Monday, May 15, 2017

Saturday, May 13, 2017

Friday, May 12, 2017

UBI

The case for and against a universal basic income in the United States by Byrd Pinkerton and Sarah Kliff

Thursday, May 11, 2017

Stiglitz

Lessons from the Anti-Globalists by Joseph Stiglitz

The lesson of all of this is something that Scandinavian countries learned long ago. The region’s small countries understood that openness was the key to rapid economic growth and prosperity. But if they were to remain open and democratic, their citizens had to be convinced that significant segments of society would not be left behind.

The welfare state thus became integral to the success of the Scandinavian countries. They understood that the only sustainable prosperity is shared prosperity. It is a lesson that the US and the rest of Europe must now learn.

Wednesday, May 10, 2017

Gillbrand, Sawicky on taxes

The Shape-Shifter by BRANKO MARCETIC

How would a populist tax? (Spoiler alert: not like Trump) by Max B. Sawicky

Tuesday, May 09, 2017

Larry Summers on Yellen, flat Phillips Curve

Less is more when it comes to Federal Reserve policy by Larry Summers

Flat Phills, all around by Jared Bernstein

unionization drive at colleges

The Higher-Education Crisis Is a Labor Crisis

" A unionization drive at Vanderbilt University shows how austerity in higher education is hurting educators and students."

Wren-Lewis: rightwing populism, economic determinism

Why are the UK and US more vulnerable to right wing populism? by Simon Wren-Lewis

It seems to me that these various explanations are quite compatible with each other. Where what we might call neoliberal policies had been strong - weak unions, declining welfare state, stagnant wages - these policies created a very large group in society that were looking for someone to blame. In a managed economy that allowed the parties of the right either to use nationalism and anti-immigration rhetoric to deflect blame from themselves, or for the far right to capture those parties. As that rhetoric also hit out at globalisation it potentially was a direct threat to global business interests, but those interests could either do nothing about this or felt they could manage that threat.

Monday, May 08, 2017

Krugman on the EU

What’s the Matter With Europe? by Paul Krugman

Which brings me back to the French election. We should be terrified at the possibility of a Le Pen victory. But we should also be worried that a Macron victory will be taken by Brussels and Berlin to mean that Brexit was an aberration, that European voters can always be intimidated into going along with what their betters say is necessary.

So let’s be clear: Even if the worst is avoided this Sunday, all the European elite will get is a time-limited chance to mend its ways.

Dean Baker on economists

https://thebaffler.com/salvos/the-wrongest-profession-baker

March 2017

OVER THE PAST TWO DECADES, the economics profession has compiled an impressive track record of getting almost all the big calls wrong. In the mid-1990s, all the great minds in the field agreed that the unemployment rate could not fall much below 6 percent without triggering spiraling inflation. It turns out that the unemployment rate could fall to 4 percent as a year-round average in 2000, with no visible uptick in the inflation rate.

As the stock bubble that drove the late 1990s boom was already collapsing, leading lights in Washington were debating whether we risked paying off the national debt too quickly. The recession following the collapse of the stock bubble took care of this problem, as the gigantic projected surpluses quickly turned to deficits. The labor market pain from the collapse of this bubble was both unpredicted and largely overlooked, even in retrospect. While the recession officially ended in November 2001, we didn’t start creating jobs again until the fall of 2003. And we didn’t get back the jobs we lost in the downturn until January 2005. At the time, it was the longest period without net job creation since the Great Depression.

When the labor market did finally begin to recover, it was on the back of the housing bubble. Even though the evidence of a bubble in the housing sector was plainly visible, as were the junk loans that fueled it, folks like me who warned of an impending housing collapse were laughed at for not appreciating the wonders of modern finance. After the bubble burst and the financial crisis shook the banking system to its foundations, the great minds of the profession were near unanimous in predicting a robust recovery. Stimulus was at best an accelerant for the impatient, most mainstream economists agreed—not an essential ingredient of a lasting recovery.

While the banks got all manner of subsidies in the form of loans and guarantees at below-market interest rates, all in the name of avoiding a second Great Depression, underwater homeowners were treated no better than the workers waiting for a labor market recovery. The Obama administration felt it was important for homeowners, unlike the bankers, to suffer the consequences of their actions. In fact, white-collar criminals got a holiday in honor of the financial crisis; on the watch of the Obama Justice Department, only a piddling number of bankers would face prosecution for criminal actions connected with the bubble.

There was a similar story outside the United States, as the International Monetary Fund, along with the European Central Bank and the European Union, imposed austerity when stimulus was clearly needed. As a result, southern Europe is still far from recovery. Even after another decade on their current course, many southern European countries will fall short of their 2007 levels of income. The situation looks even worse for the bottom half of the income distribution in Greece, Spain, and Portugal.

Even the great progress for the world’s poor touted in the famous “elephant graph” turns out to be largely illusory. If China is removed from the sample, the performance of the rest of the developing world since 1988 looks rather mediocre. While the pain of working people in wealthy countries is acute, they are not alone. Outside of China, people in the developing world have little to show for the economic growth of the last three and a half decades. As for China itself, the gains of its huge population are real, but the country certainly did not follow Washington’s model of deficit-slashing, bubble-driven policies for developing countries.

In this economic climate, it’s not surprising that a racist, xenophobic, misogynist demagogue like Donald Trump could succeed in politics, as right-wing populists have throughout the wealthy world. While his platform may be incoherent, Trump at least promised the return of good-paying jobs. Insofar as Clinton and other Democrats offered an agenda for economic progress for American workers, hardly anyone heard it. And to those who did, it sounded like more of the same.

Sunday, May 07, 2017

Saturday, May 06, 2017

Wednesday, May 03, 2017

Tuesday, April 18, 2017

Universal Basic Income

Universal Basic Income: A Utopian Idea Whose Time May Finally Have Arrived by Matt Vella

The False Promise of Universal Basic Income by Alyssa Battistoni

The False Promise of Universal Basic Income by Alyssa Battistoni

Thursday, April 13, 2017

Monday, April 10, 2017

Tuesday, April 04, 2017

Tuesday, March 28, 2017

Saturday, March 25, 2017

Thursday, March 23, 2017

Tuesday, March 21, 2017

Krugman on DBCFT

A Party Not Ready to Govern by Krugman

Then there’s corporate tax reform — an issue where the plan being advanced by Paul Ryan, the House speaker, is actually not too bad, at least in principle. Even someDemocratic-leaning economistssupport a shift to a “destination-based cash flow tax,” which is best thought of as a sales tax plus a payroll subsidy. (Trust me.)

