Trump voters

There has always been an Alt Right culture: America First, John Birch Society, Nixon's Southern Strategy, Goldwater, Reagan, Fox News.

How Trump Happened by Joseph Stiglitz

What’s Behind a Rise in Ethnic Nationalism? Maybe the Economy by Robert J. Shiller

How Dictatorships Are Born by Roger Cohen

Taking Trump voters’ concerns seriously means listening to what they’re actually saying by Dylan Matthews

How Trump Happened by Joseph Stiglitz

What’s Behind a Rise in Ethnic Nationalism? Maybe the Economy by Robert J. Shiller

Max Sawicky and Brad DeLong link to Dylan Matthews. WTF

Saturday, October 15, 2016

Baker on Furman

A Little Pre-Election BS From the White House on Income Inequality by Dean Baker

...

Anyhow, in spite of my respect, I feel the need to call him out on trying to pull the wool over folks' eyes in a recent column. The column touts many of the positive measures (in my view) to help people at the middle and the bottom under the Obama administration, such as expansion of the earned income tax credit, the child tax credit, and most importantly the Affordable Care Act which has extended health insurance coverage to 20 million people and allows people with serious health conditions to get insurance at the same price as every one else. These measures have been paid for by higher taxes on the wealthy. This is all very positive and the Obama administration deserves credit for these measures, even if I would have liked to see it go much further.

However, the reason my BS detector went off is that Furman tried to claim we had turned the corner in some big way on the upward redistribution of income from the last four decades. He tells readers:

"Partly as a result of these policy changes, the top 1 percent’s share of income after taxes was 12 percent in 2013 (the most recent year for which data are available), well below its 2007 peak and roughly equal to its share in 1997."

The problem with this story is that the 2013 numbers for the top 1 percent are skewed downward in a big way as a result of the tax increase on the rich that the administration put in place in 2012. The wealthiest 1 percent often have considerable control over the timing of their income. They knew the top tax rate would rise from 35.0 percent for 2012 to 39.6 percent in 2013. This gave them a very strong incentive to declare income in 2012 that would have otherwise appeared in 2013. This makes 2012 look really good for the 1 percent and 2013 much worse.

This shows up clearly in the data. According to the estimates from the Congressional Budget Office (Figure 7), the inflation-adjusted before-tax income of the top 1 percent rose by 37.9 percent in 2012. It then fell back by 22.0 percent in 2013. This is exactly what we would expect from this tax gaming. If we take the average of these two years, the before-tax income of the top 1 percent has risen by 73.3 percent from its 1997 level. On the plus side, it is down by 22.6 percent from the bubble peak of 2007.

I should point out that this tax timing issue is hardly a secret. CBO mentioned it explicitly in the summary of its report:

"In response to tax law changes that went into effect in 2013, some taxpayers—especially those at the top of the income distribution—shifted some income into 2012 to avoid the higher tax rates on that income in 2013."

Anyhow, it is too early to claim any big victories in turning around the rise in before-tax income inequality. (This is also the view of CBO which projects that the bulk of the wage gains in the next decade will go to high-end earners, as has been the case for the last 35 years.)

The Obama administration deserves credit for some big steps in the right direction, but we still have a very long way to go. This is why I wrote "Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer," coming this week to a website near you.

Friday, October 14, 2016

centrist Hillary Clinton and Wikileaks

The Most Important WikiLeaks Revelation Isn’t About Hillary Clinton by David Dayen

THE ILLUMINATING BUT UNSURPRISING CONTENT OF CLINTON’S PAID SPEECHES by John Cassidy

Hillary Clinton’s Campaign Strained to Hone Her Message, Hacked Emails Show

Voters sour on traditional economic policy by Larry Summers

In the same way as with Brexit, the rise of Donald Trump and Bernie Sanders, the strength of rightwing nationalists in many European countries, Vladimir Putin’s strength in Russia and the return of Mao worship in China, it is hard to escape the conclusion that the world is seeing a renaissance of populist authoritarianism.

