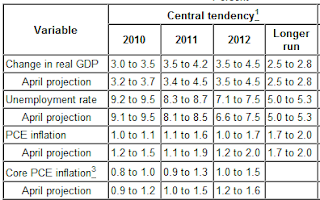

Despite this recent slowing, however, it is reasonable to expect some pickup in growth in 2011 and in subsequent years. Broad financial conditions, including monetary policy, are supportive of growth, and banks appear to have become somewhat more willing to lend. Importantly, households may have made more progress than we had earlier thought in repairing their balance sheets, allowing them more flexibility to increase their spending as conditions improve. And as the expansion strengthens, firms should become more willing to hire. Inflation should remain subdued for some time, with low risks of either a significant increase or decrease from current levels.No helicopter drop incoming. Next FOMC meeting is September 21st. According to the June minutes the Fed expects:

3.5 to 4.2 percent growth for 2011 and unemployment of 8.7 to 8.3 percent. They need higher inflation. Seems to me that the Federal Reserve Bank is going to lose its legitimacy.

Second quarter growth was revised down to 1.6 percent. I'd bet we come under 3.2 percent GDP growth for 2010.

No comments:

Post a Comment