But Mr. Ryan has failed spectacularly to make his case either to colleagues or to powerful interest groups. Why? As best I can tell, it’s because he himself doesn’t understand the point of the reform.

The case for the cash flow tax is quite technical; among other things, it would remove the incentives the current tax system creates for corporations to load up on debt and to engage in certain kinds of tax avoidance. But that’s not the kind of thing Republicans talk about — if anything, they’re in favor of tax avoidance, hence the Trump proposal to slash funding for the I.R.S.

No, in G.O.P. world, tax ideas always have to be presented as ways to remove the shackles from oppressed job creators. So Mr. Ryan has framed his proposal, basically falsely, as a measure to make American industry more competitive, focusing on the “border tax adjustment” which is part of the sales-tax component of the reform.

This misrepresentation seems, however, to be backfiring: it sounds like a Trumpist tariff, and has both conservatives and retailers like WalMart up in arms.

Sunday, March 19, 2017

center-left and Zack Beauchamp

Any answer to right-wing populism requires left-wing economics

by eshhou

Bottom line

Assuming the Democratic party does not totally abandon redistributive politics, racism will always pose a problem. The question then is: what redistributive programs and policies are most capable of overcoming this and generating cross-racial coalitions? There is little reason to believe that the means-tested programs favored by the Democratic mainstream are more capable of doing this than the more universal programs favored by those on the Left.

Why Zack Beauchamp’s piece arguing otherwise is wrong

Zack Beauchamp of Vox has written an article entitled “No easy answers: why left-wing economics is not the answer to right-wing populism.” In this piece, he argues that “tacking to the left on economics won’t give Democrats a silver bullet to use against the racial resentment powering Trump’s success [and] could actually wind up [making] Trump [stronger.]” Matt Bruenighas written about the piece’s odd moral implications; I want to discuss some of the evidence Beauchamp provides, and why I don’t find it all that convincing.

Zack Beauchamp of Vox has written an article entitled “No easy answers: why left-wing economics is not the answer to right-wing populism.” In this piece, he argues that “tacking to the left on economics won’t give Democrats a silver bullet to use against the racial resentment powering Trump’s success [and] could actually wind up [making] Trump [stronger.]” Matt Bruenighas written about the piece’s odd moral implications; I want to discuss some of the evidence Beauchamp provides, and why I don’t find it all that convincing.

...

Assuming the Democratic party does not totally abandon redistributive politics, racism will always pose a problem. The question then is: what redistributive programs and policies are most capable of overcoming this and generating cross-racial coalitions? There is little reason to believe that the means-tested programs favored by the Democratic mainstream are more capable of doing this than the more universal programs favored by those on the Left.

Saturday, March 18, 2017

Sanders, Vox vs. leftist economics

Everyone loves Bernie Sanders. Except, it seems, the Democratic party by Trevor Timm

No Easy Answers, Just Bad History by Marshall Steinbaum

The Great Recession clearly gave rise to right-wing populism by Ryan Cooper

Thursday, March 16, 2017

Lisa Hannigan cover of Bowie on Legion

Oh you Pretty Things

Don't you know you're driving your

Mamas and Papas insane

JW Mason: misc thoughts including on health care

JW Mason:

The health policy tightrope. The Republican plan health care plan, the CBO says, would increase the number of uninsured Americans by 24 million. I don’t know any reason to question this number. By some estimates, this will result in 40,000 additional deaths a year. By the same estimate, the Democratic status quo leaves 28 million people uninsured, implying a similar body count. Paul Ryan’s idea that health care should be a commodity to be bought in the market is cruel and absurd but the Democrats’ idea that heath insurance should be a commodity bought in the market is not obviously less so. Personally, I’m struggling to find the right balance between these two sets of facts. I suppose the first should get more weight right now, but I can’t let go of the second. Adam Gaffney does an admirable job managing this tightrope act in his assessment of the Obama health care legacy inJacobin. (But I think he’s absolutely right, strategically, to focus on the Republicans for the Guardian’s different readership .)

Tuesday, March 14, 2017

Krugman and the center-left

Populism and the Politics of Health by Krugman

"This ties in with an important recent piece by Zack Beauchamp on the striking degree to which left-wing economics fails, in practice, to counter right-wing populism; basically, Sandersism has failed everywhere it has been tried. Why?

The answer, presumably, is that what we call populism is really in large degree white identity politics, which can’t be addressed by promising universal benefits. Among other things, these “populist” voters now live in a media bubble, getting their news from sources that play to their identity-politics desires, which means that even if you offer them a better deal, they won’t hear about it or believe it if told. For sure many if not most of those who gained health coverage thanks to Obamacare have no idea that’s what happened.

That said, taking the benefits away would probably get their attention, and maybe even open their eyes to the extent to which they are suffering to provide tax cuts to the rich.

In Europe, right-wing parties probably don’t face the same dilemma; they’re preaching herrenvolk social democracy, a welfare state but only for people who look like you. In America, however, Trumpism is faux populism that appeals to white identity but actually serves plutocrats. That fundamental contradiction is now out in the open."

"This ties in with an important recent piece by Zack Beauchamp on the striking degree to which left-wing economics fails, in practice, to counter right-wing populism; basically, Sandersism has failed everywhere it has been tried. Why?

The answer, presumably, is that what we call populism is really in large degree white identity politics, which can’t be addressed by promising universal benefits. Among other things, these “populist” voters now live in a media bubble, getting their news from sources that play to their identity-politics desires, which means that even if you offer them a better deal, they won’t hear about it or believe it if told. For sure many if not most of those who gained health coverage thanks to Obamacare have no idea that’s what happened.

That said, taking the benefits away would probably get their attention, and maybe even open their eyes to the extent to which they are suffering to provide tax cuts to the rich.

In Europe, right-wing parties probably don’t face the same dilemma; they’re preaching herrenvolk social democracy, a welfare state but only for people who look like you. In America, however, Trumpism is faux populism that appeals to white identity but actually serves plutocrats. That fundamental contradiction is now out in the open."