Sunday, October 09, 2016

Obama and Shalizi

The way ahead by Barack Obama (2016)

Liberty! What Fallacies Are Committed in Thy Name! by Cosma Shalizi (2004)

Saturday, October 08, 2016

Game of Thrones spin off

HBO programming president Casey Bloys said he's open to the possibility of a Game of Thrones spin-off series: "For us it's about finding the right take with the right writer."

Sunday, October 02, 2016

fiscal policy, DeLong and Ip

Must-Read: Five years late, and many trillions of dollars short. But still...

Greg Ip: Fiscal Policy Makes a Quiet Turn Toward Stimulus:

---------------------------------------

What DeLong and Ip don't tell us is that Hillary's plan of $275 billion over five years is too small. The Fed says it gave us the recovery it wanted for the most part.

Greg Ip: Fiscal Policy Makes a Quiet Turn Toward Stimulus:

Now... fiscal policy across the developed world is collectively turning more stimulative for the first time since the end of the recession...

...This may be the most underappreciated economic development of the year. While the scale of the stimulus is modest in dollar terms, it signals a more profound shift in the political winds. Globally, the rise of political populism has pushed deficits down the list of priorities while elevating tax cuts and benefits for the working class. With enough critical mass, such measures could persuade central banks to rethink their own super-easy monetary policies, which would undermine the case for today’s rock-bottom bond yields and pricey stocks.

The fiscal shift is easy to miss, because rhetorically at least, governments remain devoted to cutting their debts. But numbers tell a different story.... The near-term catalyst for the fiscal turn was Britain’s vote to leave the European Union on June 23. Not only did the resulting uncertainty threaten global economic growth, it also alerted centrist political parties to how unhappy voters are with the economic status quo....

For Japan, the impetus was both Brexit and the Bank of Japan’s introduction of negative interest rates this year, which failed to work as planned; the yen went up and stocks went down. In August, Prime Minister Shinzo Abe unveiled a $73 billion package of infrastructure spending, cash handouts to poor families, and other stimulative measures. In the U.S., budget caps enacted in 2011 have already been loosened. Meanwhile, Hillary Clinton, the Democratic nominee, is campaigning to boost spending on countless programs, from college education to infrastructure.... Mr. Trump’s rise demonstrates that austerity has lost the political energy it had in 2010....

Central bankers can take credit for the shift. As the benefits of zero to negative rates have shrunk and the side effects risen, they have exhorted finance ministers to take up the burden of supporting growth...

---------------------------------------

What DeLong and Ip don't tell us is that Hillary's plan of $275 billion over five years is too small. The Fed says it gave us the recovery it wanted for the most part.

Saturday, October 01, 2016

Clinton on Sanders supporters

Clinton gives her take on Sanders supporters in leaked fundraising recording

Hacked audio of a conversation between Hillary Clinton and donors during a February fundraising event shows the Democrat nominee describing Bernie Sanders supporters as "children of the Great Recession" who are "living in their parents’ basement."

Speaking at a Virginia fundraiser hosted by former U.S. ambassador Beatrice Welters, Clinton says in a clip released by the Free Beacon that many of her former primary opponent's supporters sought things like “free college, free health care,” saying that she preferred to occupy the space "from the center-left to the center-right" on the political spectrum.

During the conversation, also reported in the Intercept, Clinton confesses to feeling "bewildered" by those to her far-left and far-right in the election.

"There is a strain of, on the one hand, the kind of populist, nationalist, xenophobic, discriminatory kind of approach that we hear too much of from the Republican candidates," she said. "And on the other side, there’s just a deep desire to believe that we can have free college, free healthcare, that what we’ve done hasn’t gone far enough, and that we just need to, you know, go as far as, you know, Scandinavia, whatever that means, and half the people don’t know what that means, but it’s something that they deeply feel."

While stressing the need to not serve as a "wet blanket on idealism," Clinton paints fans of the then-surging Vermont senator as political newbies attempting to deal with an economy that has fallen short of their expectations.

"Some are new to politics completely. They’re children of the Great Recession. And they are living in their parents’ basement," she said. "They feel they got their education and the jobs that are available to them are not at all what they envisioned for themselves. And they don’t see much of a future."

Clinton added: "If you’re feeling like you’re consigned to, you know, being a barista, or you know, some other job that doesn’t pay a lot, and doesn’t have some other ladder of opportunity attached to it, then the idea that maybe, just maybe, you could be part of a political revolution is pretty appealing."