Monday, March 13, 2017

Sunday, March 05, 2017

Sunday, February 26, 2017

Dillow on productivity and Sandwichman

NEOLIBERALISM & PRODUCTIVITY by Chris Dillow

Ponzilocks and the Twenty-Four Trillion Dollar Question by Sandwichman

Friday, February 24, 2017

Thursday, February 23, 2017

"I bet you could operate a nice gas shower."

"I bet you could operate a nice gas shower.

I could see you with a couple of Ses on your collar

Stiff goose in your step."

I could see you with a couple of Ses on your collar

Stiff goose in your step."

Tuesday, February 21, 2017

Trump and trade, Dean Baker

Trump and Trade: He’s Largely Right by Dean Baker

There are an awful lot of things to really dislike about Donald Trump and his conduct as president to date, but that doesn’t mean everything his administration does is wrong. In particular, there is considerable truth to what he has said about trade costing a large number of good paying manufacturing jobs and hurting the living standards of the middle class.

Unfortunately, rather than acknowledging this point, the media show the same determination as global warming denialists in saying that trade cannot be a problem. We got two examples of this sort of denialism in recent days.

The first was a piece in the Washington Post criticizing Trump adviser Peter Navarro’s view of trade and the trade deficit. While Navarro makes many questionable arguments in pushing his views on trade, his point that the trade deficit can reduce growth and employment is absolutely correct.

Ever since the crash in 2008 the bulk of economics profession has agreed that we faced a situation of “secular stagnation,” where the economy faced a persistent shortfall of demand. In this context, anything that boosts demand, such as an increase in government spending, private consumption, or a reduction in the trade deficit, leads to more output and employment.

In this context, the piece’s comment, taken from Harvard University economics professor N. Gregory Mankiw, “that a smaller trade deficit means lower investment along with possibly higher interest rates and less consumption” is completely wrong. If the economy is operating below full employment, as it certainly has been through most of the period from 2008 then reducing the trade deficit certainly can be a net addition to growth. As Mankiw says, “even a freshman at the end of ec 10 knows that.”

In this context, Navarro’s claim that a lower trade deficit could bring in $1.74 trillion in tax revenue over the course of a decade cannot be so easily dismissed even though the Post tells us:

“Hooey, say economists across the political spectrum.”

The key question here is whether the economy is now at potential GDP and whether it is likely to be over the next decade, even with a trade deficit that is close to 3.0 percent of GDP ($538 billion in the most recent quarter). On this question, the Congressional Budget Office (CBO) might be on the side of Navarro.

According to CBO, potential GDP for the 4th quarter of 2016 was $19,049 billion. This is 1.0 percent higher than the estimate of GDP for the quarter of $18,860.8 billion. This means that if CBO is right, if there had been more demand in the economy, for example due to imports being replaced by domestically produced goods, GDP could have been 1.0 percent higher last quarter.

Of course CBO’s estimates of potential GDP are not especially accurate. Its most recent estimates for potential GDP in 2016 are more than 10 percent below what it had projected for potential GDP in 2016 back in 2008, before the severity of the crash was recognized. It is possible it overstated potential by a huge amount in 2008, but it is also possible it is understating potential today. It also hugely understated potential GDP in the mid-1990s, with 2000 GDP coming in more than 5 percent above the estimate of potential that CBO made in 1996. In other words, it would not be absurd to think that the economy could sustain a level of output that is 2.0 percent above the current level. (The fact that the employment rate of prime age workers [ages 25-54] is still 4.0 percentage points below the 2000 peak is certainly consistent with this view.)

Suppose that GDP were consistently 2.0 percent higher than current projections over the next decade due to a lower trade deficit. This would imply an additional $4.6 trillion in output over this period. If the government captures 30 percent of this in higher taxes and lower spending on transfer programs like unemployment insurance and food stamps, this would imply a reduction in the projected deficit of $1.38 trillion over the decade. That’s not quite the $1.74 trillion projected by Navarro, but close enough to make the derision unwarranted.

In terms of how you get a lower trade deficit, Navarro’s strategy of beating up on China is probably not the best way to go. But there is in fact precedent for the United States negotiating a lower value for the dollar under President Reagan, which had the desired effect of reducing the trade deficit.

There is no obvious reason it could not pursue a similar path today, especially since it is widely claimed in business circles that China actually wants to raise the value of its currency. The U.S. could help it.

The second area of seemingly gratuitous Trump trade bashing comes from a Wall Street Journal news article on the Trump administration’s efforts to correct for re-exports in trade measures. Before getting to the article, it is important to understand what is at issue.

Most of what the United States exports to countries like Mexico, Japan, or elsewhere are goods and services produced in the United States. However, some portion of the goods that we export to these countries consists of items imported from other countries which are just transshipped through the United States.

The classic example would be if we offloaded 100 BMWs on a ship in New York and then 20 were immediately sent up to Canada to be sold there. The way we currently count exports and imports, we would count the 20 BMWs as exports to Canada and also as imports from Germany. These re-exports have zero impact on our aggregate trade balance, but they do exaggerate out exports to Canada and our imports from Germany.

If we wanted better data on bilateral trade flows, then it would be desirable to pull out the re-exports from both our exports to Canada and our imports from Germany. This adjustment would make our trade deficit with Canada appear larger and trade deficit with Germany smaller, but would leave our total trade balance unchanged.

This better measure of trade flows would be useful information to have if we wanted to know what happened to trade with a specific country following a policy change, for example the signing of a trade deal like NAFTA. The inclusion of re-exports in our export data would distort what had happened to actual flows of domestically produced exports and imports for domestic consumption.

The United States International Trade Commission already produces a measure of trade balances that excludes imports that are re-exported. However this measure is still not an accurate measure of bilateral trade balances since it still includes the re-exports on the import side. In the case mentioned above, it would include the BMWs imported from Germany that were immediately sent to Canada, as imports. In principle, we should be able to construct a measure that excludes these items on the import side as well. If this is what the Trump administration is trying to do, then it is asking for a perfectly reasonable adjustment to the data.

This is where we get to the WSJ article. According to the piece, the Trump administration was asking the Commerce Department to produce measures of bilateral trade balances that took out the re-exports on the export side, but left them in on the import side. This would have the effect of artificially inflating our trade deficit with a bogus number. If this is in fact what the Trump administration is trying to do, then we should be shooting at them with all guns. (This is metaphorical folks, I’m not advocating violence.)

However some skepticism might be warranted at this point. No one with a name actually said the Trump administration asked for this bogus measure of trade balances. The sole source listed is “one person familiar with the discussions.”

There was an official statement from the Commerce Department’s Bureau of Economic Analysis (BEA), which collects and compiles the data:

“Any internal discussions about data collection methods are no more than the continuation of a longstanding debate and are part of the bureau’s normal process as we strive to provide the most precise statistics possible.”

I take very seriously efforts to mess with the data. We are fortunate to have independent statistical agencies with dedicated civil servants who take their work very seriously. However we should wait until we have a bit more solid evidence before assuming that the Trump administration is trying to interfere in their independence, as opposed to trying to make a totally legitimate adjustment to the data that the BEA staff would almost certainly agree is an improvement.

There are an awful lot of things to really dislike about Donald Trump and his conduct as president to date, but that doesn’t mean everything his administration does is wrong. In particular, there is considerable truth to what he has said about trade costing a large number of good paying manufacturing jobs and hurting the living standards of the middle class.

Unfortunately, rather than acknowledging this point, the media show the same determination as global warming denialists in saying that trade cannot be a problem. We got two examples of this sort of denialism in recent days.

The first was a piece in the Washington Post criticizing Trump adviser Peter Navarro’s view of trade and the trade deficit. While Navarro makes many questionable arguments in pushing his views on trade, his point that the trade deficit can reduce growth and employment is absolutely correct.

Ever since the crash in 2008 the bulk of economics profession has agreed that we faced a situation of “secular stagnation,” where the economy faced a persistent shortfall of demand. In this context, anything that boosts demand, such as an increase in government spending, private consumption, or a reduction in the trade deficit, leads to more output and employment.

In this context, the piece’s comment, taken from Harvard University economics professor N. Gregory Mankiw, “that a smaller trade deficit means lower investment along with possibly higher interest rates and less consumption” is completely wrong. If the economy is operating below full employment, as it certainly has been through most of the period from 2008 then reducing the trade deficit certainly can be a net addition to growth. As Mankiw says, “even a freshman at the end of ec 10 knows that.”

In this context, Navarro’s claim that a lower trade deficit could bring in $1.74 trillion in tax revenue over the course of a decade cannot be so easily dismissed even though the Post tells us:

“Hooey, say economists across the political spectrum.”

The key question here is whether the economy is now at potential GDP and whether it is likely to be over the next decade, even with a trade deficit that is close to 3.0 percent of GDP ($538 billion in the most recent quarter). On this question, the Congressional Budget Office (CBO) might be on the side of Navarro.

According to CBO, potential GDP for the 4th quarter of 2016 was $19,049 billion. This is 1.0 percent higher than the estimate of GDP for the quarter of $18,860.8 billion. This means that if CBO is right, if there had been more demand in the economy, for example due to imports being replaced by domestically produced goods, GDP could have been 1.0 percent higher last quarter.

Of course CBO’s estimates of potential GDP are not especially accurate. Its most recent estimates for potential GDP in 2016 are more than 10 percent below what it had projected for potential GDP in 2016 back in 2008, before the severity of the crash was recognized. It is possible it overstated potential by a huge amount in 2008, but it is also possible it is understating potential today. It also hugely understated potential GDP in the mid-1990s, with 2000 GDP coming in more than 5 percent above the estimate of potential that CBO made in 1996. In other words, it would not be absurd to think that the economy could sustain a level of output that is 2.0 percent above the current level. (The fact that the employment rate of prime age workers [ages 25-54] is still 4.0 percentage points below the 2000 peak is certainly consistent with this view.)

Suppose that GDP were consistently 2.0 percent higher than current projections over the next decade due to a lower trade deficit. This would imply an additional $4.6 trillion in output over this period. If the government captures 30 percent of this in higher taxes and lower spending on transfer programs like unemployment insurance and food stamps, this would imply a reduction in the projected deficit of $1.38 trillion over the decade. That’s not quite the $1.74 trillion projected by Navarro, but close enough to make the derision unwarranted.

In terms of how you get a lower trade deficit, Navarro’s strategy of beating up on China is probably not the best way to go. But there is in fact precedent for the United States negotiating a lower value for the dollar under President Reagan, which had the desired effect of reducing the trade deficit.

There is no obvious reason it could not pursue a similar path today, especially since it is widely claimed in business circles that China actually wants to raise the value of its currency. The U.S. could help it.

The second area of seemingly gratuitous Trump trade bashing comes from a Wall Street Journal news article on the Trump administration’s efforts to correct for re-exports in trade measures. Before getting to the article, it is important to understand what is at issue.

Most of what the United States exports to countries like Mexico, Japan, or elsewhere are goods and services produced in the United States. However, some portion of the goods that we export to these countries consists of items imported from other countries which are just transshipped through the United States.

The classic example would be if we offloaded 100 BMWs on a ship in New York and then 20 were immediately sent up to Canada to be sold there. The way we currently count exports and imports, we would count the 20 BMWs as exports to Canada and also as imports from Germany. These re-exports have zero impact on our aggregate trade balance, but they do exaggerate out exports to Canada and our imports from Germany.

If we wanted better data on bilateral trade flows, then it would be desirable to pull out the re-exports from both our exports to Canada and our imports from Germany. This adjustment would make our trade deficit with Canada appear larger and trade deficit with Germany smaller, but would leave our total trade balance unchanged.

This better measure of trade flows would be useful information to have if we wanted to know what happened to trade with a specific country following a policy change, for example the signing of a trade deal like NAFTA. The inclusion of re-exports in our export data would distort what had happened to actual flows of domestically produced exports and imports for domestic consumption.

The United States International Trade Commission already produces a measure of trade balances that excludes imports that are re-exported. However this measure is still not an accurate measure of bilateral trade balances since it still includes the re-exports on the import side. In the case mentioned above, it would include the BMWs imported from Germany that were immediately sent to Canada, as imports. In principle, we should be able to construct a measure that excludes these items on the import side as well. If this is what the Trump administration is trying to do, then it is asking for a perfectly reasonable adjustment to the data.

This is where we get to the WSJ article. According to the piece, the Trump administration was asking the Commerce Department to produce measures of bilateral trade balances that took out the re-exports on the export side, but left them in on the import side. This would have the effect of artificially inflating our trade deficit with a bogus number. If this is in fact what the Trump administration is trying to do, then we should be shooting at them with all guns. (This is metaphorical folks, I’m not advocating violence.)