"I think we all should be really understanding of that," Clinton said.

The audio, which according to the Free Beacon was "revealed by hackers who breached the email account of a campaign staffer," surfaces the same week that Sanders hit the campaign trail to try to win those same young voters that Clinton has struggled to attract since clinching the Democratic nomination.

Editor’s note: The headline and lede of this story have been changed to better reflect Clinton’s tone. The audio was originally published on Sept. 27, not Friday as first reported.

Sunday, September 25, 2016

Corbyn wins Labour election

Jeremy Corbyn Is Re-elected as Leader of Britain’s Labour Party by Steven Erlanger

...

Mr. Corbyn, a 67-year-old hard-left politician, won 61.8 percent of the more than 500,000 votes cast, up from the 59.5 percent he won a year ago, when his victory shocked and divided the party....

Waldmann on macro

Macroeconomic Puzzles by Robert Waldmann

Macroeconomic Puzzles II Aggregate Supply by Robert Waldmann

Friday, September 23, 2016

Thursday, September 22, 2016

Wednesday, September 21, 2016

Monday, September 19, 2016

Emmy's 2016

Game of Thrones, Tatiana, Maslany or Orphan Black, Veep, July-Louise Dreyfus, Rami Malek for Mr. Robot.

B&B won writing for Battle of the Bastards.

B&B won writing for Battle of the Bastards.

Sunday, September 18, 2016

Star Trek

THE ENDURING LESSONS OF “STAR TREK” By Manu Saadia

It is hard to overstate how much of a departure the “Star Trek” franchise’s eighties-and-nineties-straddling incarnation, “The Next Generation,” was from the original series. It retained much of the nomenclature and established codes (the inscrutable techno-scientific babble, the ship’s name, the naval ranks, the canonical alien species) but swung almost entirely toward the second, more cerebral form of science fiction. It had no anchor in the present, nor did it genuflect before America’s frontier myths. “The Next Generation” was wholesale utopia, a thought experiment on how humans would behave under terminally improved material circumstances. Civilization, and the future, had won.

And what a future! At the end of the show’s first season, the new captain, Jean-Luc Picard, laid bare his world’s parameters. In “The Neutral Zone,” a reverse-time-travel episode, cryogenically preserved twentieth-century humans awake on the Enterprise. One of them, a take-charge Wall Street tycoon, is particularly eager to reclaim his stock portfolio and his status as master of the universe. “People are no longer obsessed with the accumulation of things,” Picard tells him—and us, the audience—sternly. “We’ve eliminated hunger, want, the need for possessions. We’ve grown out of our infancy.”

Friday, September 16, 2016

Thursday, September 15, 2016

Wednesday, September 14, 2016

Monday, September 12, 2016

Sunday, September 11, 2016

Summers on infrastructure

Building the case for greater infrastructure investment by Larry Summers

How much more do we need to invest? For the foreseeable future, there is no danger that the US will overinvest in infrastructure. An increase in investment of 1 per cent of gross domestic product over a decade would total $2.2tn and permit substantial steps both to catch up on deferred maintenance and embark on new projects.

Saturday, September 10, 2016

Bernstein on Fed Targets

New paper from our full employment project: Binder/Rodrigue on updating Fed toolbox by Jared Bernstein

Note to self:

Good think tanks or "centers:"

Center for Budget and Policy Priorities

Center for Budget and Policy Priorities

Center for Economic and Policy Research

Wednesday, September 07, 2016

Bake on employment rate and America's stinginess

NPR Reports on the Mystery of Rivers Flowing Downstream and Men Leaving the Workforce by Dean Baker

Okay, they only consider the latter a mystery, but for those who follow the data both are equally mysterious. The piece was titled "an economic mystery: why are men leaving the workforce?" The piece noted the reduction in the percentage of prime-age men in the workforce from nearly 100 percent in the 1960s to 88.3 percent at present. It then said that no one really knows why there has been this decline.