However some skepticism might be warranted at this point. No one with a name actually said the Trump administration asked for this bogus measure of trade balances. The sole source listed is “one person familiar with the discussions.”

There was an official statement from the Commerce Department’s Bureau of Economic Analysis (BEA), which collects and compiles the data:

“Any internal discussions about data collection methods are no more than the continuation of a longstanding debate and are part of the bureau’s normal process as we strive to provide the most precise statistics possible.”

I take very seriously efforts to mess with the data. We are fortunate to have independent statistical agencies with dedicated civil servants who take their work very seriously. However we should wait until we have a bit more solid evidence before assuming that the Trump administration is trying to interfere in their independence, as opposed to trying to make a totally legitimate adjustment to the data that the BEA staff would almost certainly agree is an improvement.

Monday, February 20, 2017

hikikomori

4chan: The Skeleton Key to the Rise of Trump

It was still a group of hikikomori — a group of primarily young males who spent a lot of the time at the computer, so much so they had retreated into virtual worlds of games, T.V., and now the networks of the internet. This was where most or all of their interaction, social or otherwise took place. The real world, by contrast, above their mothers’ basements, was a place they did not succeed, perhaps a place they did not fundamentally understand.

Sunday, February 19, 2017

Krugman 38 depression, Bernstein dynamic scoring

New Deal economics by Krugman

Limited fiscal force

Limited fiscal force

NOVEMBER 8, 2008

Limited fiscal force

Limited fiscal force

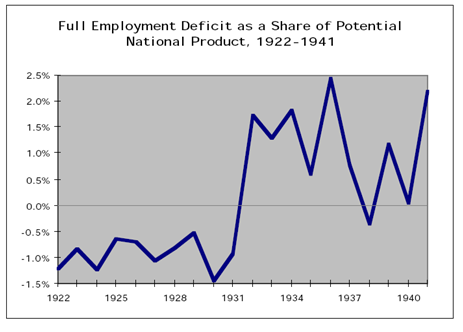

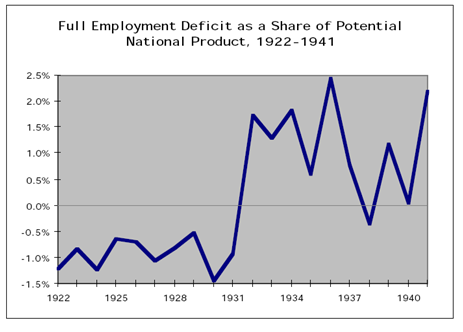

Now, you might say that the incomplete recovery shows that “pump-priming”, Keynesian fiscal policy doesn’t work. Except that the New Deal didn’t pursue Keynesian policies. Properly measured, that is, by using the cyclically adjusted deficit, fiscal policy was only modestly expansionary, at least compared with the depth of the slump. Here’s the Cary Brown estimates, from Brad DeLong:

Net stimulus of around 3 percent of GDP — not much, when you’ve got a 42 percent output gap. FDR might have been more of a Keynesian if Keynesian economics had existed — The General Theory wasn’t published until 1936. Note in particular that in 1937-38 FDR was persuaded to do the “responsible” thing and cut back — and that’s what led to the bad year in 1938, which to the WSJ crowd defines the New Deal.

If only we could apply dynamic scoring to the rest of life by Jared BernsteinBaker on taxes, Reich on Republican plan, Weregild, Corey Robin

A Progressive Way to End Corporate Taxes by Dean Baker

It’s time to start thinking about a realignment: 2 things for the left to do by Corey Robin

Republican tax sham by Robert Reich

Weregild and the Price of People by Elaine

Sunday, February 12, 2017

Baker on Tax reform, Fernholz on DBCFT

Neil Irwin Warns of Financial Crisis from Corporate Tax Reform by Dean Baker

This is the Republican plot to kill the US corporate income tax as we know it by Tim Fernholz

This is the Republican plot to kill the US corporate income tax as we know it by Tim Fernholz

Yet border adjustment—and the consumption tax behind it—deserves consideration because it is what Trump might propose if he were interested in crafting policy not with the aim of offending trade partners, liberals, and the Republican establishment, but rather with the goal of bringing investment back to the US while still conceding the reality of a globalized economy. It also would fit with the world view of his trade advisor Peter Navarro, who is eager to tear down the global supply chains that undergird the success of US multinationals today. And, together with the other big changes under consideration in Congress, it might actually shift more investment toward the US without the negative consequences of punitive tariffs or the ad hoc cronyism of Trump’s twitter bullying.

Atrios, DBCFT, Buttigieg

Your Moment Of Zen

Liberals Can’t Wait for Republicans to Adopt the Border-Adjusted Tax by VERONIQUE DE RUGY

Deluded Republicans are accidentally pushing for progressive corporation tax reform by Ben Chu

Everything You Ever Wanted to Know about Border-Adjustable Taxation, but Were Afraid (or too Bored) to Ask by Dan Mitchell

Trump Calls House GOP Tax Plan ‘Too Complicated.’ He May Be Right. by Dan Mitchell

Indiana Mayor Running for D.N.C. Chairman

Joseph A. Buttigieg, professor at Notre Dame.

"He is also the editor and translator of the multi-volume complete critical edition of Antonio Gramsci's Prison Notebooks, a project that has been supported by a major grant from the National Endowment for the Humanities. Several of his articles on Gramsci have been translated into Italian, German, Spanish, Portuguese, and Japanese. He was a founding member of the International Gramsci Society of which he is president. The Italian Minister of Culture appointed him to a commission of experts to oversee the preparation of the "edizione nazionale" of Gramsci's writings. Buttigieg serves on the editorial and advisory boards of various journals, and he is a member of the editorial collective of boundary 2."

Tuesday, February 07, 2017

Setser on Germany

Brad Setser:

I suspect the politics around trade would be a bit different in the U.S. if the goods-exporting sector had grown in parallel with imports.