Actually, it really is not much of a mystery. While the piece wants to attribute it to the peculiar situation men face in the labor market, it is worth noting that there has also been a sharp decline in the percentage of prime-age women in the labor market. (Actually, a better measure is simply looking at the share of people who are employed. Many workers stop saying they are looking for jobs when they are no longer eligible for unemployment benefits. With a sharp reduction in eligibility for benefits over the last three decades, people who are not working are now much less likely to say they are looking for work.)

The figure below shows the percentage of prime-age women that are working since 1990.

Okay, they only consider the latter a mystery, but for those who follow the data both are equally mysterious. The piece was titled "an economic mystery: why are men leaving the workforce?" The piece noted the reduction in the percentage of prime-age men in the workforce from nearly 100 percent in the 1960s to 88.3 percent at present. It then said that no one really knows why there has been this decline.

Actually, it really is not much of a mystery. While the piece wants to attribute it to the peculiar situation men face in the labor market, it is worth noting that there has also been a sharp decline in the percentage of prime-age women in the labor market. (Actually, a better measure is simply looking at the share of people who are employed. Many workers stop saying they are looking for jobs when they are no longer eligible for unemployment benefits. With a sharp reduction in eligibility for benefits over the last three decades, people who are not working are now much less likely to say they are looking for work.)

The figure below shows the percentage of prime-age women that are working since 1990.

[figure]

The chart shows that after rising sharply from 1993 to 2000. It then fell sharply following the 2001 recession and again in 2007–2009 recession. It has since risen in the recovery but it is still 3.8 percentage points below the peak hit in 2000. The pattern among prime-age men is similar, although the employment rate is now 4.8 percentage points below the 2000 peak. (Remember the EPOP for women had been rising before the 2001 recession and was projected at the time to continue to rise.)

The fact the EPOP for men and women has followed a very similar pattern since 2000, and the declines have been associated with weak demand in the economy, suggests that the explanation might be weak demand. In other words, the problem is not too many men getting disability or lacking the skills needed in a 21st century economy, but rather just not enough demand.

If we could get the trade deficit down or got the government to spend more money then we could boost demand and get the prime-age men discussed in this piece back to work. We would do the same for prime-age women. (We could also follow the German model and reduce the length of the average work year, thereby spreading around available work.)

So the villains are not lazy men, but rather folks like Paul Ryan, Peter Peterson, and the Washington Post who insist that we have to keep our budget deficits low even in a context of near record low interest rates and very low inflation.

It is also worth mentioning that the lazy welfare cheat story doesn't fit the data at all. Benefits of various stripes have gotten more stingy over the period when men's EPOPs were declining. Also, as the report cited in the piece from the President's Council of Economic Advisers notes, the United States ranks near the bottom among wealthy countries in the generosity of benefits. It also ranks near the bottom in prime age EPOPs.

The chart shows that after rising sharply from 1993 to 2000. It then fell sharply following the 2001 recession and again in 2007–2009 recession. It has since risen in the recovery but it is still 3.8 percentage points below the peak hit in 2000. The pattern among prime-age men is similar, although the employment rate is now 4.8 percentage points below the 2000 peak. (Remember the EPOP for women had been rising before the 2001 recession and was projected at the time to continue to rise.)

The fact the EPOP for men and women has followed a very similar pattern since 2000, and the declines have been associated with weak demand in the economy, suggests that the explanation might be weak demand. In other words, the problem is not too many men getting disability or lacking the skills needed in a 21st century economy, but rather just not enough demand.

If we could get the trade deficit down or got the government to spend more money then we could boost demand and get the prime-age men discussed in this piece back to work. We would do the same for prime-age women. (We could also follow the German model and reduce the length of the average work year, thereby spreading around available work.)

So the villains are not lazy men, but rather folks like Paul Ryan, Peter Peterson, and the Washington Post who insist that we have to keep our budget deficits low even in a context of near record low interest rates and very low inflation.

It is also worth mentioning that the lazy welfare cheat story doesn't fit the data at all. Benefits of various stripes have gotten more stingy over the period when men's EPOPs were declining. Also, as the report cited in the piece from the President's Council of Economic Advisers notes, the United States ranks near the bottom among wealthy countries in the generosity of benefits. It also ranks near the bottom in prime age EPOPs.

Subscribe to:

Posts (Atom)