That is one key difference between the U.S. and Germany. Manufacturing jobs fell during reunification—and Germany went through a difficult adjustment in the early 2000s. But over the last ten years the number of jobs in Germany’s export sector grew, keeping the number of people employed in manufacturing roughly constant over the last ten years even with rising productivity. Part of the “trade” adjustment was a shift from import-competing to exporting sectors, not just a shift out of the goods producing tradables sector. Of course, not everyone can run a German sized surplus in manufactures—but it seems likely the low U.S. share of manufacturing employment (relative to Germany and Japan) is in part a function of the size and persistence of the U.S. trade deficit in manufactures. (It is also in part a function of the fact that the U.S. no longer needs to trade manufactures for imported energy on any significant scale; the U.S. has more jobs in oil and gas production, for example, than Germany or Japan).

demagogues and stagnation

We’re re-learning today what we should have learned in the 30s…economic stagnation breeds reaction and intoleranceChris Dillow

Monday, February 06, 2017

Sunday, February 05, 2017

Saturday, February 04, 2017

Trump voters

The Fight in the Borderlands by Josh Marshall

We hear people constantly saying 'Nothing will change his supporters' minds. They're with him no matter what.' First of all this is enervating defeatism which is demoralizing and loserish. But it also misses the point. It is factually wrong. For the supporters those people have in mind, they're right. They're true believers, authoritarians who are energized by Trump's destructive behavior. But there are not that many of those people. A big chunk of Trump's voters voted for him in spite of their dislike. Those people can be carved away. But Democrats will regain power by winning it in what amount to our 21st century internal American borderlands, not in the big cities or rural areas mainly but in between. So what's happening now to lay that groundwork for 2018?

Friday, February 03, 2017

Monbiot on neoliberalism

Neoliberalism – the ideology at the root of all our problems by George Monbiot

When, in 1947, Hayek founded the first organisation that would spread the doctrine of neoliberalism – the Mont Pelerin Society – it was supported financially by millionaires and their foundations.

With their help, he began to create what Daniel Stedman Jones describes inMasters of the Universe as “a kind of neoliberal international”: a transatlantic network of academics, businessmen, journalists and activists. The movement’s rich backers funded a series of thinktanks which would refine and promote the ideology. Among them were the American Enterprise Institute, the Heritage Foundation, the Cato Institute, the Institute of Economic Affairs, the Centre for Policy Studies and the Adam Smith Institute. They also financed academic positions and departments, particularly at the universities of Chicago and Virginia.

Thursday, February 02, 2017

DBCFT

THURSDAY, FEBRUARY 2, 2017

The Auerbach Tax and Automobile Multinationals

Bloomberg reports:

A proposed tax on imports that President Donald Trump is said to be warming to could upend the competitive landscape for carmakers, boosting Ford Motor Co. while hindering manufacturers that rely more on overseas factories including Toyota Motor Corp. House Republican leaders have proposed a so-called border-adjusted tax, which would place a levy on vehicles imported into the U.S. and fully exempt those exported. Though Trump initially deemed the idea too complicated, White House Press Secretary Sean Spicer last week said it was under consideration and could help pay for a wall along the Mexico border. The overhaul to the U.S. tax system could hand an advantage to Ford, Honda Motor Co. and General Motors Co., which rely the least on imported vehicles among major automakers. The shake-up would also undermine ToyotaIs Bloomberg assuming a fixed yen/$ exchange rate so these border adjustments boost exports and discourage imports? Greg Mankiw and Paul Krugman take a very different view. Greg breaks down this Destination Based Cash Flow tax as a three-fer:

Impose a retail sales tax on consumer goods and services, both domestic and imported; Use some of the proceeds from the tax to repeal the corporate income tax.; and Use the rest of the proceeds from the tax to significantly cut the payroll tax.Greg is assuming the rise in sales taxes is greater than the cut in income taxes, which is not clear. But let’s hear from Paul:

Greg and I disagree on whether replacing profits taxes with sales taxes is a good idea, but agree that all of this has nothing to do with trade and international competition – because it doesn’t. I suspect, however, that Greg is being naïve here in assuming that we’re just seeing confusion because border tax adjustment sounds as if it must involve competitive games. There’s some of that, for sure, but one reason the competitiveness thing won’t go away is that it’s an essential part of the political pitch. “Let’s eliminate taxes on profits and tax consumers instead” is a hard sell, even if you want to claim that the incidence isn’t what it looks like. Claiming that it’s about eliminating a dire competitive disadvantage plays much better, even though it’s all wrong.Alan Auerbach – the proponent of this idea – joined with Douglas Holtz-Eakin to state why this competitiveness argument is all wrong: These two (AHE) wrote:

Unlike tariffs on imports or subsidies for exports, border adjustments are not trade policy. Instead, they are paired and equal adjustments that create a level tax playing field for domestic and overseas competition; Border adjustments do not distort trade, as exchange rates should react immediately to offset the initial impact of these adjustments. As a corollary, border adjustments do not distort the pattern of domestic sales and purchasesSo if this is not going to advantage Ford and GM to the disadvantage of Toyota, could something else be driving Ford’s support and the opposition from companies like Toyota. I have been looking more at the transfer pricing angle objecting to this claim from AHE:

Border adjustments eliminate the incentive to manipulate transfer prices in order to shift profits to lower-tax jurisdictionsA lot of people read this and think transfer pricing manipulation goes away. But this is clearly wrong if our trading partners have positive corporate tax rates that are sourced based. Even AHE admits this later:

Thus, the multinational would have no incentive to use transfer prices to shift profits away from the United States, even if the tax rate in the foreign country is very low. Indeed, it would benefit by shifting profits to the United States, to reduce the taxes it pays in the low-tax country.Lawrence Summers adds:

Businesses that invest heavily, hire extensively and export a large part of their product will have negative taxable income on a chronic basis .. Fourth, the combination of a sharply lower rate, new opportunities for tax arbitrage and the fact that any revenue gains from bringing overseas cash home are one-shot means the Federal revenue base would erode. The result would be cuts in entitlement payments to consumers who spend heavily, tax hikes on individuals and reductions in government spending. Over time, this will slow growth and burden the middle class.He is correct about the “new opportunities for tax arbitrage" which is what I referring to with my Trump Toaster Oven example where I noted:

While currently Tiffany might want to raise the intercompany price – she knows the IRS could object. Of course Auerbach’s DBCFT would change her incentives as she might want to lower this price to only $80 to eliminate the Canadian income tax – assuming the Canadian Revenue Agency does not object.Of course the Canadian Revenue Agency would strongly object. Toyota is a lot like our example. The Auerbach proposal would raise its U.S. taxes and give it an incentive to ship their cars to the U.S. at cost costs only. Toyota’s 10-K indicates that its 2015 sales were $260 billion with over $100 billion to the U.S. Its operating margin was 10 percent with the U.S. getting about half of that on its U.S. sales. So on U.S sales, Toyota has U.S. profits near $5 billion and Japanese profits near $5 billion – both taxes at fairly high rates. The Auerbach tax would give Toyota the incentive to have all $10 billion sourced in the U.S. But one would certainly expect the Japanese tax authorities to strongly object. Summers example reminds me of Boeing which sells over $90 billion a year with 58 percent of those sales to foreign customers. It currently incurs near $1.9 billion in U.S. taxes given its 7.5 percent profit margin and the fact that it allocates over 95 percent of its income to the U.S. The Auerbach tax would cut this tax bill to zero. It would also cut the U.S. tax bill for companies such as Starbucks. So what about Ford and GM? Alas Dylan Matthews has this all wrong with:

For example, suppose that a car company — let’s just call it, uh, General Motors — makes $1 billion in profit manufacturing cars in the US and selling them domestically and exporting them to subsidiaries abroad. That would normally subject it about $350 million in taxes, since the US has a 35 percent corporate tax rate. But GM could instead have its foreign subsidiaries pay $1 billion less for the cars they buy from the US branch of the company. That wipes out GM’s US profits, leaving it with no US tax liability and shifting the profits to the subsidiaries abroad. If those subsidiaries are in countries with a low or nonexistent corporate income tax, that could wind up being a very good deal ... This makes most tax evasion schemes pointless.I doubt Dylan looked at the 10-K filings of either Ford or GM when he drafted this base erosion fairy tale. Ford sources less than 17 percent of its income to foreign affiliates and GM sources almost none of its income abroad. So the Auerbach tax would represent a major reduction in their U.S. tax bills. These foreign affiliates are not in tax havens unless you think Canada, Mexico, and our European trading partners have zero corporate tax rates (hint – their tax rates are 20 percent or more). Think of their operations as having a European component and a North American component. The European affiliates produce and distribute cars paying royalties back to the U.S. parent. Under the Auerbach proposal, they might want to increase those royalties to bleed their European affiliates dry. But of course the tax authorities in France, Germany, and the UK are not stupid. In North America, Mexican maquiladoras make the components, Detroit assembles, and a Canadian distributor sells to Canadian customers. The Auerbach tax would give Ford and GM the incentives to manipulate transfer pricing to strip all Canadian and Mexican income so the last line from Dylan that I quoted is quite wrong. But it would also be wrong to assume that the Canadian Revenue Agency and the Mexican authorities would just roll over.

Posted by ProGrowthLiberal at 5:51 PM

DBCFT and Gorsuch

The Prospects For Tax Reform in 2017 Are Dimming by Howard Gleckman

DEMOCRATS RUSH INTO A SUPREME COURT BATTLE by John Cassidy

DEMOCRATS RUSH INTO A SUPREME COURT BATTLE by John Cassidy

Wednesday, February 01, 2017

DBCFT

Idiot's Guide to DBCFT, Ryan Style by Allison Christians

Understanding the Republicans’ corporate tax reform by Bill Gale

A Modern Corporate Tax by Alan J. Auerbach (Center for America Progress)

Tuesday, January 31, 2017

trade

JB on Brad DeLong’s Vox piece on trade deals and trade by Jared Bernstein

Trade deficits and real blue-collar manufacturing compensation by Jared Bernstein

Painful Nonsense on Trade by Dean Baker

Truthiness on Trade by Dean Baker

Donald Trump's "paying for the wall by hiking prices on avocados" controversy, explained by Dylan Matthews

How a Clever GOP Tax Plan Managed to Baffle Everyone by Ramesh Ponnuru

Exporters forming coalition to support House GOP border tax

DNC boots candidate from chairman’s race for criticizing Ellison’s Islamic faith

Truthiness on Trade by Dean Baker

The GOP’s radical tax plan by WaPo editorial board

Sunday, January 29, 2017

Republican tax plan

Paul Krugman and the Republican Corporate Income Tax Proposal by Dean Baker

Washington Post Pushed Fear on Corporate Tax Reform by Dean Baker

US tax reform is vital but Trump’s plan is flawed by Larry Summers

My take on the Republicans’ new, interesting corporate tax plan by Jared Bernstein

Second, interest payments to bondholders, banks and other creditors will no longer be deductible.Results from my Twitter poll on the legislative prospects of the DBCFT by Jared Bernstein

Saturday, January 28, 2017

Reagan, too tight monetary policy, appreciating dollar

Must-Read: Dani Rodrik: What Did NAFTA Really Do? by DeLong

As I wrote to Dani: The U.S. went from 30% of its nonfarm employees in manufacturing to 12% because of rapid growth in manufacturing productivity and limited demand, yes? The U.S. went from 12% to 9% because of stupid and destructive macro policies–the Reagan deficits, the strong-dollar policy pushed well past its sell-by date, too-tight monetary policy–that diverted it from its proper role as a net exporter of capital and finance to economies that need to be net sinks rather than net sources of the global flow of funds for investment, yes?

Wednesday, January 25, 2017

Friday, January 20, 2017

Thursday, January 19, 2017

Monday, January 16, 2017

Sunday, January 15, 2017

Friday, January 13, 2017

Thursday, January 12, 2017

Monday, January 02, 2017

Saturday, December 31, 2016

Sunday, December 25, 2016

Milonvic interview

Q: During the US election, a rather strange and heated debate took place between liberals that insisted the rise of Trumpism could be blamed on 'economic anxiety' or on racial resentment, as if it had to be one of the two. How would you theorize the relation between economic motivations for voter rebellion and other perhaps complementary causes for the huge transformations we saw in 2016? Do economic problems cause racism or nativism to emerge, for example? Historically how has this usually worked when inequality gets out of control?

M. I really do not think that the causality runs one way only: either from economic problems to racism, or from racism to economic problems. I think that the two work together. But I think that it was always wrong to blame support that Trump has received only on racism or misogyny. By doing this, one commits two mistakes: first, writes off that portion of the population as “irredeemable” since their racism or misogyny makes them impervious to any rational argumentation; and second, entirely plays down economic factors and thus fails to propose any change in economic policy. The view that nativism alone was responsible for the rise of right-wing populism in the US, or even more bizarrely the view held by some that the “losers” in rich countries should not complain because they are better off than workers in China, were just wrong answers to a very real problem.

Q. This kind of an interpretation has received strong pushback in the United States since Trump's victory, with mainstream Democratic supporters calling it either hopelessly leftist or tantamount to rationalizing away racism. Others point to the fact that many rich people supported Trump (as admittedly often supported other Republican candidates). What do you make of this criticism?

M. I do not understand the pushback. Do they really believe that Trump, Brexit, Le Pen, the rise of many right-wing populist parties in Europe etc. have nothing to do with economics? That suddenly all these weird nationalists and nativists got together thanks to the social media and decided to overthrow the established order? People who believe this remind me of Saul Bellow’s statement that “a great deal of intelligence can be invested in ignorance when the need for illusion is strong”.

Saturday, December 24, 2016

Tuesday, December 20, 2016

Yggies on the white working class

The boring reason policy to help struggling regions won’t win “Rust Belt” votes

It’s not a struggling region. Updated by Matthew Yglesias

It’s not a struggling region. Updated by Matthew Yglesias

Monday, December 19, 2016

UBI in Finland

Free Cash in Finland. Must Be Jobless. by Peter S. Goodman

Finland will soon hand out cash to 2,000 jobless people, free of bureaucracy or limits on side earnings. The idea, universal basic income, is gaining traction worldwide.

Saturday, December 17, 2016

midwest/rustbelt and the new social darwinists

Thursday, December 15, 2016

DeLong disagrees with Yellen and Krugman

Must-Read: Let me disagree a bit with Paul: although evidence does suggest that we are near full employment, we are not at full employment--and the suggestion that we are near full employment is a very weak one. The unemployment rate is 4.6%--and six years ago I would have said that 5% unemployment is full employment. The prime-age employment-to-population ratio is 78.1%--and six years ago I would have said that an 80% prime-age employment-to-population ratio is full employment. It is possible to reconcile the two by saying that hysteresis has permanently knocked 2% of the prime-age population out of the labor force. But that claim is, itself, uncertain.

Paul rests his case for continued monetary policy at the zero lower bound and for fiscal expansion on the "precautionary motive". That case is there, and is very strong. But IMHO there is still a very strong case for continued monetary policy at the zero lower bound and fiscal expansion resulting from recognition of our uncertainty about the current state of the economy.

The downsides of further expansionary policy to see if full employment is an 80% prime-age employment-to-population ratio are small. The upsides are large. We should follow Rikki-Tikki-Tavi, and run and find out.and

More Expansionary FIscal Policy Is Needed: The Only Question Is Whether for a Short-Term Full Employment Attainment or a Medium-Term Full-Employment Maintenance Purpose

If the Federal Reserve wants to have the ammunition to fight the next recession when it happens, it needs the short-term safe nominal interest rate to be 5% or more when the recession hits. I believe that is very unlikely to happen withoutsubstantial fiscal expansion. No, at least in the world that Janet Yellen sees, "fiscal policy is not needed to provide stimulus to get us back to full employment." But fiscal policy stimulus is needed to create a situation in which full employment can be maintained. It would be a rash economist indeed who would forecast a short-term safe nominal interest rate above 3% when the time for the next loosening cycle arrives:

[chart]

Thus if we do not shift to a more expansionary fiscal policy--and the higher neutral rate of interest that it brings--now, what do we envision will happen when the next recession arrives? Do we trust that congress and the president will then understand and react appropriately in a timely fashion and at the right scale to deal with the slump in aggregate demand?

Once again, it would be a very rash economist who would forecast that. An FOMC that does not press strongly for more expansionary fiscal policy now is an FOMC that is adopting a policy that threatens to make life very difficult indeed for their successors between two and six years from now.

And, of course, there is the chance--I see it as a substantial chance--that full employment is attained at a prime-age employment-to-population ratio of not 78% but 80%--or 81.5%. In that case, Janet Yellen is wrong to say that "fiscal policy is not needed to provide stimulus to get us back to full employment."

Friday, December 09, 2016

Monday, December 05, 2016

Duy, Bernstein, Kweku and Baker

Desperately Searching For A New Strategy by Tim Duy

Yes, the Rust Belt demands an answer. But does anyone know what it is? by Jared Bernstein

HOW TO BEAT WHITE NATIONALISM AT THE POLLS by EZEKIEL KWEKU

Trade, Trump, and the Economy: What Does Greg Mankiw's Textbook Say? by Dean Baker

Yes, the Rust Belt demands an answer. But does anyone know what it is? by Jared Bernstein

Friday, December 02, 2016

current account surpluses

If the Chinese can buy US Treasuries to appreciate the dollar, why can't the US buy Chinese and German government bonds in order to reduce the trade deficit?

If they wont' allow it, then dont allow them to buy US Treasuries.

If they wont' allow it, then dont allow them to buy US Treasuries.

Thursday, December 01, 2016

Waldman, Mason and Trump voters

The economic geography of a universal basic income by Steve Randy Waldman

Socialize Finance by JW Mason

Blame the identity apostles – they led us down this path to populism by Simon Jenkins

Liberal Anti-Politics by Shuja Haider

Everybody Hates Cornel West by Connor Kilpatrick

Socialize Finance by JW Mason

Blame the identity apostles – they led us down this path to populism by Simon Jenkins

Wednesday, November 30, 2016

Rubin and the strong dollar

Big Deficit, Bob Rubin, and the Strong Dollar by Dean Baker

Rubin or Trump as the Strong Dollar Type by PGL

Two Generations of Trade Deficits: A Wee Complaint with Jared Bernstein by PGL

Needed: Plain Talk About the Dollar by Christina Romer

MONDAY, MAY 23, 2011

Strong Dollar = Strong Economy ?

An excellent column from Christy Romer.

Strong Dollar = Strong Economy ?

An excellent column from Christy Romer.

Tuesday, November 29, 2016

Sunday, November 27, 2016

Wednesday, November 23, 2016

Sunday, November 13, 2016

The Totebaggers who gave us Trump are in denial

EMichael, Trump and Obamacare

If the White Working Class Is the Problem, What's the Solution? by Kevin Drum

Trump Won a Lot of White Working-Class Voters Who Backed Obama by Eric Levitz

On Wisconsin! by Barkley Rosser

It's Rarely One Thing by Duncan Black

they’re going to keep losing by Freddie deBoer

It's Rarely One Thing by Duncan Black

they’re going to keep losing by Freddie deBoer

Clinton suffered her biggest losses in the places where Obama was strongest among white voters. It's not a simple racism story

Monday, November 07, 2016

Subscribe to:

Posts (Atom)